Left to file Form 990-T for May 15, 2025.

E-File Form 990-N

(e-Postcard) Online

in

3 Simple Steps!

Search EIN, Choose Tax Year, Review and Transmit to the IRS.

Benefits of Using ExpressTaxExempt to

E-File 990-N

- Simple, Secure, and Accurate filing

- Instant IRS status updates

- Additional Users to Manage Accounts

- FREE Retransmission for Rejected Returns

- U.S based Chat, Email, & Phone Support

View Pricing

The Tax990 Commitment: Accepted, Every Time—Nonprofit Tax Filing

Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Need more time to file? Submit Form 8868 for an automatic extension for free.

Retransmit Rejected Returns

If your return is rejected by the IRS due to errors, you can correct and resubmit it at no additional cost.

No Cost Corrections

Found an error after submitting your return? You can submit corrections free of charge–up to three times.

Money-Back Guarantee

If your form isn't accepted or is flagged as a duplicate, we’ll issue a full refund—no questions asked.

Why Should Nonprofits Choose ExpressTaxExempt for Filing Form 990-N (e-Postcard)?

3 Step 990-N Filing

E-file your 990-N in a matter of a few minutes with 3 simple steps.

File 990-N From Any Device

You can file your 990-N on a desktop, mobile, or tablet from anywhere, anytime.

Get Real-Time Updates

Receive instant updates on the IRS status of your forms via email or text.

Free Retransmission

In case of IRS rejections, fix the errors and retransmit your 990-N returns for free.

View Filing History

Access your organization's prior year 990-N filings in one place.

Dedicated Customer Support

Our team of experts is available via live chat, phone, and email to assist with your e postcard queries.

How to File Form 990-N (e-Postcard) Online in 3 Simple Steps?

