E-file IRS Form 1120-POL Online

Securely Prepare and E-File Form 1120-POL with ExpressTaxExempt

Why E-File Form 1120-POL with ExpressTaxExempt?

- Invite Users to Manage Filing

- Retransmit Rejected Returns for FREE

- Free First Amendment for original return filed with us

- Supports Amended Return

- U.S based Chat, Email, & Phone Support

How to e-file Form 1120-POL?

The Tax990 Commitment: Accepted, Every Time—Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Retransmit Rejected Returns

If your return is rejected by the IRS due to errors, you can correct and resubmit it at no additional cost.

No Cost Amendments

Found an error after filing? You can file up to 3 amendments without paying extra.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

See why our clients choose ExpressTaxExempt!

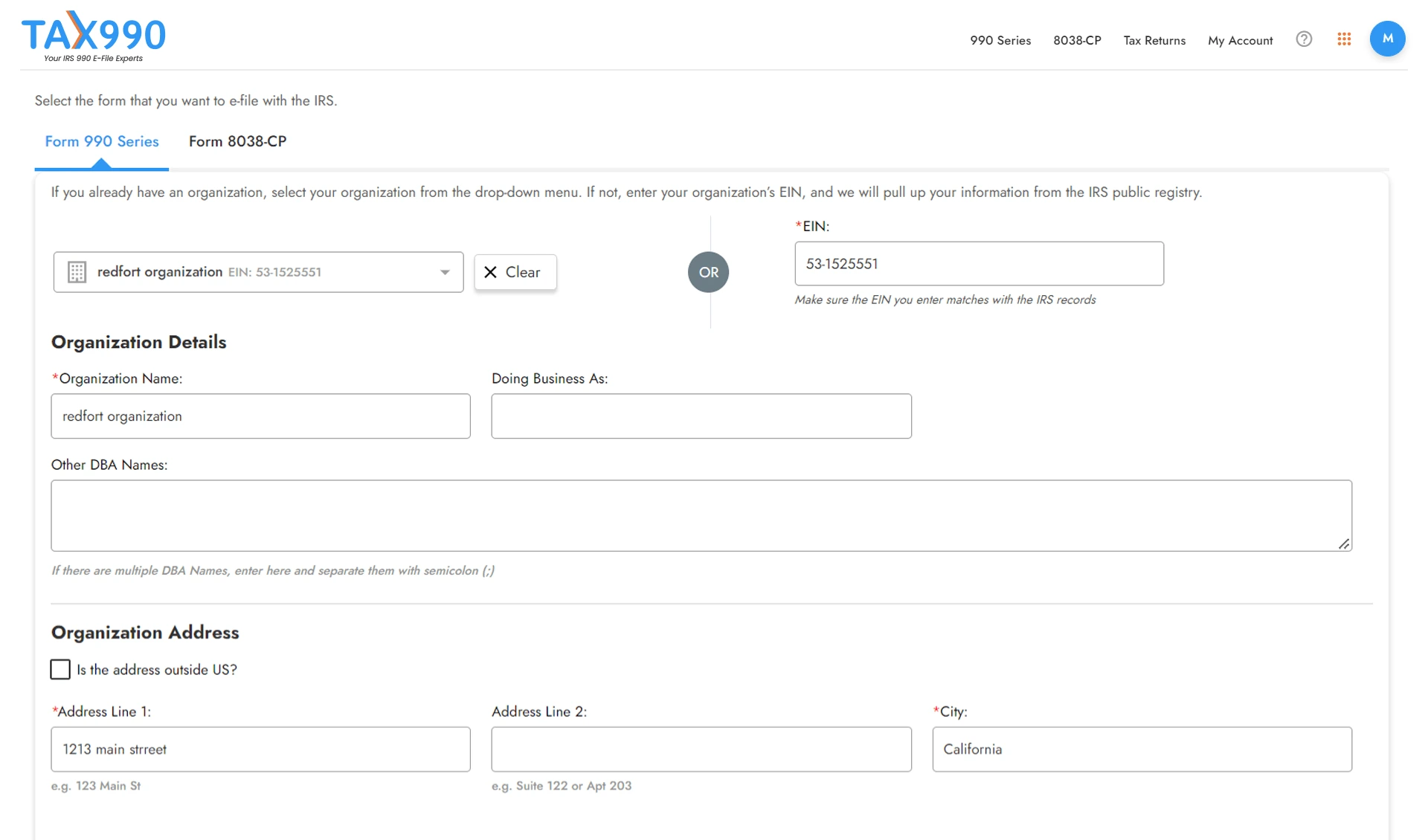

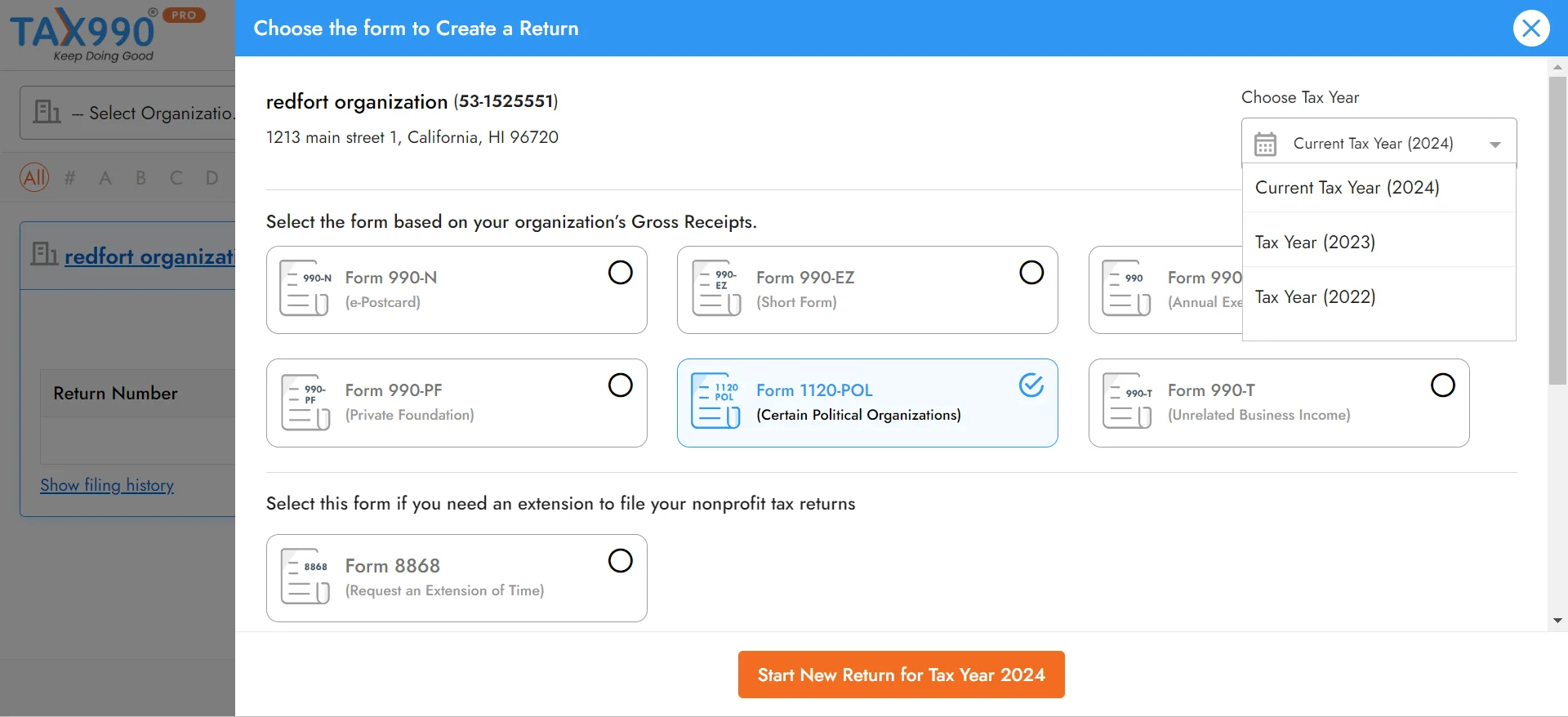

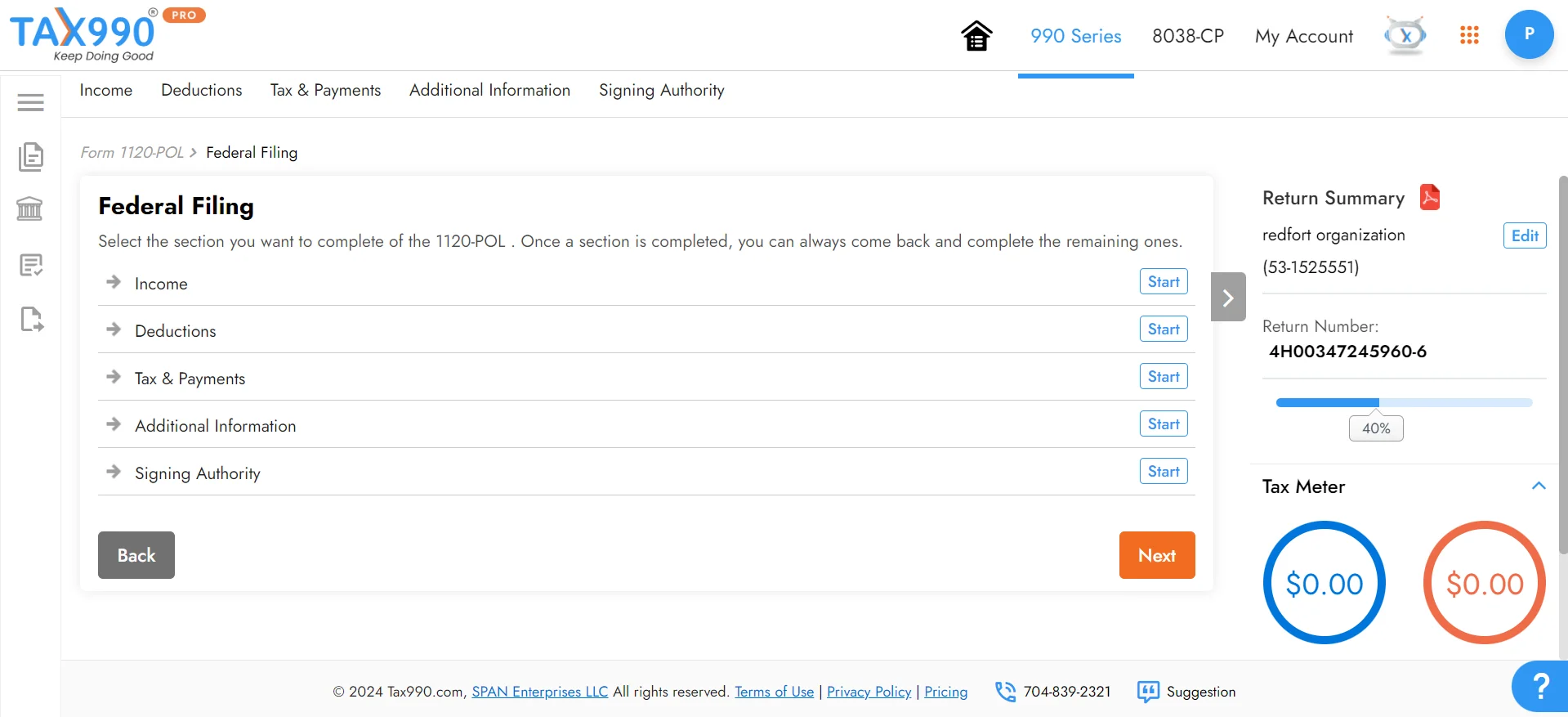

