2024 Form 990 PF Instructions

Quick Links:

The IRS Mandates

E-File of Form 990-PF

Get Started with ExpressTaxExempt to

E-File Your Form 990-PF!

- Secure & Accurate Filing

- Auto-generate 990-PF Schedule B

- E-file your Amended Return

- Retransmit Rejected Returns for Free

- Supports Extension Form 8868

2024 Form 990-PF Instructions -

A Complete Guide

- Updated September 03,2024 - 8.00 AM - Admin, ExpressTaxExempt

The IRS requires Private Foundations to file Form 990-PF in order to report their nonprofit expenses, revenue, activities, officer details, capital gains, and distributable amount of charitable distributions during the tax year.

Form 990-PF is due by the 15th day of the 5th month from the organization's accounting period ending. For organizations following the calendar tax year, the 990-PF deadline is May 15. If you need more time to file your 990-PF, you can file Form 8868 now to get a 6-month automatic extension now.

With ExpressTaxExempt, you can e-file your 8868 extension in minutes.

E-file 8868 Now.

This article comprises step-by-step instructions on how to fill out your Form 990-PF.

Table of Contents

1. IRS 2024 Form 990-PF Instructions

IRS Form 990-PF consists of 16 parts. Here are the instructions on how to complete each part of the form.

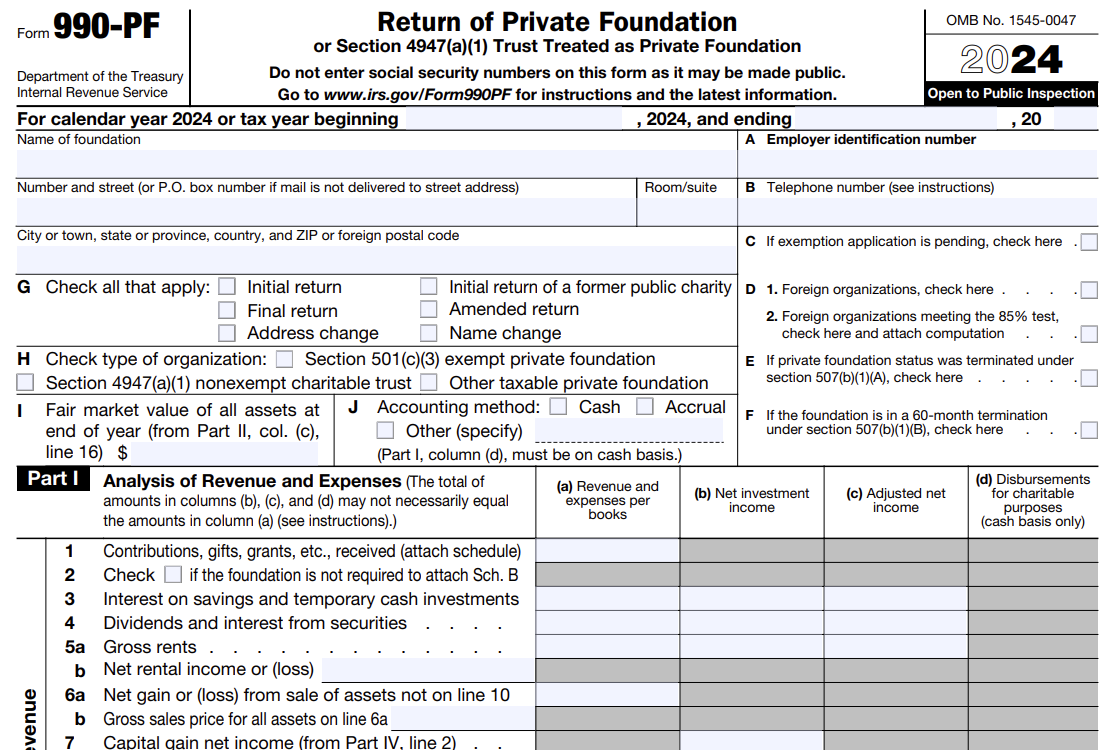

The IRS requires private foundations to provide the following basic information.

Basic Information about your Organization:

At the top of the form, Enter:

- Start and end dates of the corresponding tax year

- Name and address of the organization

Following that, there will be separate boxes that require details about:

- Item A - Employer Identification Number (EIN)

- Item B - Telephone number

Check the following fields if applicable:

- Item C - For foundations whose exempt application status is pending

- Item D - For foreign organizations

- Item E - For private foundations terminated under section 507(b)(1)(A)

- Item F - For Foundations in a 60-month termination under 507(b)(1)(B)

-

Item G - Type or Purpose of return

- Initial return

- Final return

- Address change

- Initial return of a former public charity return

- Amended return

- Name change

-

Item H - Type of Organization

- Section 501(c)(3) exempt private foundation

- Section 4947(a)(1) nonexempt charitable trust

- Other taxable private foundation

-

Item J - Accounting method

- Cash

- Accrual

- Other accounting method (if any)

-

Item I - The Fair market value of all assets at the end of the year

can be entered

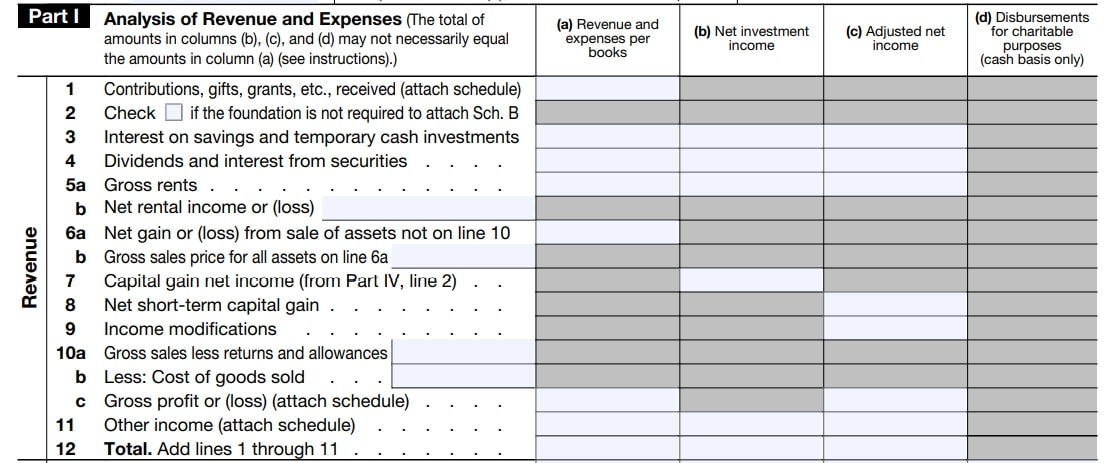

Part I - Analysis of Revenue and Expenses:

This part is split into two subparts.