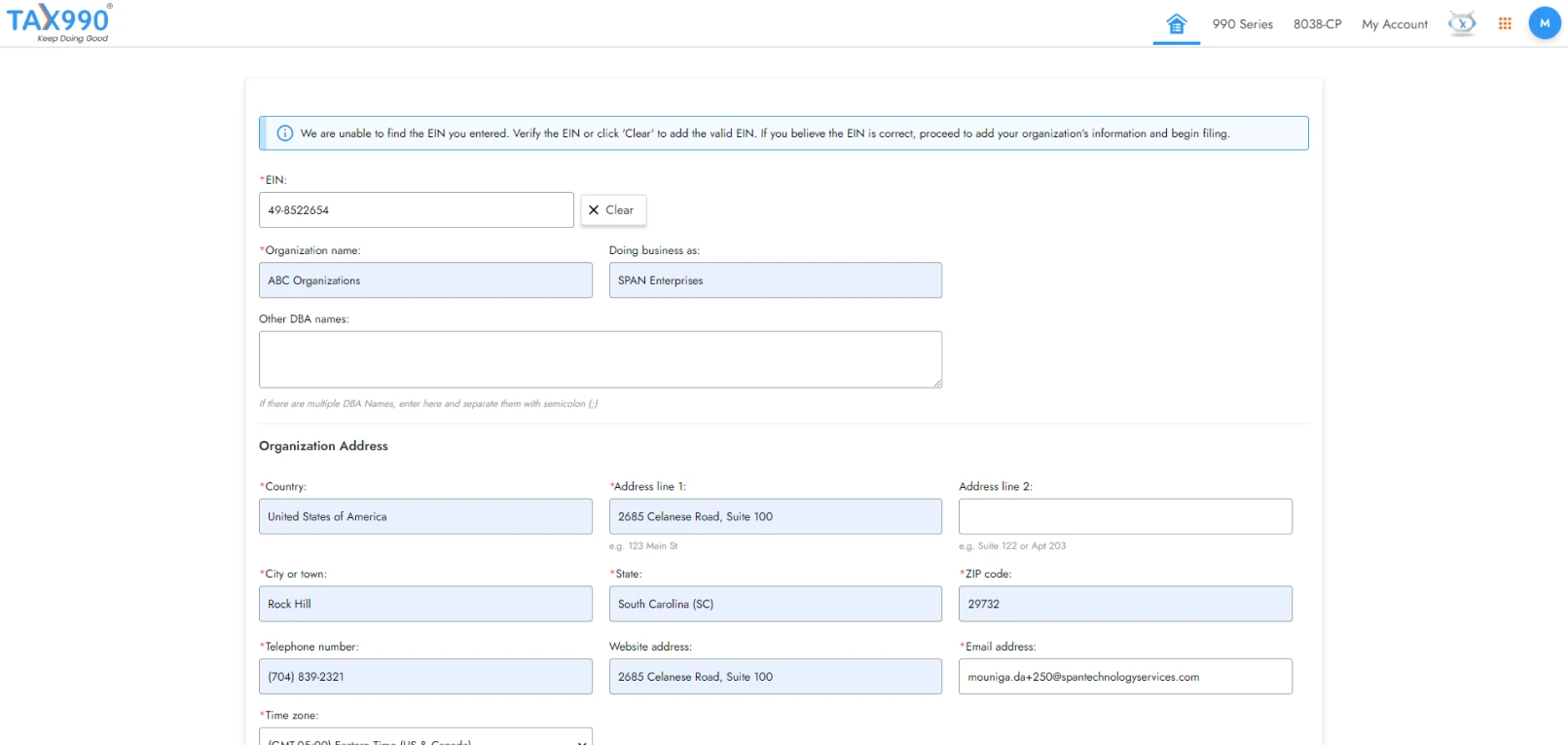

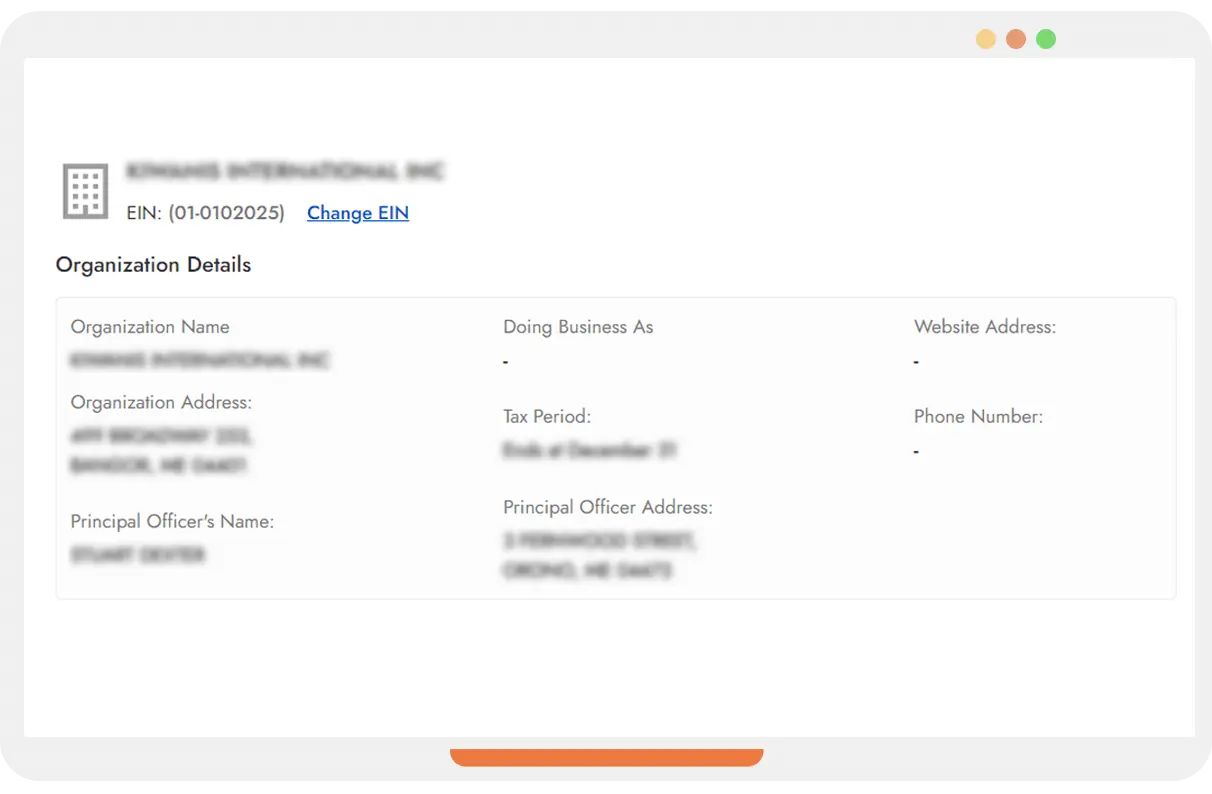

Simply search for your EIN, and our system will automatically import your organization’s data from the IRS.

