How to Fill Out your 2024

Form 990-T?

In this article we will cover the following points:

The IRS Mandates

E-File of Form 990-T

Get Started with ExpressTaxExempt to E-File Your Form 990-T!

- Direct-Form entry filing process

- Includes 990-T Schedule A

- Internal Audit Check for Accurate Returns

2024 Form 990-T Filing:

A Line by Line Instructions

- Updated April 21, 2023 - 5.00 PM - Admin, ExpressTaxExempt

Every year Nonprofits and Private Foundations need to report their Unrelated Business Income to the IRS. The information is reported through Form 990-T.

Employees' trusts, defined in section 401(a) need to report before the 15th day of 4th month after the accounting period ends.

For trusts other than section 401(a) or 408(a), IRS Form 990-T needs to be filed by the 15th day of the 5th month after the accounting period ends.

IRS requires all Nonprofits and Private Foundations to make their Form 990-T annual return and all related supporting documents available to the public.

Table of Content

1. Form 990-T - An Overview

Exempt organizations are required to file Form 990 annually to report information about their revenue, expenses, assets, liabilities, programs and services, and governing officers.

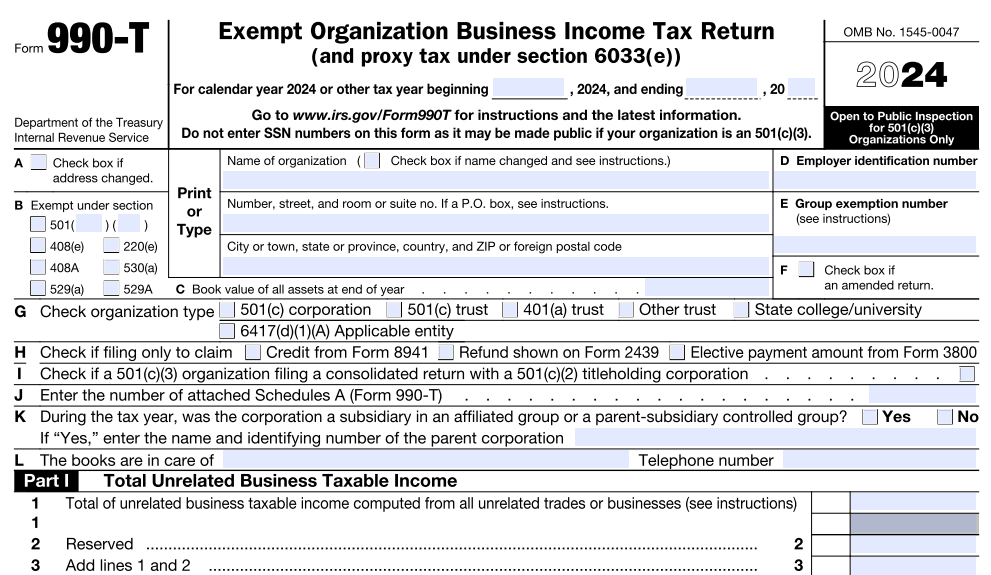

In some cases, tax-exempt organizations are liable for taxes on unrelated business income. This income needs to be reported to the IRS on Form 990-T, Exempt Organization Business Income Tax Return (and Proxy Tax Under Section 6033(e)). Form 990-T gives the IRS a clear picture of an organization’s unrelated business income and tax liabilities. Learn more about Form 990-T.

2. Who needs to file Form 990-T?

Exempt organizations that file Form 990-EZ, 990, or 990-PF and have a gross income of $1,000 or more from unrelated businesses for the tax year must file Form 990-T.

3. When is the Form 990-T due date?

Employees’ Trusts, defined in section 401(a), IRAs (including SEPs and SIMPLEs), Roth IRAs, Coverdell ESAs, and Archer MSAs are required to file IRS Form 990-T by the 15th day of the 4th month after the end of their organization’s tax year.

Other organizations must file 990-T by the 15th day of the 5th month after the end of

their tax year.