- Revenue ( Lines 1-12 )

- Operating and Administrative Expenses (Lines 13 - 26)

Revenue ( Lines 1-12 ):

You need to report your foundation’s revenue generated from various sources.

-

Lines 1-11:

- Enter the value of contributions, gifts, interest on savings, dividends, interest from securities, gross rents, net rental income, capital gain net income, net short-term capital gain, income modifications, gross sales less returns, allowances, and other incomes in the respective lines.

Note: If your foundation is not required to attach Form 990-PF Schedule B, you need to check the box on Line 2.

-

Line 12:

- Enter the Total Revenue by adding Lines 1 through 11.

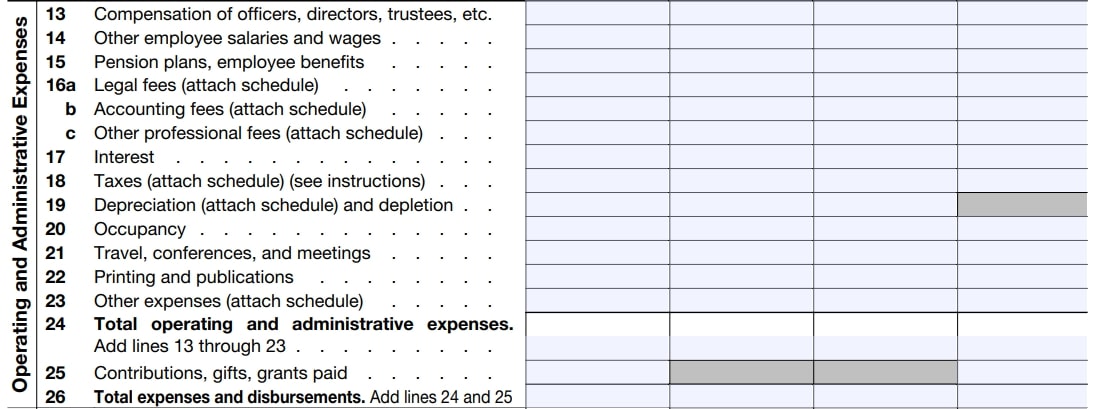

Operating and Administrative Expenses (Lines 13 - 26):

Report various expenses made by your foundation during the corresponding tax year.

-

Lines 13 - 23:

- Enter the employee salaries and wages spent for the tax year, the compensation given to officers, directors, and trustees, pension plans, employee benefits, travel expenses, conferences, and meetings.

-

Line 24:

- Enter the total operating and administrative expenses by adding Lines 13 through 23.

-

Line 25:

- Enter the contributions, gifts, and grants paid.

-

Line 26:

-

Enter the total expenses and disbursements by adding

Lines 24 and 25.

-

Enter the total expenses and disbursements by adding

-

Line 27:

-

After providing all the revenue and expenses information, enter the following details:

- Excess of revenue over expenses and disbursements

- Net investment income

- Adjusted net income

-

After providing all the revenue and expenses information, enter the following details:

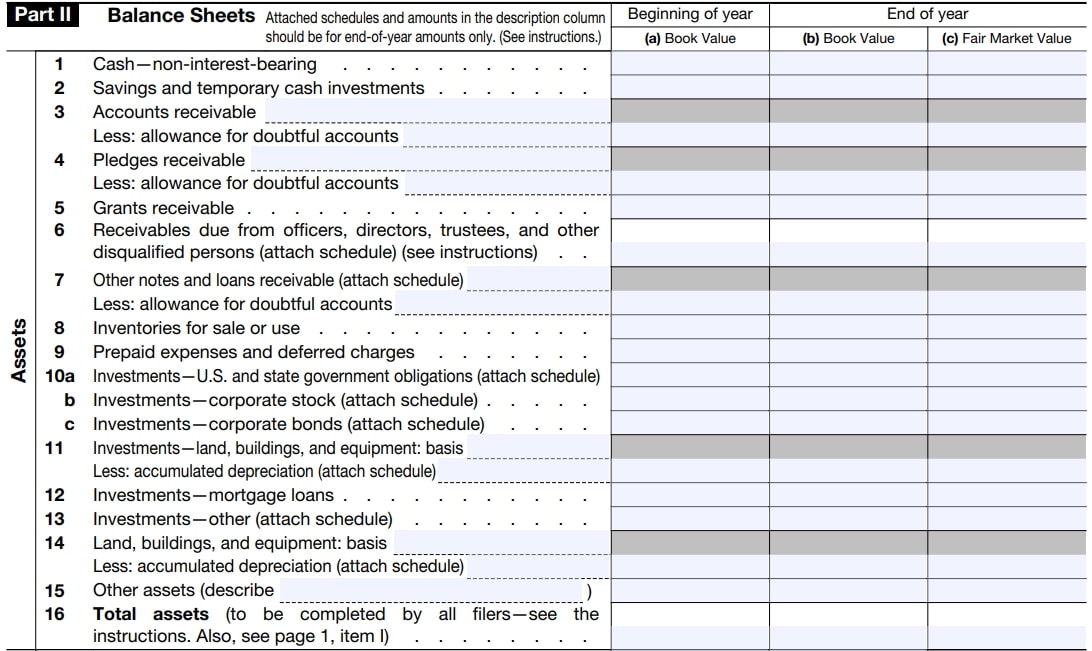

Part II - Balance Sheet

This part is split into three parts:

- Assets

- Liabilities

- Net Assets or Fund Balances

Assets (Lines 1 -16):

The balance sheet requires details regarding your foundation’s assets.

