IRS Form 990 Schedules

IRS Form 990 Schedules

- Updated April 21, 2023 - 12.00 PM Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations must provide additional information about the financial and other activities when filing Form 990.

IRS requires the Organizations to attach additional information through 990 Schedules. In total, there are 16 Schedules available for Form 990 that may need to be attached based on the organizational activities.

Table of Content

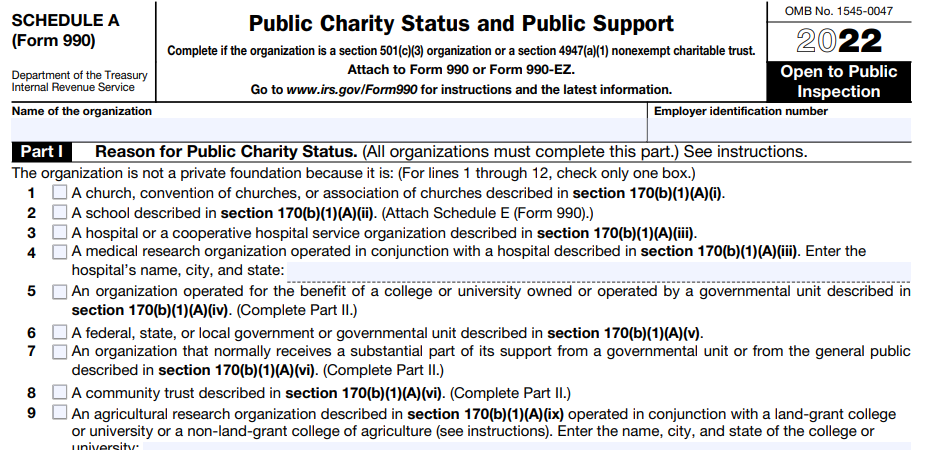

1. Schedule A (Form 990 or 990-EZ) - Public Charity Status and Public Support

2. Schedule B (Form 990, 990-EZ, 990-PF) - Schedule of Contributors

3. Schedule C (Form 990 or 990-EZ) - Political Campaign and Lobbying Activities

4. Schedule D (Form 990) - Supplemental Financial Statements

5. Schedule E (Form 990 or 990 EZ) - Schools

6. Schedule F (Form 990) - Statement of Activities Outside the United States

8. Schedule H (Form 990) - Hospitals

10. Schedule J (Form 990) - Compensation Information

11. Schedule K (Form 990) - Supplemental Information on Tax-Exempt Bonds

12. Schedule L (Form 990 or 990-EZ) - Transactions with Interested Persons

13. Schedule M (Form 990) - Noncash Contributions

15. Schedule O (Form 990 or 990-EZ) - Supplemental Information

16. Schedule R (Form 990) - Related Organizations and Unrelated Partnerships

1. Schedule A (Form 990 or 990-EZ) - Public Charity Status and Public Support

Nonprofit Organizations that file Form 990 or Form 990-EZ use this schedule A to provide required information about public charity status and public support.

2. Schedule B (Form 990, 990-EZ, 990-PF) - Schedule of Contributors

Nonprofit Organizations and Private Foundations must use this schedule b to provide information on contributions they reported on Form 990-PF, Form 990, IRS Form 990-EZ.

3. Schedule C (Form 990 or 990-EZ) - Political Campaign and Lobbying Activities

Section 501(c) organizations and Section 527 organizations use Schedule C to provide additional information on political campaign activities or lobbying activities.

4. Schedule D (Form 990) - Supplemental Financial Statements

Nonprofit Organizations that file Form 990 use schedule D to provide information for donor-advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information.

5. Schedule E (Form 990 or 990 EZ) - Schools

Organizations that file Form 990-EZ or Form 990 use this schedule to report information on private schools.

6. Schedule F (Form 990) - Statement of Activities Outside the United States

Nonprofits and Tax-Exempt Organizations that file Form 990 use Schedule F (Form 990) to provide information on their activities conducted outside the United States at any time during the tax year.

7. Schedule G (Form 990 or 990-EZ) - Supplemental Information Regarding Fundraising or Gaming Activities

Nonprofits and Tax-Exempt Organizations that file Form 990 or Form 990-EZ use schedule G to report professional fundraising services, fundraising events, and gaming with the IRS.

8. Schedule H (Form 990) - Hospitals

Hospital organizations use Schedule H to provide information on the activities and policies of, and community benefit provided by, its hospital facilities and other non-hospital health care facilities that it operated during the tax year.

It includes facilities operated either directly or indirectly through disregarded entities or joint ventures.

9. Schedule I (Form 990) - Grants and Other Assistance to Organizations, Governments, and Individuals in the U.S.

Nonprofits and Tax-exempt Organizations use this schedule to report information on grants and other assistance made by the filing organization during the year to domestic organizations, domestic governments, and domestic individuals.

10. Schedule J (Form 990) - Compensation Information

Nonprofits and Tax-Exempt Organizations that file Form 990 use this schedule to report the compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices.

11. Schedule K (Form 990) - Supplemental Information on Tax-Exempt Bonds

Organizations use schedule K to report certain information on their outstanding liabilities associated with tax-exempt bond issues.

12. Schedule L (Form 990 or 990-EZ)- Transactions with Interested Persons

13. Schedule M (Form 990)- Noncash Contributions

Schedule M is used to report the types of noncash contributions received during the year and additional information on these contributions.

14. Schedule N (Form 990 or 990-EZ) - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

Schedule N is to provide information relating to going out of existence or disposing of more than 25 percent of their net assets through a contraction, sale, exchange, or other disposition.

15. Schedule O (Form 990 or 990-EZ) - Supplemental Information

An organization should use Schedule O (Form 990 or 990-EZ), rather than separate attachments, to:

- Report responses in detail to specific questions on Form 990 or 990-EZ.

- Explain the organization’s operations or responses to various questions.

16. Schedule R (Form 990) - Related Organizations and Unrelated Partnerships

Organizations that file Form 990 use this schedule R to provide information on related organizations, on certain transactions with related organizations, and on certain unrelated partnerships through which they conduct significant activities.

ExpressTaxExempt auto generates Form 990 Schedules and FREE while filing your 990-EZ Form with our Software

ExpressTaxExempt supports all Schedules of Form 990.

The Schedules are auto-generated based on your input on Form 990.

You can view your filing summary and then transmit your return to the IRS.