Form 990-T Schedule A - Schedule of Unrelated

Business Income

Quick Links:

Form 990-T Schedule A - Unrelated Business Income

- Updated April 21, 2023 - 5.00 PM - Admin, ExpressTaxExemptForm 990-T is filed by tax-exempt organizations to report their Unrelated Business Income ($1000 or more) to the IRS.

Organizations that file Form 990-T should include Schedule A with their main form.

This article is an overview of what tax-exempt need to know about filing Form 990-T, Schedule A.

Table of Content

1. What is Form 990-T schedule A?

Form 990-T Schedule A (Unrelated Business Taxable Income From an Unrelated Trade or Business) is used by organizations to report the income and allowable deductions for each unrelated trade or business that they have reported on

IRS Form 990-T.

2. Who needs to attach Form 990-T Schedule A?

Organizations that file Forms 990, 990-EZ, and 990-PF should also file IRS Form 990-T with Schedule A when they generate $1000 or more from one or more unrelated trades or businesses.

Note: A separate Schedule A should be included for each unrelated trade or business.

3. Instructions to complete Form 990-T Schedule A

Find our step-by-step instructions below on how to complete Form 990-T

Schedule A.

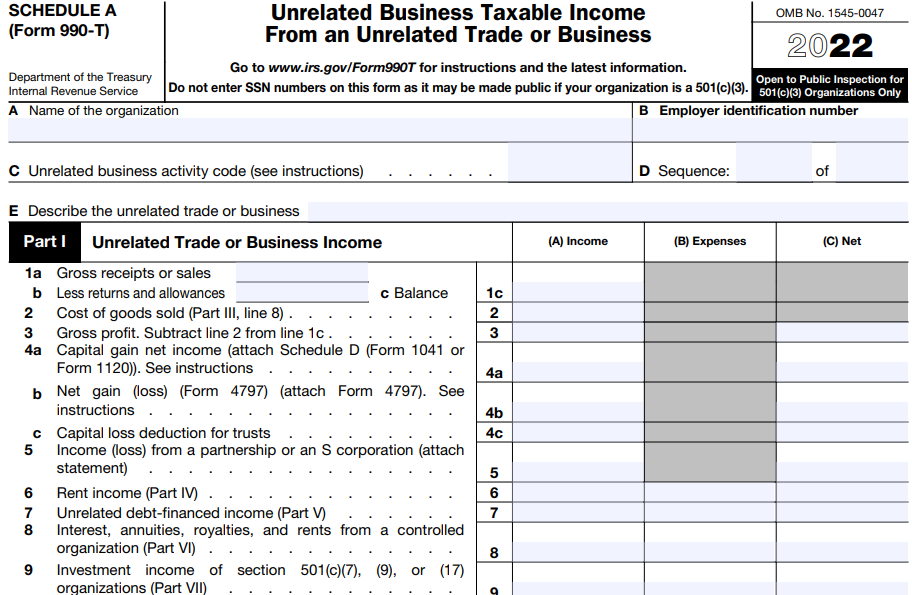

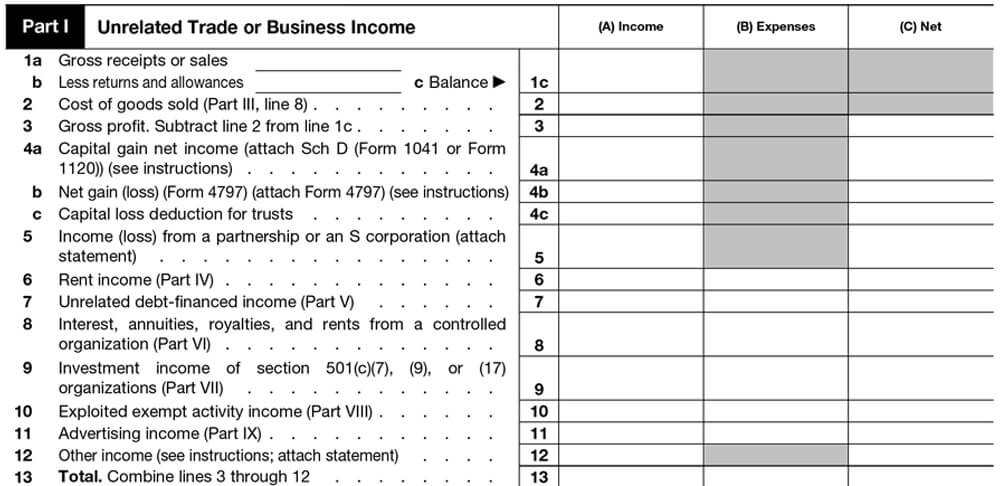

Part I - Unrelated Trade or Business Income

In this part, you must report the unrelated business income generated by your organization in the corresponding tax year.