-

Lines 1 - 15:

- Enter details about cash—non-interest-bearing, Savings, and temporary cash investments, Grants receivable, Prepaid expenses and deferred charges, Investments—mortgage loans, and other assets.

- The value for each asset at the beginning and the end of the year needs to be reported.

-

Line 16:

- Enter the value of Total Assets.

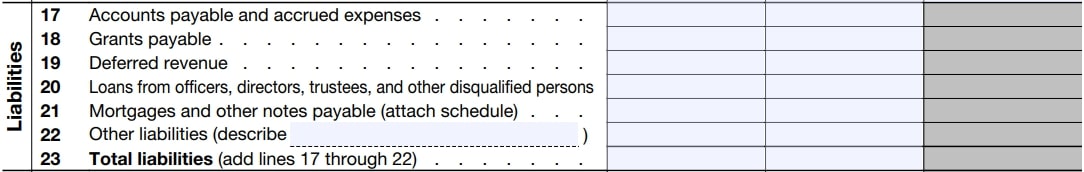

Liabilities (Line 17-23):

Report the details regarding your foundation’s liabilities.

-

Lines 17 - 22:

- Enter the liability details such as deferred revenue, grants payable, loans from officers, directors, trustees, and other disqualified persons.

-

Line 23:

- Enter the value of Total Liabilities by adding Lines 17 through 22.

Net Assets or Fund Balances (Line 24-30):

Provide the details about your foundation’s net assets or fund balances.

-

Lines 24 - 28:

- Enter the asset or fund balance details such as net assets without donor restrictions, net assets with donor restrictions, Capital stock, trust principal, current funds and retained earnings, accumulated income, endowment, and any other funds, if you’re following FASB ASC 958.

-

Line 29:

- Enter the total net assets or fund balances.

-

Line 30:

- Enter the total liabilities and net assets/fund balances.

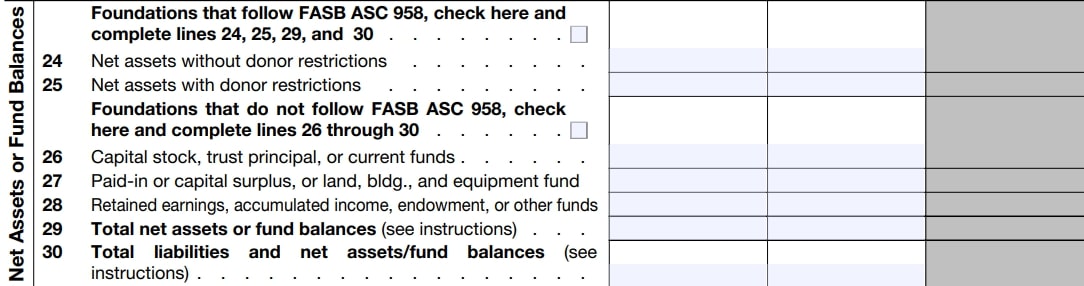

Part III - Analysis of Changes in Net Assets or Fund Balances

Any excess of revenue or expenses at the end of the tax year can generally be attributed to a change in an organization’s net assets.

-

Lines 1- 6:

- Report the changes in your organization’s net assets by calculating the difference between the value of net assets or fund balances at the beginning and the end of the year.

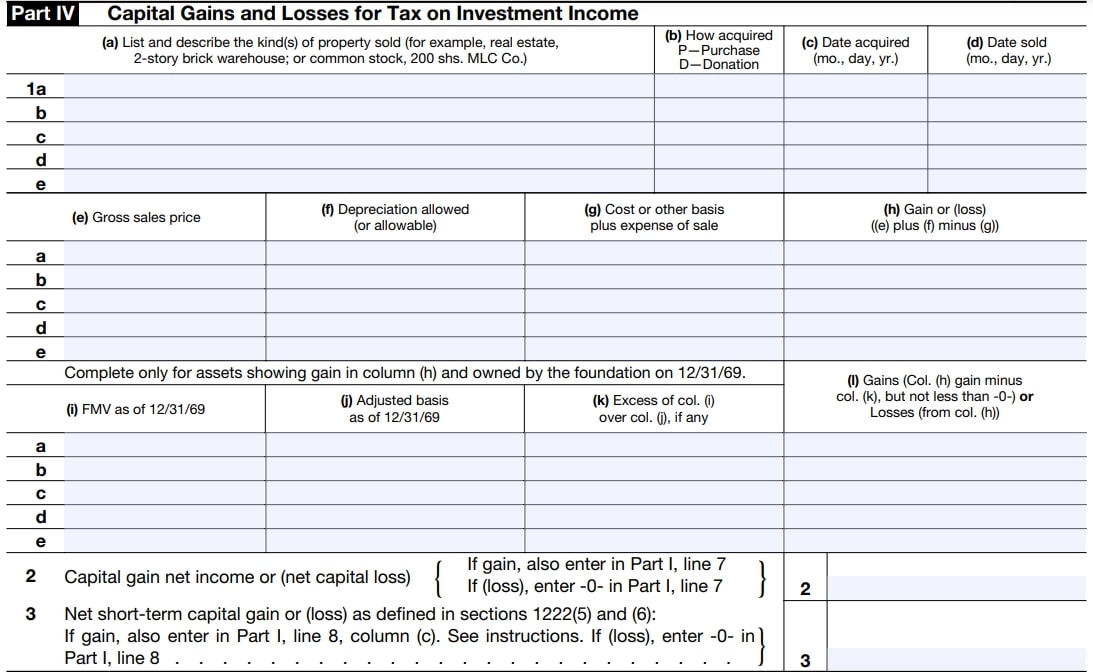

Part IV - Capital Gains and Losses for Tax on Investment Income

The gains and losses in terms of long-term and short-term investment income can be reported in this part.

Note: This part doesn't apply to foreign organizations.

-

Line 1:

-

Enter the following details:

- The kind(s) of property sold

- Describe whether the property was Purchased or Donated

- Date acquired

- Date sold

- Gross sales price

- Depreciation allowed

- Cost or other basis plus the expense of sale

- Gain or loss ( e + f - g)

Complete the fields below only if the assets show a gain and were owned by the foundation on December 31, 1969:

- Fair Market Value of the asset on December 31, 1969.