Note: If the due date falls on a Saturday, Sunday, or legal holiday, file the form on the next business day.

4. Instructions on how to file Form 990-T

The IRS has mandated electronic filing for Form 990-T. Therefore, effective in 2021, all Form 990-Ts due on or after April 15, 2025, must be filed electronically for the 2024 tax year.

Single Schedule to report income and deductions

Previously, Form 990-T had separate schedules for reporting information on various income and deductions. Now, for the current tax year, Schedule A has all the schedules attached to it. Therefore, it is enough that you complete and attach a separate Schedule A to report income and allowable deduction for each separate unrelated trade or business.

Basic Information about your organization

The following information is required to

file IRS Form 990-T:

- The organization's name, EIN, address, and phone number.

- Relevant information on any address changes, name changes, or amended returns.

- Group exemption number.

- Organization's tax-exempt status.

- If you are only filing Form 990-T to claim a credit from Form 8941 and/or to claim a refund shown on Form 2439, be sure to provide the relevant details.

- Form of organization.

- The fair market value of all assets at the end of the year.

- Schedule A details attached with Form 990-T.

990-T filing Instructions

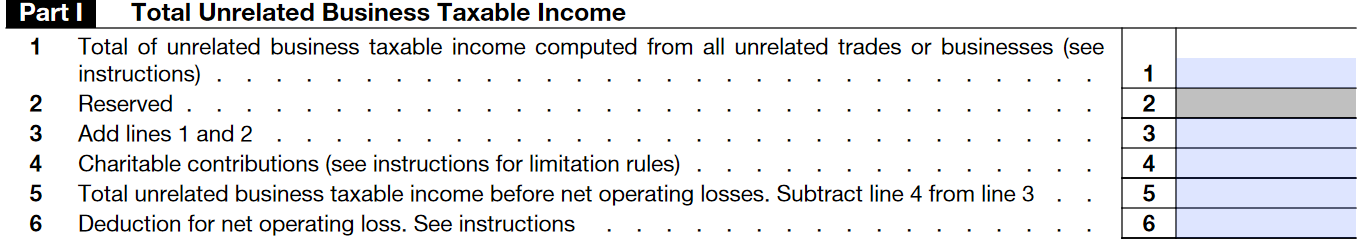

Form 990-T Part I Instructions - Total Unrelated Business Taxable Income

Line 1- 11 of Part I requires information about your organization’s unrelated business income.

-

Line 1 - Total of Unrelated Business Taxable Income computed from all Unrelated Trades or Businesses

It requires information about your organization’s unrelated business income. If your organization has only one unrelated trade or business, enter the amount from Schedule A (IRS Form 990-T), Part II, line 18; if more than one unrelated trade or business, enter the sum of the positive amounts from all Schedules A, Part II,

line 18. -

Line 2 - Reserved for future use

The IRS has not specified their plans for this line, but has instructed employers to leave it blank.

-

Line 3 - Total

Add Line 1 and 2 and enter the total.

-

Line 4 - Charitable Contributions

On this line, enter contributions or gifts paid within the tax year to or for the use of charitable and governmental organizations described in section 170(c). Also, enter any unused contributions carried over from previous years.

-

Line 5 - Total of Unrelated Business Taxable Income before Net operating Losses

Subtract line 4 from line 3 and enter that value. This is the Total unrelated business taxable income before net operating losses.

-

Line 6 - Deduction for Net Operating Loss

Enter the smaller of (a) the amount of net operating losses arising in tax years beginning before January 1, 2018, or (b) the amount shown on Part I, line 1.