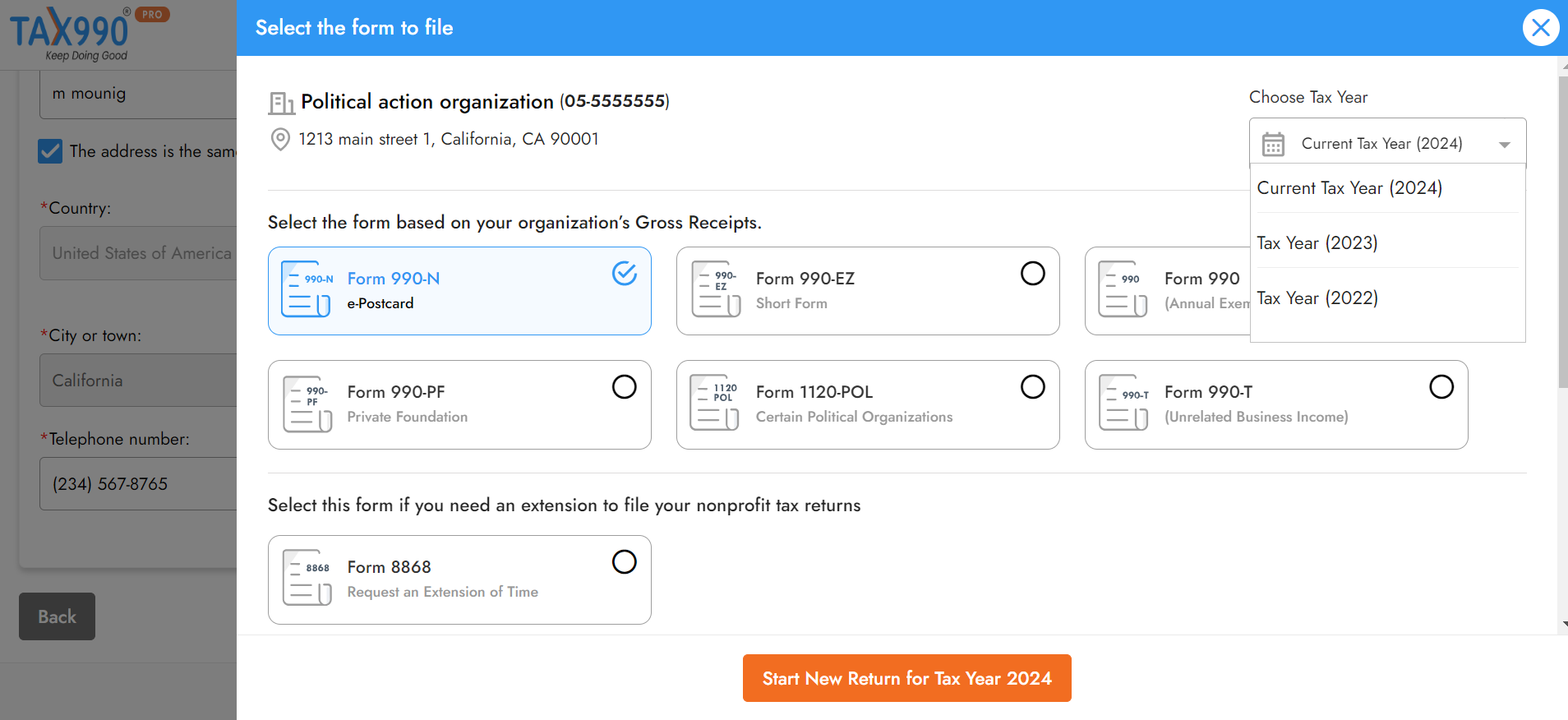

Tax 990 supports 990-N filing for both the current and previous tax years. Choose the applicable tax year, select Form 990-N, and proceed.