- Adjusted basis of the asset on December 31, 1969.

- If the FMV was greater than the adjusted basis, enter the excess amount.

-

Calculate the gain or loss for the assets:

- If there is a gain, subtract (k) from (h) if applicable. If the result is less than zero, enter zero.

- If there is a loss, enter the amount from (h) if no (k) applies.

Note: The gains or losses for any portion of the property should not be included if

- The property was used for a year or more in promoting the foundation's exempt purpose.

- The property is exchanged for another similar property to be used primarily in promoting the foundation's exempt purpose.

Also, when an asset is held for longer than a year, it is considered a long-term investment for tax purposes.

-

Enter the following details:

-

Line 2:

- Enter the capital gain net income (or) net capital loss.

-

Line 3:

- Enter the net short-term capital gain (or) loss as defined in sections 1222(5) and (6).

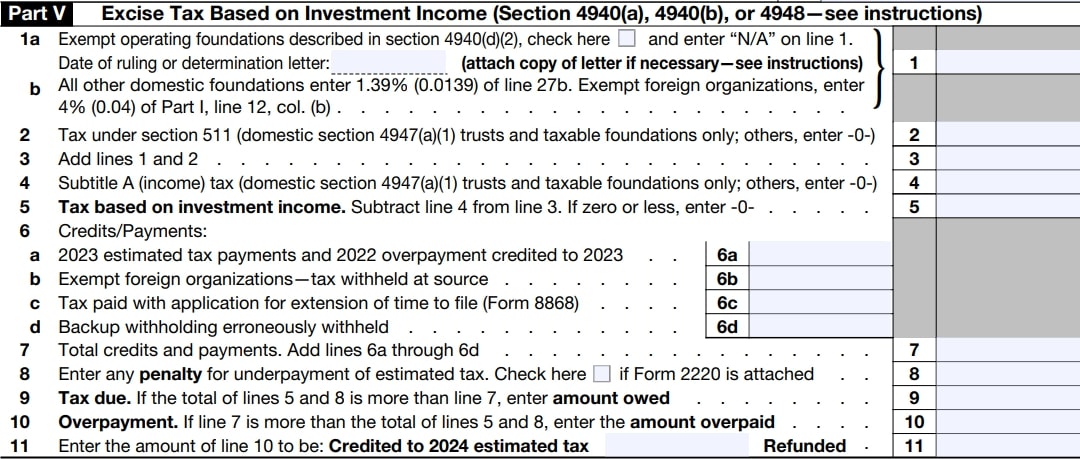

Part V - Excise Tax Based on Investment Income

This part applies only to the private foundations described under Sections 4940(a), 4940(b), or 4948.

-

Line 1:

- The exempt operating foundations described in section 4940(d)(2) are required to check the box and enter “N/A”.

- All other domestic foundations, enter 1.39% (0.0139) of line 27b (Net investment income).

-

Lines 2 - 4: (Section 4947(a)(1) trusts and taxable foundations only)

- Enter the tax under section 511 and Subtitle A (income) tax.

-

Lines 5-11:

- Enter the tax based on the investment income, any penalty for underpayment of estimated tax, and tax due and overpayment.

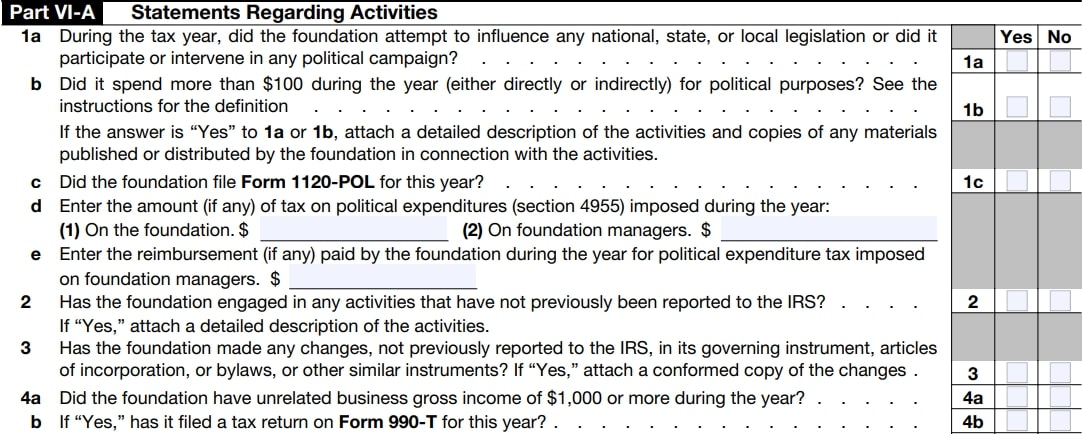

Part VI-A - Statements Regarding Activities

In this part, each question must be answered in “Yes,” “No,” or “N/A”.

-

Lines 1 - 16:

- Answer all the questions regarding your foundation’s political activities and expenditures, unrelated business income, substantial contributors, and a few other information.

-

Lines 2 - 4: (Section 4947(a)(1) trusts and taxable foundations only)

- Enter the tax under section 511 and Subtitle A (income) tax.

-

Lines 5-11:

- Enter the tax based on the investment income, any penalty for underpayment of estimated tax, and tax due and overpayment.

When to File Form 990-T?