-

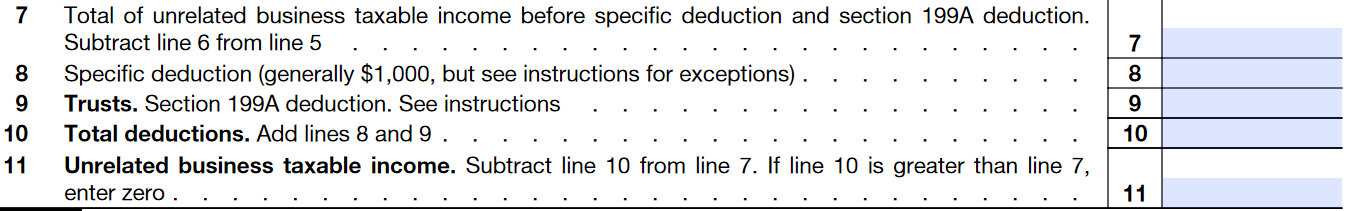

Line 7 - Total of unrelated business taxable income before specific deduction and section 199A deduction

Subtract line 6 from line 5 and enter that value.

-

Line 8 - Specific Deduction

Claim a specific deduction amount. Each specific deduction will be the smaller of $1,000 or the gross income from any unrelated trade or business the local unit conducts. If you claim a total specific deduction larger than $1,000, attach a statement showing how you figured the amount.

-

Line 9 - Trusts

If you are a Trust filing Form 990-T and have unrelated business income, you may have Qualified Business Income (QBI) and may be allowed a QBI deduction under section 199A.

Refer to Form 8995, Qualified Business Income Deduction Simplified Computation instructions to determine whether your organization meet the requirements for the QBI deduction and how to complete the application form.

-

Line 10 - Total Deductions

Add Line 8 and 9 and enter their sum to report Total Deductions.

-

Line 11 - Unrelated business taxable income

Subtract line 10 from line 7 and enter the value. If the value in line 10 is greater than line 7, enter zero for Line 11. This value will be your Unrelated business taxable income.

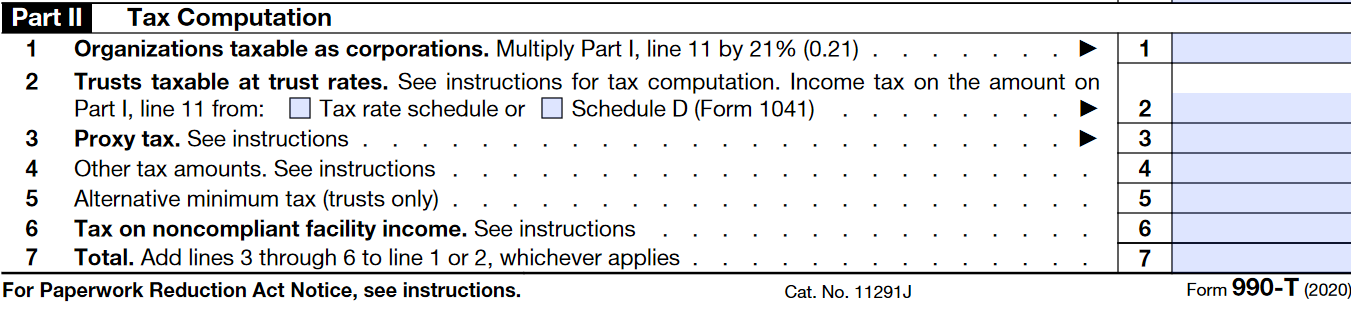

Form 990-T Part II Instructions - Tax computation

Line 1- 7 of Part II requires information about your organization’s taxable income.

-

Line 1 - Organizations Taxable as Corporations.

Multiply the amount reported on Part I, line 11 (Unrelated business taxable income) by 21% (0.21), and enter that value.

-

Line 2 - Trusts Taxable at Trust Rates

Here, Trusts alone should choose whether the income tax amount on Part I, line 11 was computed from a Tax rate schedule or Schedule D (Form 1041) and enter that value.

-

Line 3 - Proxy Tax

A proxy tax is a tax amount imposed against a tax-exempt organization that fails to correctly estimate the amount of money it will spend on lobbying activities for the tax year. Enter the proxy tax amount on this line and attach a statement showing the tax computation.