-

Enter the values of gross receipts or sales, cost of goods, unrelated business income, investment income, and other income in the following columns:

- Income

- Expenses

- Net value

- Add lines 3 through 12 and enter the total income, expenses, and

Net value.

Note: Trust should report their capital gains and losses on Schedule D (Form 1041), whereas corporations must report them on Schedule D (Form 1120). If the organization has gains and losses to report other than capital assets, it must report them on Form 4797, Sales of Business Property.

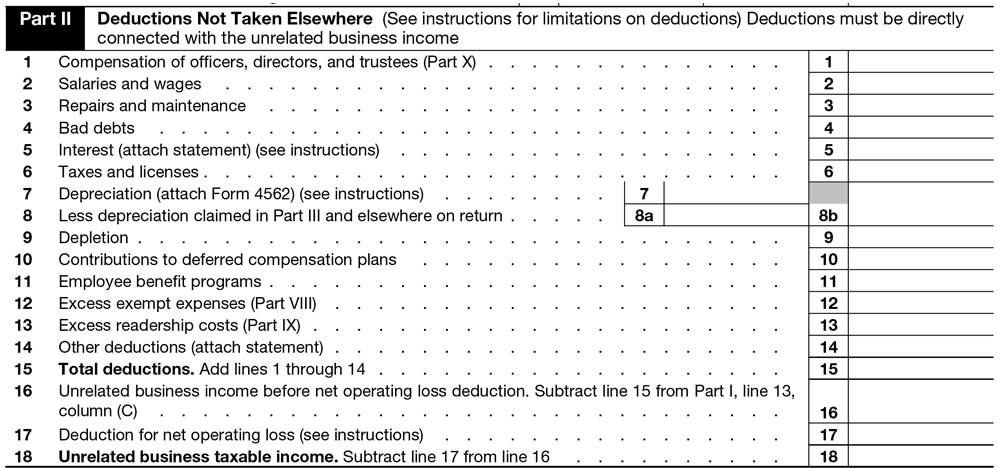

Part II - Deductions Not Taken Elsewhere

If the aggregate sum of the income (part I, line 13a) reported on all Schedules A (Form 990-T) is $10,000 or less, you don't have to complete lines 1 through 14 of part II.

- Provide information about the various expenses and contributions that the organization made for the taxable year, including the compensation of officers, directors, trustees, salaries, wages paid, employee benefit programs, and other deductions.

- Add the values of lines 1 through 14 and enter the total deductions. Then, determine and report the deduction for the net operating loss. Enter the Unrelated business taxable income by subtracting line 17 from line 16.

Note: Both corporations and trusts can file Form 4562, Depreciation and Amortization, to report other information besides the depreciation value.

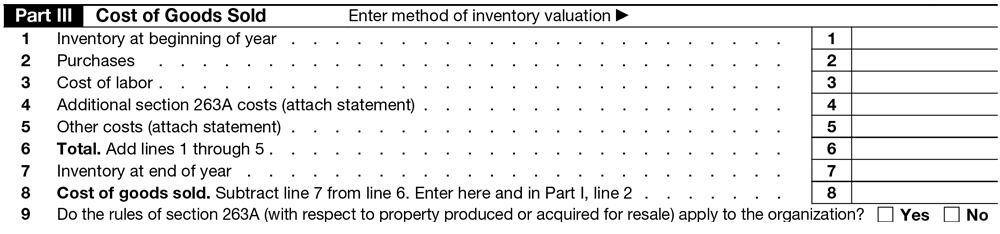

Part III - Cost of Goods Sold

This part requires you to report the costs related to the inventory and

goods sold.

At the top of Part III, enter the method of inventory valuation.

- Enter the value of inventory at the beginning and end of the tax year, including purchases, labor costs, and other costs.

- Use this information to calculate and indicate the Cost of goods sold.