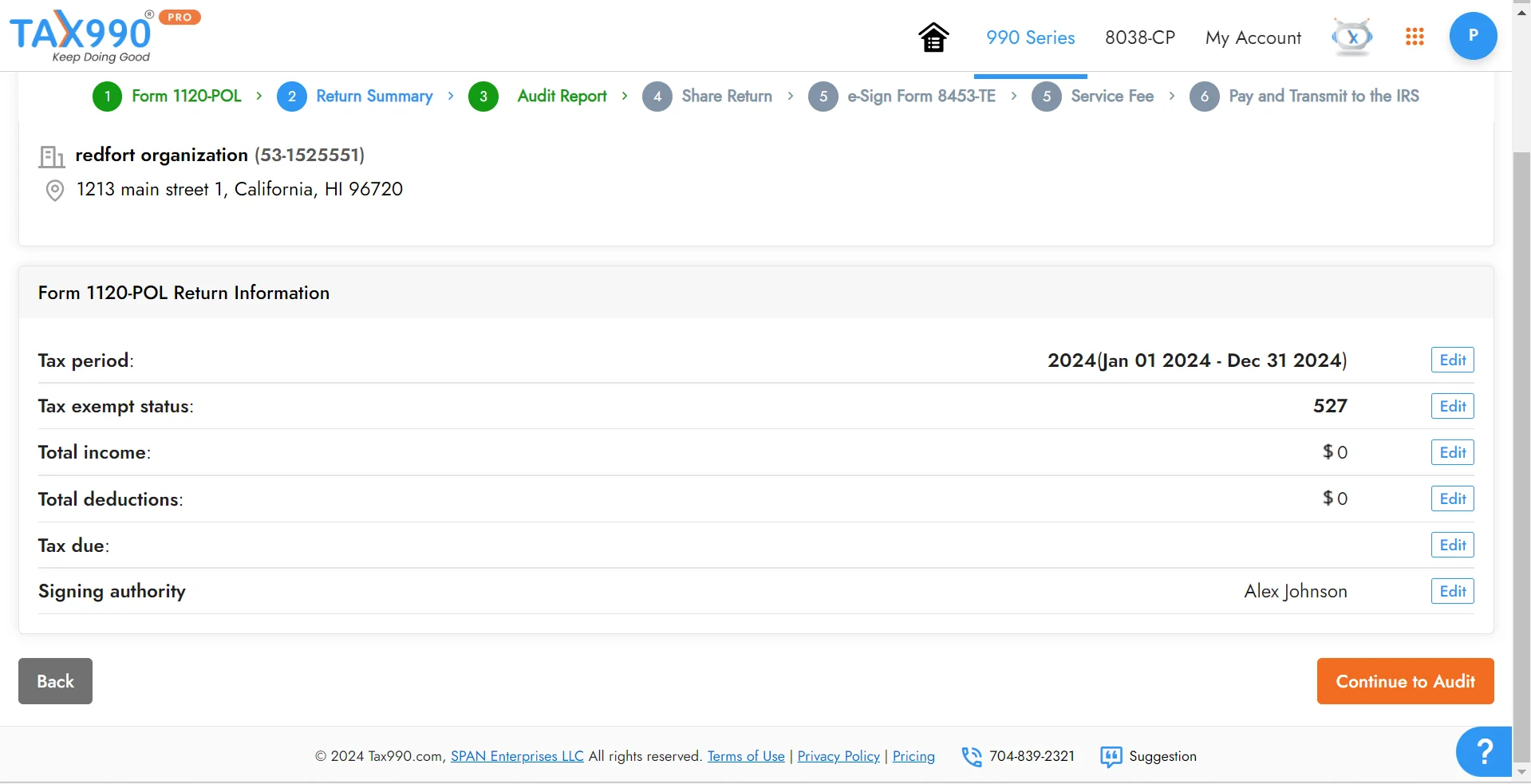

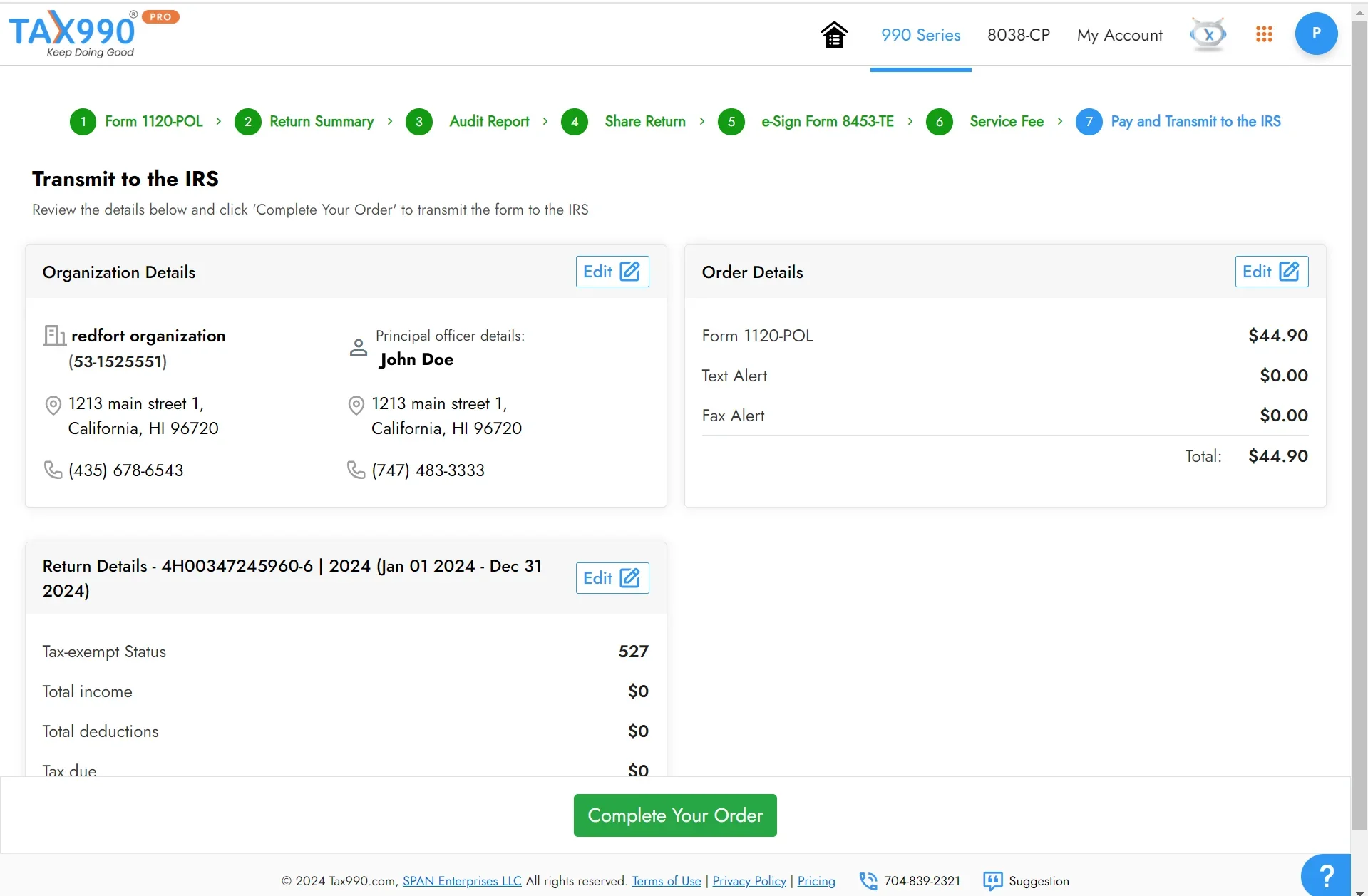

How to E-file Form 1120-POL Online for the 2024 Tax Year

with ExpressTaxExempt

Ready to File Your Form 1120-POL Electronically?