If your foundation has a gross income of $1,000 or more from unrelated businesses for the tax year, you must file Form 990-T. Learn More

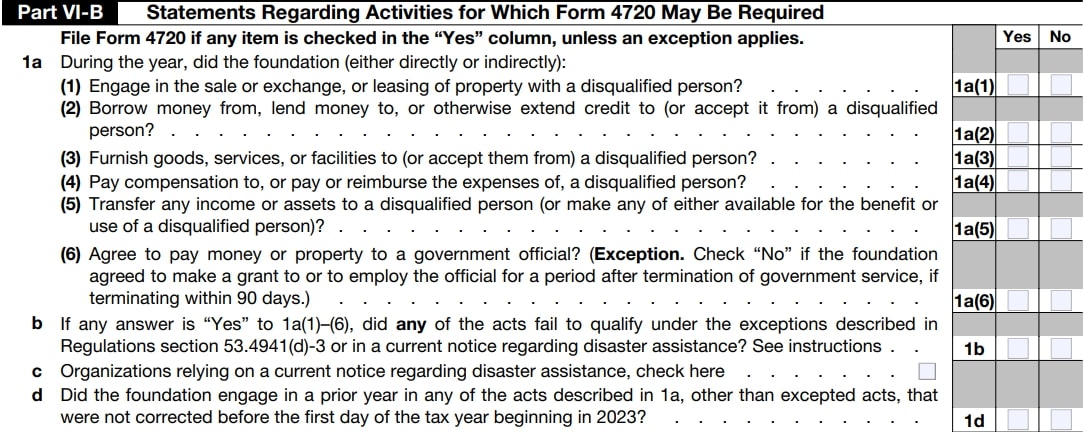

Part VI-B - Statements Regarding Activities for Which Form 4720

May Be Required

-

Lines 1 - 8:

- This part also consists of a series of “Yes” or “No” questions regarding your foundation’s activities.

- Any foundation that answers “Yes” to any of the questions in this part should file Form 4720 unless an exception applies.

Form 4720 is used with IRS Form 990-PF to figure out and report the initial taxes imposed under sections 4941, 4942, 4943, 4944, and 4945 on private foundations, foundation managers, and disqualified persons.

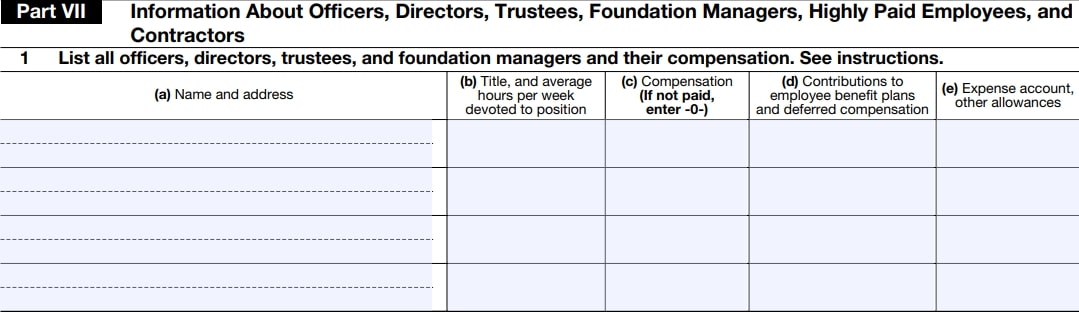

Part VII - Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors

This part requires you to provide details about your foundation’s officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors.

-

Line 1:

-

Enter the following details:

- Name and address

- Title and average hours per week devoted to position

- The compensation (if not paid, enter 0)

- The contributions to employee benefit plans and deferred compensation

- The expense account and other allowances

-

Enter the following details:

-

Line 2:

- Enter the compensation amounts of the five highest-paid employees (other than those included in line 1—see instructions). If none, enter “NONE.”

-

Line 3:

- Provide details about five of the highest-paid independent contractors for professional services.

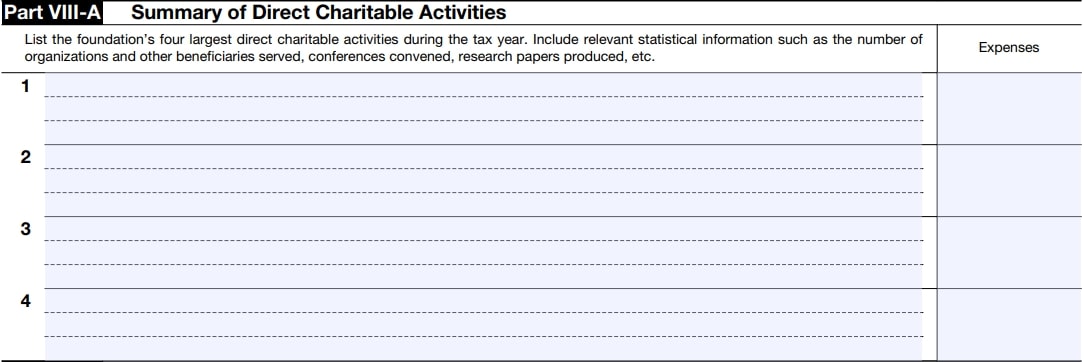

Part VIII-A - Summary of Direct Charitable Activities

The four largest charitable activities, events, and expenses made during the tax year, including relevant statistical information such as the number of organizations and other beneficiaries served, conferences convened, research papers produced, etc., can be summarized in this part.

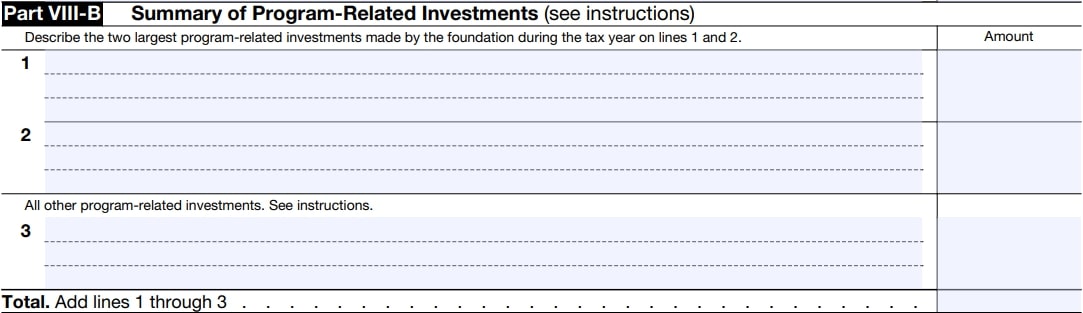

Part VIII-B - Summary of Program-Related Investments

Program-related investments are the investments made by the organization that serve the foundation’s exempt purpose.

-

Lines 1 and 2:

- Enter two of your foundation’s major program-related investments made during the tax year.

-

Line 2:

- If your foundation makes any other program-related investments, enter them here.

Form 4720 is used with Form 990-PF to figure out and report the initial taxes imposed under sections 4941, 4942, 4943, 4944, and 4945 on private foundations, foundation managers, and disqualified persons.