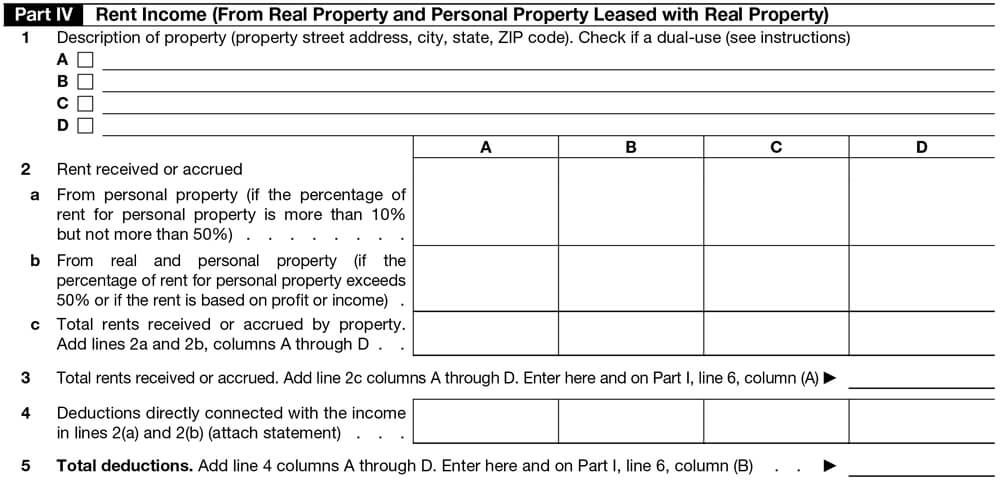

Part IV - Rent Income (From Real Property and Personal Property Leased with Real Property)

All organizations that have applicable rent income (except section 501(c)(7), (9), and (17) organizations) should complete this part.

- Provide details (street address, city, state, ZIP code) about the properties.

- Based on the percentage of rents received or accrued, enter the rents received from personal property, real property, and total rents. Then, calculate and report the total deductions.

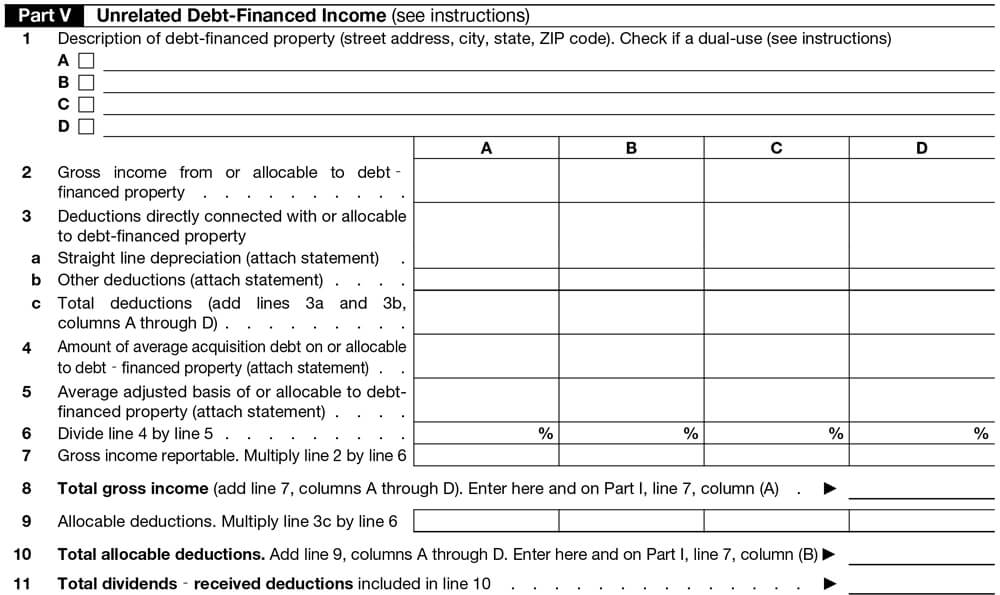

Part V - Unrelated Debt-Financed Income

This part is used to compute unrelated debt-financed income described in Sections 512(b)(4) and 514 from debt-financed properties. (Only when this income doesn’t constitute income from the conduct of an unrelated trade or business and isn't specifically taxable under other provisions of the Code).

- Provide details regarding the debt-financed properties, gross income from or allocable to those properties, deductions, and depreciation.

