Left to file Form 990-T for May 15, 2025.

IRS Form 990 Filing Due Date 2025

Find the deadline to file Form 990,

990-EZ, 990-N, 990-PF,

990-T, and 8868.

Meet your IRS Mandated E-filing Deadline with ExpressTaxExempt

- No subscription fees or contracts

- Live support by phone, email, or chat

- Attach applicable 990 Schedules for FREE

- Members can review and approve returns

- State filing guidance

Form 990 and Extension Due Date 2024

The IRS mandates electronic filing for 990 series forms

Get Started with ExpressTaxExempt, an IRS authorized Provider to E-file your 990 Forms.

-

Supports Form 990, 990-EZ, 990-PF, 990-N,

990-T, 8868 - Interview Style or Form based filing process

- 100% Transparent Pricing

Form 990 Deadline for 2025 - What Nonprofits Should Know

- Updated January 16, 2025 - 10.00 AM - Admin, ExpressTaxExemptForm 990 is used by 501(c)(3) Tax-Exempt Organizations to report their income, expenses, assets, liabilities, and activities with the IRS.

This article discusses the deadlines for 990 forms, Form 8868, and more.

When is Form 990 Due?

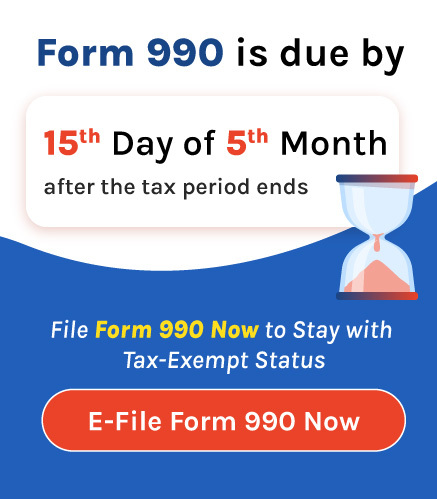

IRS Form 990 is due by the 15th day of the 5th month after the accounting period ends. This deadline also applies to other 990 variants such as 990-N, 990-EZ, and 990-PF.

The due date will vary for each organization depending on the accounting

period they follow.

Upcoming Form 990 Deadline:

- If your organization’s accounting tax period starts on March 01, 2024, and ends on February 28, 2025, your Form 990 is due by July 15, 2025.

- Also, If you filed an 8868 extension on January 15, 2025, then your Form 990 extended deadline is July 15, 2025.

Operating on a fiscal tax year? Find your due date using our due date finder.

When is Extension Form 8868 Due?

Form 8868 must be filed on or before the actual due date of the original 990 return, i.e., the 15th day of the 5th month after the tax period ends. Filing Form 8868 extends your deadline up to 6 months.

May 15, 2025.

Find Your 990 Due Date For the 2024 Tax Year

You can find the upcoming Form 990 deadlines for various accounting

period end dates.

| Fiscal Year End Date | Form 990 / 990-EZ /990-PF / 990-N Due Dates |

8868 Extension Due Dates |

|---|---|---|

| 02/28/2025 | 07/15/2025 | 01/15/2026 |

| 03/31/2025 | 08/15/2025 | 02/16/2026 |

| 04/30/2025 | 09/15/2025 | 03/16/2026 |

| 05/31/2025 | 10/15/2025 | 04/15/2026 |

| 06/30/2025 | 11/17/2025 | 05/15/2026 |

| 07/31/2025 | 12/15/2025 | 06/15/2026 |

| 08/31/2025 | 01/15/2026 | 07/15/2026 |

| 09/30/2025 | 02/16/2026 | 08/15/2026 |

Still not clear with the deadline? Try our due date calculator.

When is Form 990-T Due?

IRS Form 990-T due date will vary depending on the organization type.

| Organization Type | Deadline to file Form 990-T |

|---|---|

| For Employees' trusts, defined in section 401(a), IRAs (including SEPs and SIMPLEs), Roth IRAs, Coverdell ESAs, or 408(a) (Archer MSAs). |

|

| Other Nonprofit Organizations |

|

Operating on a fiscal tax year? Find your due date using our due date finder.

Variants of 990 Forms

Based on their gross receipts, total assets, and primary source of the contribution, the tax-exempt organizations are required to file different variants of the nonprofit tax returns as follows:

| Form 990 | Gross receipts ≥ $200,000 (or) Total assets ≥ $500,000 |

| Form 990-EZ | Gross receipts < $200,000 and total assets < $500,000 |

| Form 990-N | Gross receipt ≤ $50,000 |

| Form 990-PF | Private foundations (regardless of financial status) |

| Form 990-T | To report unrelated business income |

Click here to find your 990 Form.

Meet your IRS-Mandated Electronic Filing Requirements

The IRS mandates that tax-exempt organizations must file 990 Forms electronically for the tax year beginning on or after July 2, 2019.

Filing the 990 forms electronically helps the IRS process returns more quickly, saving a lot of time. Learn More

Tax990 (Formerly ExpressTaxExempt) - The IRS Authorized Form 990 E-filing Software You Can Trust

Get Started with Tax990, Formerly ExpressTaxExempt, the industry-leading e-file provider, and meet the mandated e-filing requirements without any sort of hassle.

-

We support the e-filing of IRS Forms 990, 990-EZ, 990-N, 990-T, 8868,

1120-POL, and CA Form 199. - Our software includes the applicable 990 Schedules for Free based on the information you provide on your return.

- You can add more users to manage your return if required. Also, you can send the completed form to your organization members and let them review and approve the returns.

Need more assistance in preparing your Form? Reach out to our live customer support team via phone, email, or chat.