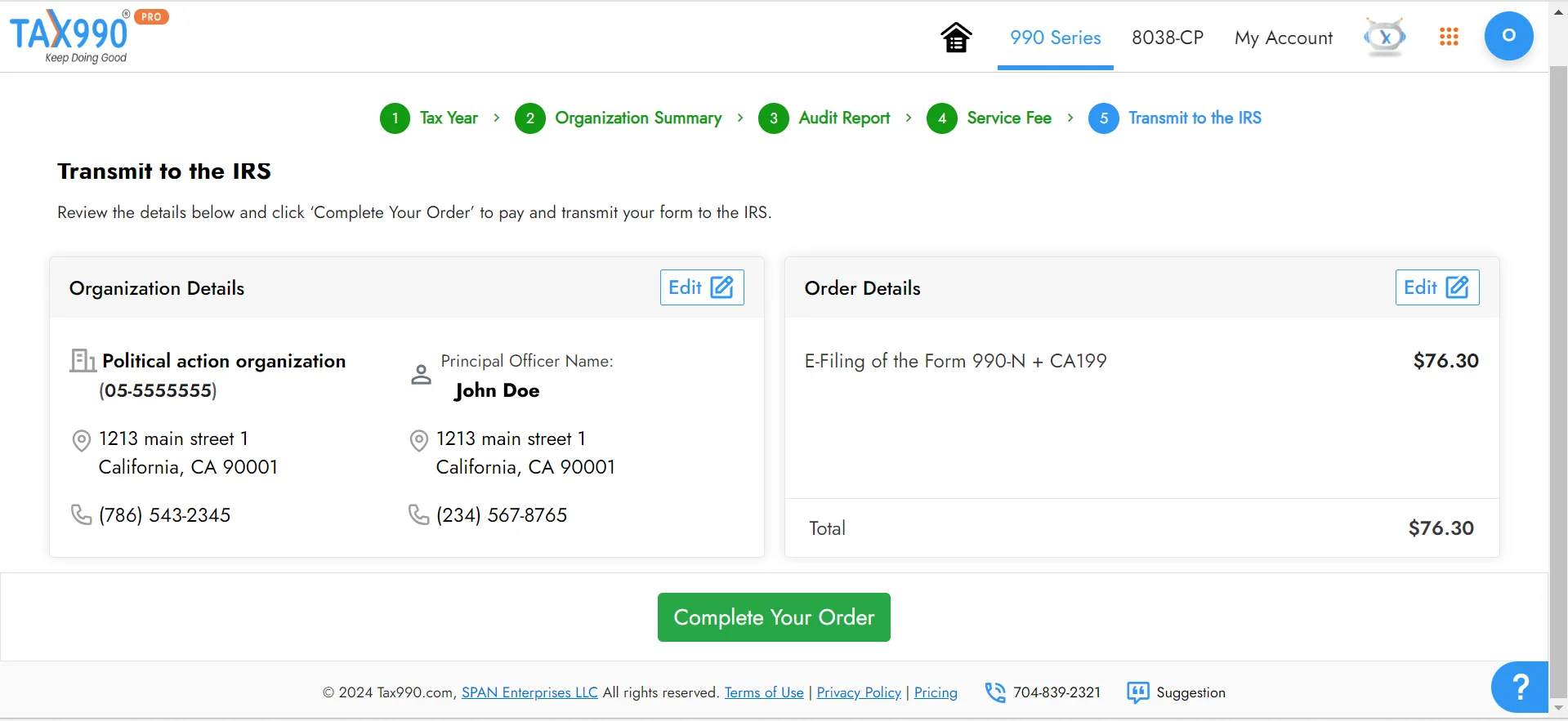

Once you review the form, transmit it to the IRS. Our system will notify you of the IRS status of your form via email or text.

Ready to File Your Form 990-N Electronically?

Information Required to file 990-N (epostcard) Online

Here are the details you need to file 990-N online,

- Organization’s EIN

- Organization’s accounting period

- Legal name and mailing address

- Other names of the organization

- Principal officer details

- Organization’s website address (if applicable)

- Confirmation that the organization's annual gross receipts are $50,000 or less

- Statement of termination (if applicable)

Ready to file Form 990-N (e-Postcard) with our software?

Frequently Asked Questions About Filing Form 990-N

What is IRS Form 990-N?

Small tax-exempt organizations with gross receipts of $50,000 or less must file e-file form 990-N, the Electronic Notice (e-Postcard), to fulfill their annual reporting requirements.

Note: Organizations can also voluntarily file Form 990 or 990-EZ.

When is the deadline to file my Form 990-N?

The deadline for filing Form 990-N is the 15th day of the 5th month after their respective tax year ends.

If your organization follows the calendar tax year, the deadline is May 15. E-file Now

If the due date falls on a weekend or a federal holiday, you must file your nonprofit tax return by the next business day.

Use the Due Date Calculator to find your 990-N deadline.

Should Form 990-N be filed electronically?

Yes! Form 990-N must be filed electronically. You cannot paper file Form 990-N.

Choose an IRS Authorized provider like tax990.com to e-file your 990-N Forms in 3 easy steps.

Is there any penalty for late filing Form 990-N?

There is no penalty for filing Form 990-N late. However, if the organization fails to file 990-N for three consecutive years, the IRS will revoke the tax-exempt status of the organization.

Can I extend my 990-N deadline?

No, the Form 990-N deadline cannot be extended (unlike other 990 forms).

Can Form 990-N be amended?

No! You cannot file an amended return for Form 990-N. However, our software allows you to retransmit the 990-N returns rejected due to IRS errors for Free.

Can I file Form 990-EZ/990 instead of Form 990-N?

Yes! A small exempt organization eligible to file Form 990-N may choose to file Form 990-EZ or even Form 990 voluntarily to satisfy its annual reporting requirements.

See how ExpressTaxExempt facilitated nonprofits to

file Form 990 efficiently!

Recent Queries on Form 990N Filing

- How long should an organization keep records for tax purposes?

-

My organization changed its legal name. Is there any additional reporting to be done with

Form 990-N? - Can a small organization file a previous year's Form 990-N return?

- My organization doesn't have an EIN. Can I use the EIN of my parent organization to file Form 990-N?

-

My Form 990-N has been rejected by the system. What should I

do next?