-

Line 4 - Other Tax Amounts

Enter the tax amounts that weren't reported in Part III, Line 3 of IRS Form 990-T, and attach a statement describing these tax amounts.

-

Line 5 - Alternative Minimum Tax

Only trusts liable for tax on unrelated business taxable income will be liable for an alternative minimum tax. You only need to complete this line if you're a trust liable on unrelated business taxable income.

Also, you must attach Schedule I (Form 1041), Alternative Minimum Tax—Estates and Trusts, and enter the taxable amount from Schedule I on this line.

-

Line 6 - Tax on Noncompliant Facility Income

It requires information about tax on a hospital organization’s non-compliant facility income. This tax is an income tax that is separate from the excise tax on a failure to meet the community health needs assessment (CHNA) requirements of section 501(r)(3) that is reported on Form 4720.

-

Line 7 - Total

Add the values entered on lines 3 through 6 to line 1 or 2, whichever applies, and enter that amount in line 7. The value entered in this line is the Total Tax Computation.

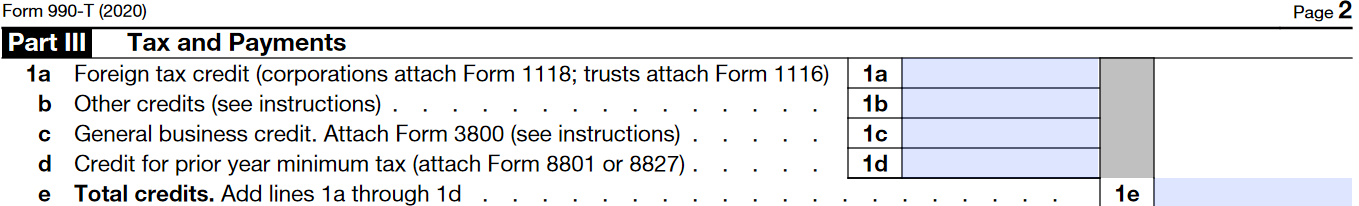

Form 990-T Part III Instructions - Tax and Payments

Part III of IRS Form 990-T requires information about the tax amount your organization

owes the IRS.

Line 1, Part III consists of 5 sub-sections

-

Line 1a - Foreign Tax Credit

Enter the foreign tax credit and attach Form 1118 if you function as a corporation;

Form 1116 if you function as a trust. -

Line 1b - Other Credits

Enter the non-refundable credits not identified elsewhere in Part III, line 1. Also, attach a statement that lists the applicable form and the amount of the credit.

-

Line 1c - General Business Credit, Attach Form 3800

Enter the organization's total general business credit. Do not include the work opportunity credit, employee retention credit, the empowerment zone employment credit, the Indian employment credit, and the credit for employer differential wage payments.

-

Line 1d - Credit for Prior Year Minimum Tax

It requires information on the Credit for Prior Year Minimum Tax. Use Form 8801 to figure the minimum tax credit and any carryforwards of that credit for trusts. If you're a corporation, use Form 8827.

-

Line 1e - Total Credits

add Line 1a through 1d and enter the total.

-

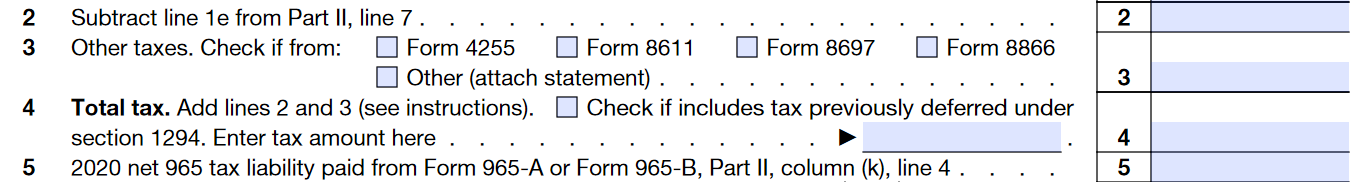

Line 2 - Total Tax Computation

Subtract line 1e from Part II, line 7 (Total Tax Computation), and enter that value.