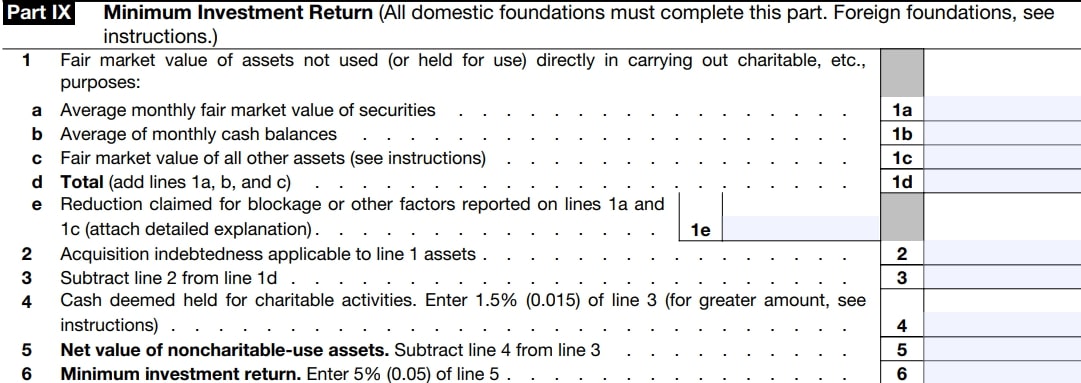

Part IX - Minimum Investment Return

All domestic foundations must complete this part.

-

Lines 1:

- List out the Fair Market Value (FMV) of assets not used (or held for use) directly in carrying out charitable purposes, Average monthly FMV of securities, Average monthly cash balances, and FMV of all other assets.

-

Line 2:

-

Enter the application indebtedness of the assets mentioned on

Line 1.

-

Enter the application indebtedness of the assets mentioned on

-

Lines 3 and 4:

- Determine and enter the Cash deemed held for charitable activities.

-

Lines 5 and 6:

- Using the above information, the net value of noncharitable-use assets and minimum investment return can be derived and reported.

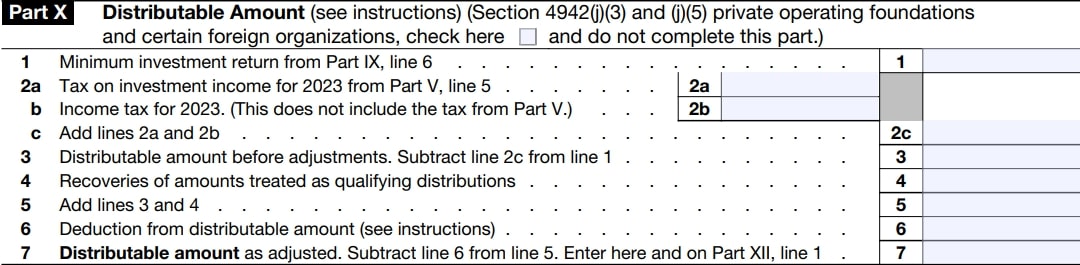

Part X - Distributable Amount

Section 4942(j)(3) and (j)(5) private operating foundations and certain foreign organizations do not need to complete this section.

-

Lines 1 - 7:

- Report the monetary amount for the tax year that your foundation must distribute by the end of 2023 as qualifying distributions to avoid the 30% tax on the undistributed portion.

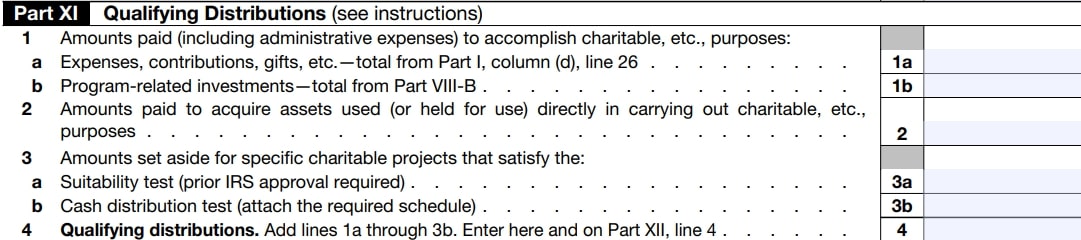

Part XI - Qualifying Distributions

Qualifying distributions are amounts spent or amounts set aside for religious, educational, or similar charitable purposes.

-

Line 1a and 1b:

-

Enter expenses, contributions, gifts, program-related

investments, etc.

-

Enter expenses, contributions, gifts, program-related

-

Line 2:

- Enter the amounts paid to acquire assets used or held for carrying out charitable activities:

-

Line 3:

- Enter the amounts set aside for specific charitable projects that satisfy the Suitability test and Cash distribution test.

-

Line 4:

- Using the information above, Qualifying distributions can be derived and reported here.

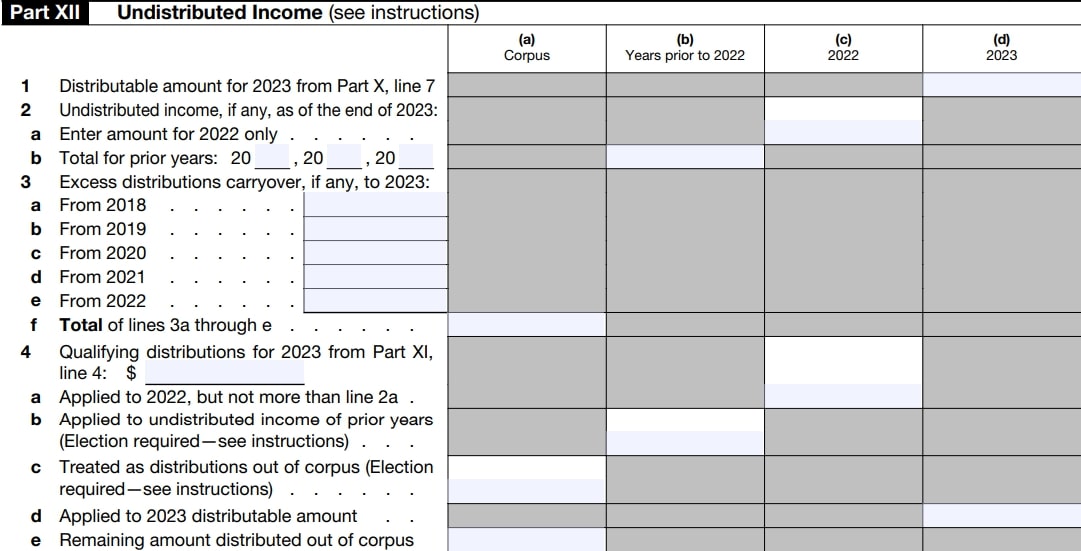

Part XII - Undistributed Income

Non-operating foundations must complete this part.