- Enter the total gross income, total allocable deductions, and total dividends.

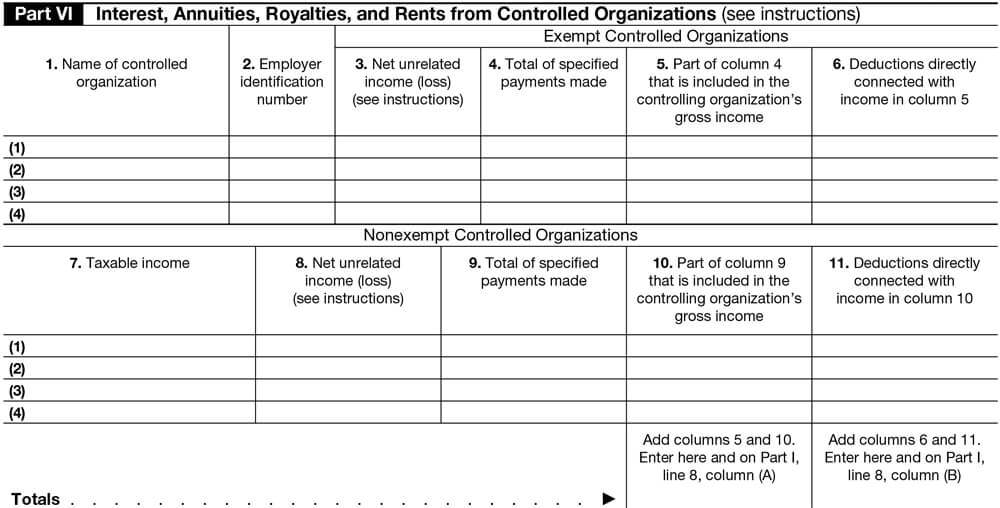

Part VI - Interest, Annuities, Royalties, and Rents from Controlled Organizations

As the name indicates, this part requires information regarding interest, annuities, royalties, and rents from both exempt and nonexempt controlled organizations.

Provide details regarding the name and EIN of the controlled organizations, net unrelated income, taxable income, and deductions.

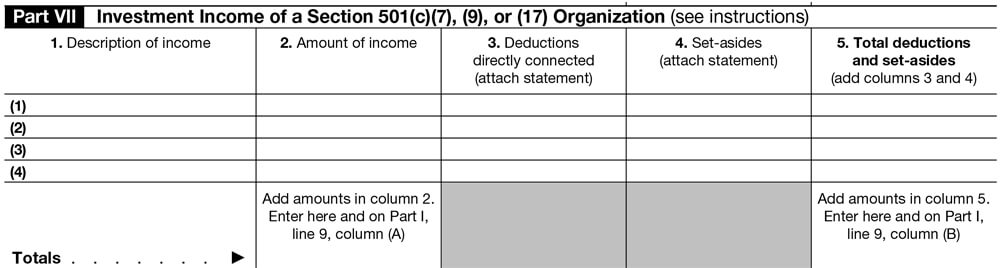

Part VII - Investment Income of a Section 501(c)(7), (9), or (17) Organization

This part requires information about your organization's investment income.

Report all the income generated from the organization’s investments in securities and other similar investment income from nonmembers, including 100% of income from debt-financed property.

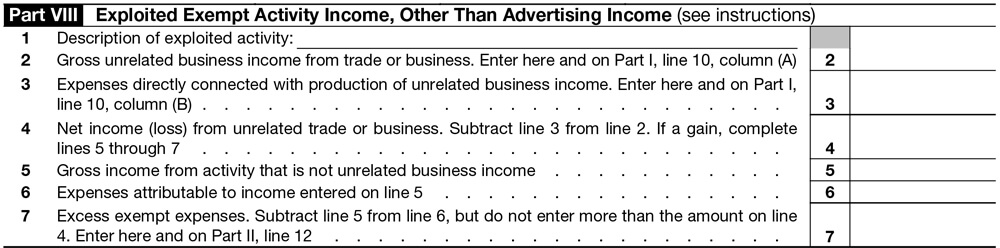

Part VIII - Exploited Exempt Activity Income, Other Than Advertising Income

Exempt organizations with gross income from an unrelated trade or business activity that exploits an exempt activity (other than periodical advertising income reportable in Schedule A Part IX) must complete this part of 990-T Schedule A.