-

Line 3 - Other Taxes

Check the relevant check box, based on the tax amount your organization owes.

- Check Form 4255 for recapture of investment credit

- Check Form 8611 for recapture of low-income housing credit

- Check Form 8697 for interest due under the look-back method

- Check Form 8866 for interest due under the look-back method for property depreciated under the income forecast method

- Check Other if the previous boxes do not apply. If you checked Other, attach a statement showing the computation of each item included in the total for

Part III, line 3.

-

Line 4 - Total Tax

Add Lines 2 and 3 and enter the total. Also, include any deferred tax on the termination of a section 1294 election applicable to shareholders in a qualified electing fund in the amount entered on Part III, Line 4

-

Line 5 - Net 965 Tax Liability Payments

Check the relevant check box, based on the tax amount your organization owes.

- For Corporations - If an election to pay the section 965 net tax liability in installments has been made under section 965(h), complete and attach Form 965-B. Enter the current year section 965 installment payment (from

Form 965-B, Part II, column (k), line 4). -

For Trusts- If an election to pay the section 965 net tax liability in installments has been made under section 965(h), complete and attach Form 965-A. Enter the current year section 965 installment payment (from Form 965-A, Part II, column (k),

line 4).

- For Corporations - If an election to pay the section 965 net tax liability in installments has been made under section 965(h), complete and attach Form 965-B. Enter the current year section 965 installment payment (from

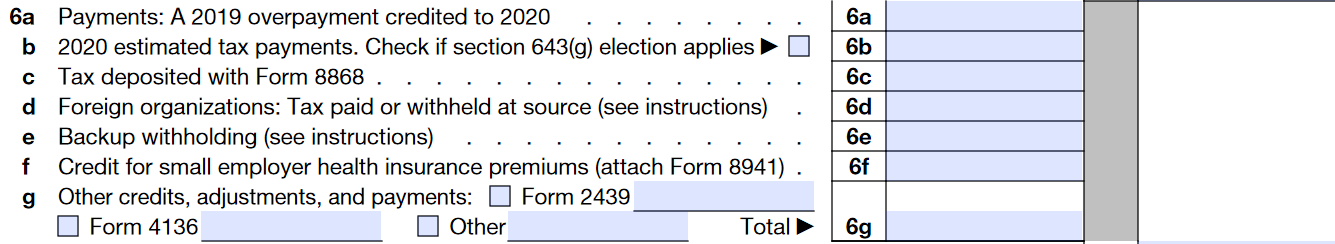

Line 6, Part III consists of 7 sub-sections

-

Line 6a - Payments

Enter the 2023 overpayment credited to the 2024 tax year.

-

Line 6b - Estimated Tax Payments

Enter the total estimated tax payments made for the tax year. If your organization is the beneficiary of a trust, and the trust makes a section 643(g) election to credit its estimated tax payments to its beneficiaries, include the organization's share of the estimated tax payment in the total amount entered here. Also, attach a statement showing the amount of section 643(g) credit amount.

-

Line 6c - Tax Deposited with

Form 8868Enter the tax amount deposited with Form 8868.

-

Line 6d - Foreign Organizations

Enter the tax withheld on unrelated business taxable income from U.S. sources that aren’t effectively connected with a trade or business conduct within the United States.

-

Line 6e - Backup Withholding

It requires information about Backup Withholding. Suppose your organization was subject to erroneous backup withholding because the payer didn’t realize you were an exempt organization and not subject to this withholding. In that case, you can claim credit for the amount withheld by including it in this line.

-

Line 6f - Credits for Small Employer Health Insurance Premiums

Any organization described under Section 501(c) and exempt from tax under section 501(a) may be eligible to claim the refundable small employer tax credit for a percentage of certain health insurance premiums paid on its employees. A tax-exempt eligible small employer can also request refundable credits by filing and attaching Form 8941, Credit for Small Employer Health Insurance Premiums, and showing the calculation for the refundable credit amount claimed.