The purpose of this part is to show that your foundation complies with the rules for applying its qualifying distributions for the year 2024.

-

Lines 1 - 10:

- Reduce any undistributed income from prior years

- The organization may use any part of or all remaining qualifying distributions for 2024 to satisfy elections.

- If no elections are involved, apply the remaining qualifying distributions to the 2024 distributable amount on Line 4d.

- If the remaining qualifying distributions are greater than the 2024 distributable amount, the excess is treated as a distribution out of corpus on Line 4e.

- Enter the amount of excess distributions carryover, for the five prior tax years.

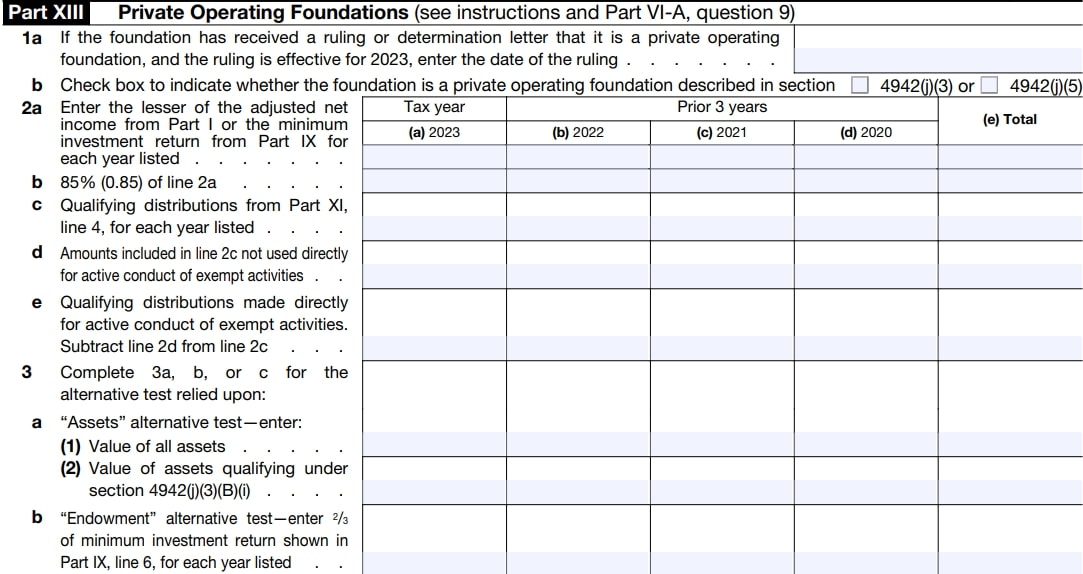

Part XIII - Private Operating Foundations

All organizations that claim status as private operating foundations under section 4942(j)(3) or (5) for 2019 must complete this section.

-

Line 1a and 1b:

- Enter your private foundation’s ruling or determination date (if received) and the section under which the foundation is described.

- Check if your foundation is a private operating foundation described in section 4942(j)(3) or 4942(j)(5).

-

Line 2:

- Enter the lesser of the adjusted net income or the minimum investment return for each year listed and provide details about the qualifying distributions.

-

Line 3:

-

Enter details about the alternative test relied upon.

- “Assets” alternative test

- “Endowment” alternative test

- “Support” alternative test

-

Enter details about the alternative test relied upon.

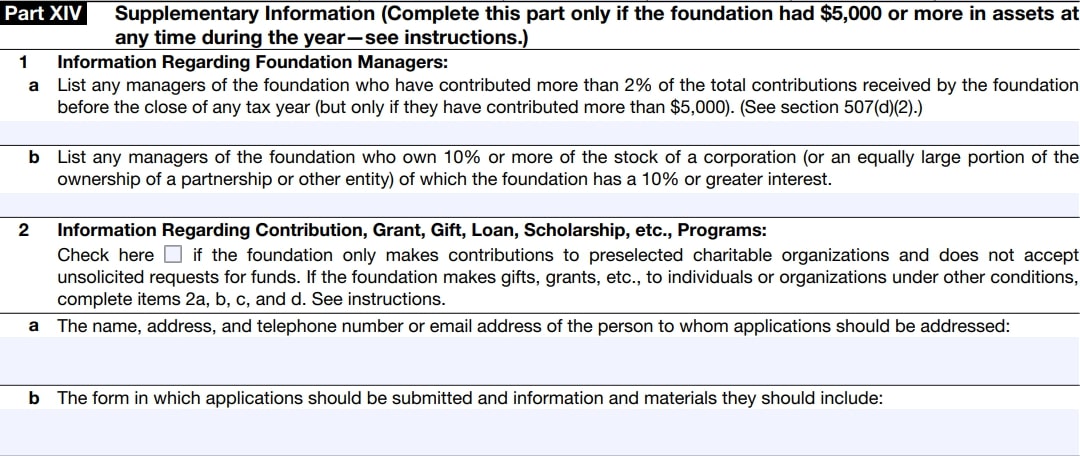

Part XIV - Supplementary Information

This part needs to be completed only if your foundation had $5,000 or more in assets at any time during the year.

-

Line 1:

- Provide information regarding foundation managers, contributions, grants, and similar programs.

-

Line 2:

- Provide information regarding contributions, grants, gifts, loans, scholarships and programs.

-

Line 3:

- Enter details about the grants and contributions paid during the year or approved for future payment.