Why E-file Form 1120-POL Online with ExpressTaxExempt?

Prepare your form easily using Interview-style filing

Ensure accurate return with our internal audit check

Add and manage additional users to assist while filing

Re-transmit rejected

1120-POL Forms for free

E-file an amended Form

1120-POL return securely

Get your queries resolved by our live support team

Ready to e-file Form 1120-POL with ExpressTaxExempt?

Form 1120-POL Amended Return

Need to correct information on your previously filed Form 1120-POL?

You can easily e-file an amended return with ExpressTaxExempt and update information from a previously filed return. When filing an amended return, you will need to provide a reason for why you need to change your Form 1120-POL.

Note: Organizations that need to e-file an amended Form 1120-POL return must have e-filed their original return through ExpressTaxExempt

Frequently Asked Question on Form 1120-POL

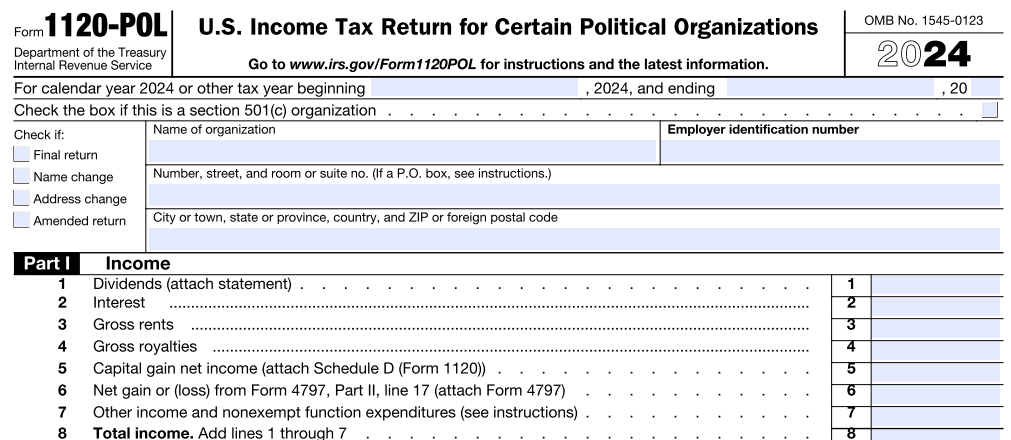

What is IRS Form 1120-POL?

Form 1120-POL is an annual income tax return that must be filed by organizations with political organization taxable income exceeding $100 for the taxable year.

Only taxable income (generally, the organization's investment income) is reported on Form 1120-POL.

When is the due date to file Form 1120-POL?

Form 1120-POL must be filed before the 15th day of 4th month after the organization tax year ends. For the organizations that operate on a calendar tax year, must file Form 1120-POL by April 15. E-file Now

How to file an extension for Form 1120-POL?

If needed, you may file Form 7004 to get an automatic 6 month extension to file your Form 1120-POL. You must file Form 7004 before the original Form 1120-POL filing due date to get the extension.

What are the late filing penalties for Form 1120-POL?

Organizations that fail to file Form 1120-POL before their deadline must pay an additional amount equal to 5% of the tax due for each month the return is late. The maximum penalty for late filing of Form 1120-POL is 25% of the tax due; the minimum penalty for a return more than 60 days late is the smaller of the tax due or $135.

Recent Queries

- Is it mandatory to fill out schedules when filing Form 990?

- Can I switch the filing method from form-based to interview-based or vice-versa mid-way?

- Can I save my return and come back later to complete my form?

- How do I download my 990 return?

- Can I review the form before transmitting it to the IRS?