-

Line 6g - Other Credits, Adjustments and Payments.

Here, check the relevant check box and provide the credit information.

-

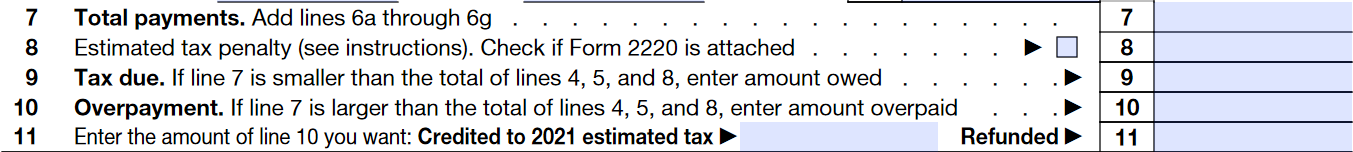

Line 7 - Total Payments

Add the values entered on lines 6a through 6g and enter the total.

-

Line 8 - Estimated Tax Penalty

Use Form 2220, Underpayment of Estimated Tax by Corporations, to see if the organization owes a penalty and its amount. Check the box on Line 8 if you're attaching Form 2220, and enter the penalty amount in the line.

-

Line 9 - Tax Due

Enter the Tax Due amount in Line 9, Part III. If Line 7 is smaller than the total of lines 4, 5, and 8, enter the amount owed on Line 9.

-

Line 10 - Overpayment

Enter the Overpayment amount on Line 10, Part III. If Line 7 is larger than the total of lines 4, 5, and 8, enter the amount overpaid on

Line 10. -

Line 11 - Refunded

Enter the amount of overpayment you want to credit to the 2021 estimated tax.

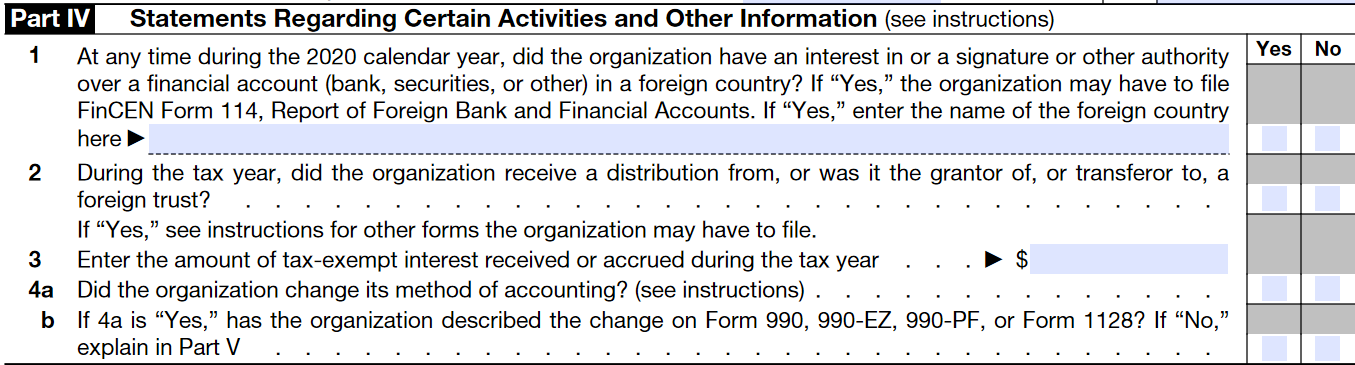

Form 990-T Part IV Instructions - Statements regarding certain activities and other information

Line 1 to 4 of Part IV requires information on your organization’s various activities and changes made for the tax year.

-

Line 1 - Did the organization has financial account in a Foreign country, If yes File FinCEN

Form 114:Select Yes if the organization has an interest in or a signature or other authority over a financial account (bank, securities, or other) in a foreign country and enter the name of the foreign country. Also, your organization is required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR) electronically with the Department of the Treasury using FinCEN's BSA E-Filing System. Since FinCEN Form 114 isn't a tax form, don't file it with Form 990-T.

