Report Unrelated Business Taxable Income (UBTI) on

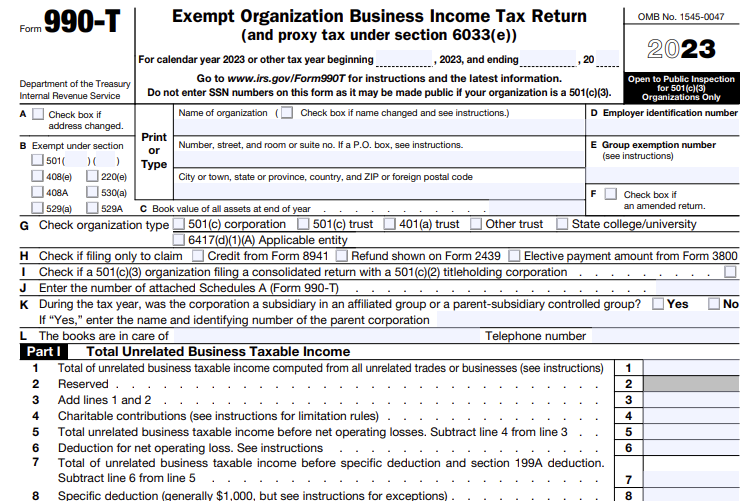

Form 990-T

In this article we will cover the following points:

Unrelated Business Taxable Income - An Overview

- Updated April 21, 2023 - 10.00 AM Admin, ExpressTaxExemptNonprofits and Exempt Organizations must report their income from business or trade which is unrelated to charitable purposes to the IRS by filing Form 990-T.

It’s also called Unrelated Business Taxable Income.

Table of Content

1. What is unrelated business income?

2. What is considered an unrelated business?

3. Organizations Subject to UBTI Tax

4. Unrelated Business Income Tax and filing requirements

5. Unrelated Business Income Tax Exceptions and Exclusions

7. Choose ExpressTaxExempt for reporting unrelated business taxable income on Form 990-T

1. What is unrelated business income?

Unrelated business income is income from a trade or business, regularly carried on, that is not substantially related to the charitable, educational, or other purpose that is the basis of the organization’s exemption.

2. What is considered an unrelated business?

For most organizations, an activity is an unrelated business if it meets the following three requirements:

- It is a trade or business - meaning it is carried on to produce income from selling goods or services

- It is regularly carried on - these are activities that show frequency and continuity

- It is not substantially related to furthering the organization’s exempt purpose - activities that generate income but do not contribute significantly to accomplishing the organization’s exempt purpose are not substantially related.

3. Organizations Subject to UBTI Tax

Not all organizations are imposed with unrelated business income tax.; only organizations that have unrelated business income are subject to UBTI tax.

The unrelated business income tax is imposed on the following:

- Organizations exempt from tax under section 501(a) of the Internal Revenue Code

- Employees' trusts forming part of pension, profit-sharing, and stock bonus plans described in section 401(a)

- Individual retirement arrangements

- State and municipal colleges and universities

- Qualified state tuition programs

- Medical savings accounts

- Coverdell savings accounts

4. Unrelated Business Income Tax and filing requirements

Organizations with unrelated business taxable income must complete Form 990-T and also separate Schedule A (Form 990-T) for each separate unrelated trade or business.

However, if the filing organization has no UBTI tax to report but is entitled to file Form 990-T, it must only file the 990-T return and is not required to complete or attach Schedule A

(Form 990-T) return.

5. Unrelated Business Income Tax Exceptions and Exclusions

Outlined by the Internal Revenue Code, exempt organizations that have unrelated business income are subject to various tax exclusions and exceptions from it.

Listed below are the activities that are specifically excluded from the definition of unrelated trade or business:

- Volunteer Labor: Any trade or business is excluded in which substantially all the work is performed for the organization without compensation. Some fundraising activities, such as volunteer-operated bake sales, may meet this exception.

- Convenience of Members: Any trade or business is excluded that is carried on by an organization described in section 501(c)(3) or by a governmental college or university primarily for the convenience of its members, students, patients, officers, or employees. A typical example of this is a school cafeteria.

- Selling Donated Merchandise: Any trade or business that sells merchandise that was received as gifts or contributions is excluded. Many thrift shop operations of exempt organizations would meet this exception.

- Bingo: Certain bingo games are not considered an unrelated trade or business.

6. Revised Form 990-T

The purpose of IRS Form 990-T is to report unrelated business taxable income made by certain exempt organizations. The 990-T return has been completely revised with many of the changes relating to the new regulations under the Tax Cuts and Jobs Act of 2017.

The revisions are also being made to improve its utility for reporting unrelated business taxable income consistent with the 'siloing' rules of Section 512(a)(6) as the Tax Cuts and Jobs Act put in place.

The updated form and other changes that relate to the filing of Form 990-T should be considered while preparing your 990-T return.

a) Schedule A

The redesigned 990-T Form now includes a separate “Schedule A” for each unrelated trade or business activity engaged by the organization. The filing organization must list the number of Schedules A they have attached to the return on “Line J” on Page 1 of the 990-T return.

b) Update on mandatory electronic filing of Form 990-T

Under the Taxpayer First Act, which was enacted into law on July 1, 2019, certain exempt organizations were required to file information and tax returns electronically for tax years beginning after July 1, 2019. At that time, the IRS system could not accept the e-filing of Form 990-T return. However, pending the conversion of Form 990-T to electronic format, the IRS continued to accept the 2019 tax-year versions of this return on paper.

Now that the IRS has updated its systems to enable e-filing of this form, the IRS Form 990-T and its instructions have been updated to reflect the mandatory e-filing requirement. Therefore, forms 990-T with due dates on or after April 15, 2021, must be e-filed.

7. Choose ExpressTaxExempt for reporting unrelated business taxable income on Form 990-T

ExpressTaxExempt is the one stop solution for filing 990 Forms.

Thousands of exempt organizations choose our software to e-file their Forms to report unrelated business taxable income easily.

Features that simplify your 990-T Filing

- File your Form 990-T using our direct form entry process

- Supports Form 990-T Schedule A

- Adding users to assist in 990-T filing process

- Invite organization members to review and approve your 990-T Forms

- Access our U.S based support via chat, email and phone

You can also file form 990-EZ, 990, 990-PF, 990-N (e-Postcard), and tax extension Form 8868 with our software.