Describe the exploited activity and provide details regarding the gross and net income and expenses of that activity.

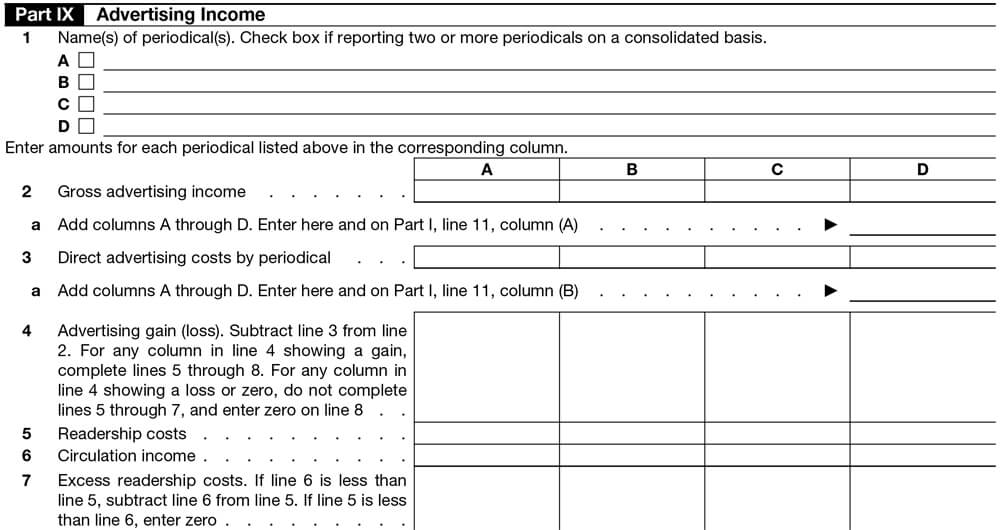

Part IX - Advertising Income

The exempt organizations that generated gross income from the sale of advertising in an exempt organization periodical are required to complete this part.

Enter the name of the periodicals and report the gross advertising income, advertising, and readership expenses for each periodical.

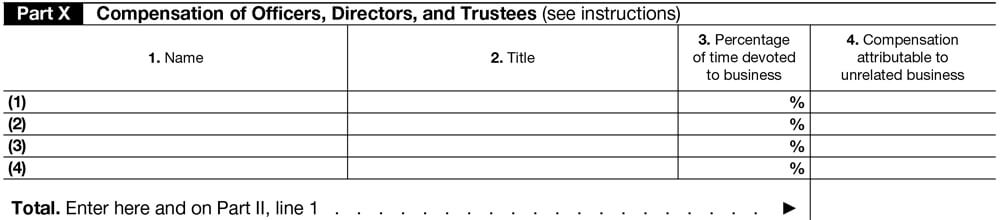

Part X - Compensation of Officers, Directors, and Trustees

This part requires information on the compensation made to your organization’s Officers, Directors, and Trustees.

Enter the required details about your officers, directors, and trustees, such as name, title, percentage of time devoted to business, and compensation attributable to unrelated business, in the corresponding columns.

Part XI - Supplemental Information

This part requires details about your organization’s operations. It also allows you to provide information on lines that don’t have an embedded attachment, information to supplement embedded attachments, or any other information about amounts reported on the Schedule.

Note: Suppose an organization associated its unrelated trade or business activity with a different NAICS or Business Activity Code during a prior year than the one shown on Schedule A for the current tax year. They can use this part to provide an explanation regarding the reason for the change.

4. Searching for the Best Way to File Your Form 990-T with?

Get started with ExpressTaxExempt to complete your filing of Form 990-T with Schedule A effortlessly.

ExpressTaxExempt, the market-leading e-file provider, is the perfect solution for filing your Form 990-T with Schedule A.

There are many benefits of choosing ExpressTaxExempt:

- As an IRS-authorized e-file provider, we provide a secure and accurate option for e-filing 990 returns.

- Attaching Schedule A is free when you are filing a Form 990-T with us.

- Our Internal Audit Check feature reviews your returns for errors so that you file them accurately with the IRS.

- Our dedicated, live customer support team is available to assist you by phone, email, and live chat.

Article Sources

- Specific Instructions – Schedule A (Form 990-T):

E-file your Form 990-T with our Software

E-file your Form 990-T with ExpressTaxExempt

Accurate and Secure Filing

IRS Authorized E-File Provider