-

Line 2 - Organization receives a distribution from a foreign trust.

Select Yes if your organization received a distribution from a foreign trust. Your organization may be required to file Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

-

Line 3 - Report Tax-exempt received or accrued.

Report any tax-exempt interest received or accrued. Also, include any exempt-interest dividends received as a shareholder in a mutual fund or other regulated investment company.

-

Line 4a - Change in Accounting Method

It requires information about your organization’s accounting method.

-

Line 4b - Select Yes if your organization changed its accounting method

Click the check box Yes if your organization changed its accounting method and explained the change on Form 990, 990-EZ, 990-PF, or Form 1128. If not, provide an explanation in Part V, Supplemental Information of

IRS Form 990-T.

To change accounting methods, organizations must file Form 3115, Application for Change in Accounting Method.

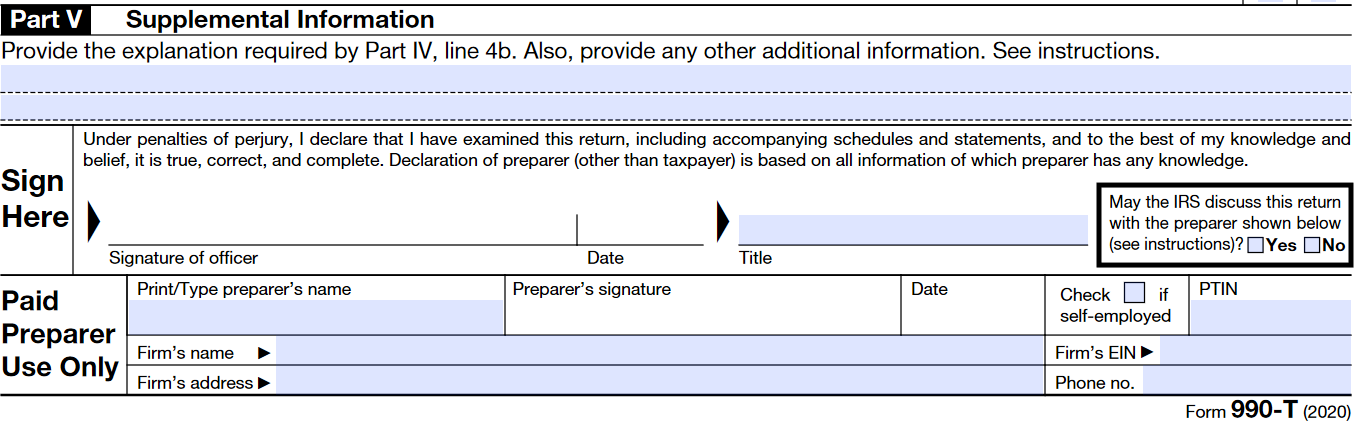

Form 990-T Part V Instructions - Supplemental information

Part V of 990-T requires organizations to respond to a series of questions. In this section, you will need to explain your organization’s operations and responses to various questions asked in previous parts of IRS Form 990-T.

Once each part is completed you need to sign the 990-T Form.

ExpressTaxExempt makes filing 990-T Form easier by following the instructions above.

File IRS Form 990-T before the due date and transmit it to the IRS.

5. How to fill out Form 990-T electronically?

Get started with an IRS-authorized e-file provider like ExpressTaxExempt for the easiest

Form 990-T filing process. When you e-file with us, you’ll get instant notifications on your return’s status.

To e-file Form 990-T, get started with ExpressTaxExempt and follow these simple steps:

- Step 1: Enter your EIN and search for your organization’s details.

- Step 2: Select the tax year you’re filing Form 990-T for and complete your form using our direct form-based entry.

- Step 3: Once you enter all the required information, we will check your return for mistakes. If we find any errors, you’ll be able to correct them quickly.

- Step 4: Review your form and make any necessary corrections.

- Step 5: Finally, transmit your return

to the IRS.