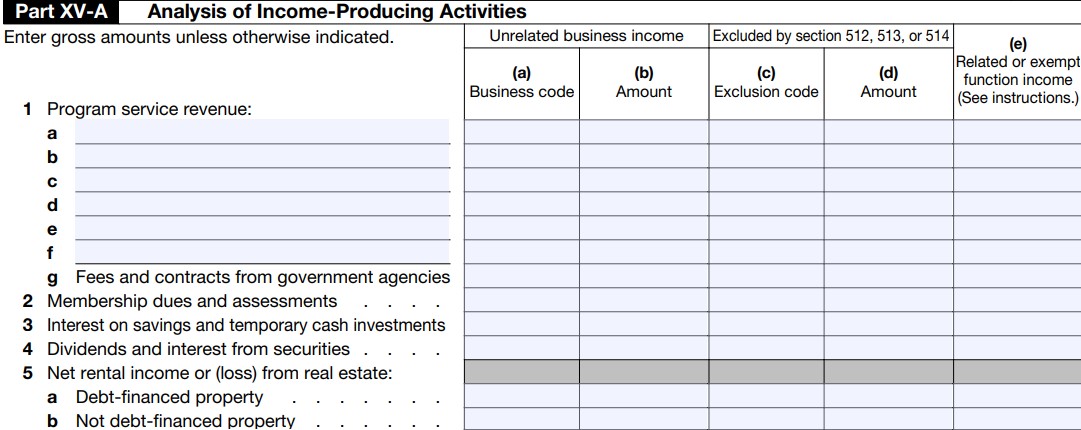

Part XV-A - Analysis of Income-Producing Activities

In this part, you need to enter your foundation’s unrelated business income and related or exempt function income generated from various sources are required.

-

Lines 1 - 13:

- Enter details about program service revenue, Membership dues and assessments, Dividends and interest from securities and etc.,

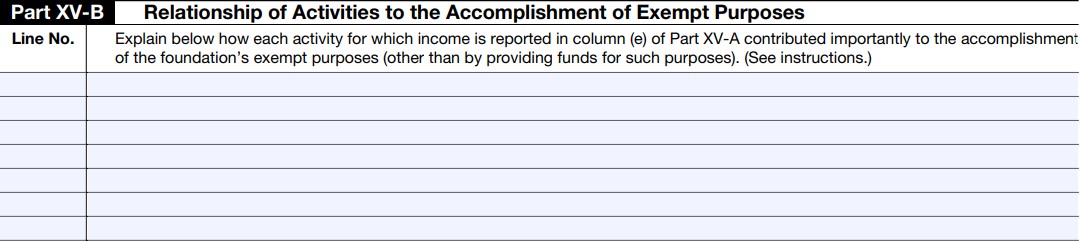

Part XV-B Relationship of Activities to the Accomplishment of

Exempt Purposes

This part requires an explanation of how each activity for which income is reported in Part XV-A contributed importantly to the accomplishment of the foundation’s exempt purposes.

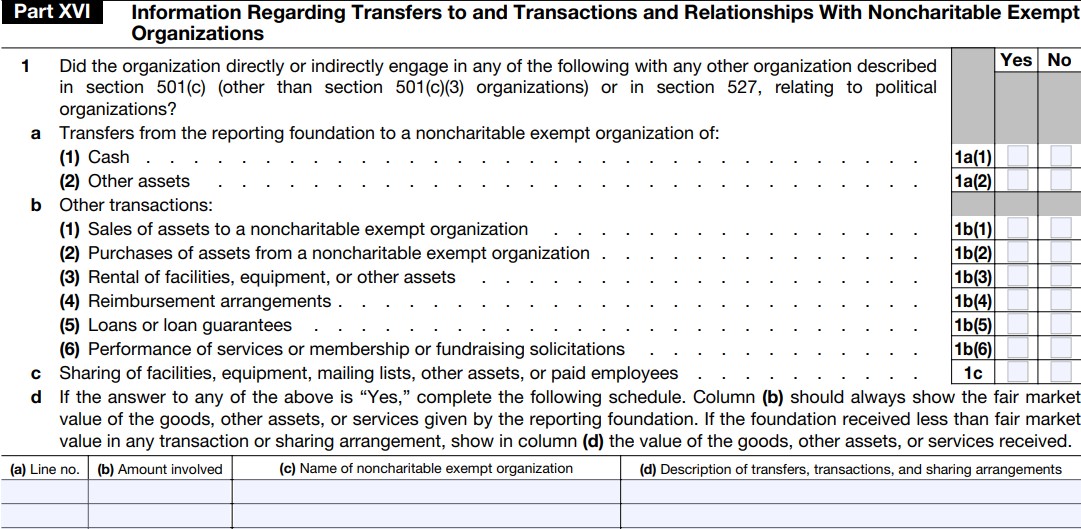

Part XVI - Information Regarding Transfers To and Transactions and Relationships With Noncharitable Exempt Organizations

This part requires details regarding the transfers and transactions and other transactions.

It consists of a series of “Yes” or “No” questions.

-

Line 1:

- Enter “Yes” if your foundation engaged in any transfers or transactions with any other organization described in section 501(c) (other than section 501(c)(3) organizations) or section 527 political organizations

-

Line 1a:

-

Enter “Yes” if your foundation engaged in transfers with a noncharitable exempt organization of:

- Cash

- Other Assets

-

Enter “Yes” if your foundation engaged in transfers with a noncharitable exempt organization of:

-

Line 1b:

-

Enter “Yes” if your foundation engaged in transactions with a noncharitable exempt organization of:

- Sales of assets to a noncharitable exempt organization

- Purchases of assets from a noncharitable exempt organization

- Rental of facilities, equipment, or other assets

- Loans or loan guarantees

- Performance of services or membership or fundraising solicitations

-

Enter “Yes” if your foundation engaged in transactions with a noncharitable exempt organization of:

-

Line 1c:

- Enter “Yes” if your foundation is engaged in the sharing of facilities, equipment, mailing lists, other assets, or paid employees.

-

Line 1d:

- If you have answered “Yes” to any of the questions above, elaborate on those details in the table.

-

Line 2:

- Enter “Yes” if your foundation is affiliated with any tax-exempt organizations described in section 501(c) (other than section 501(c)(3)) or Section 527) and elaborate on the details in the table.

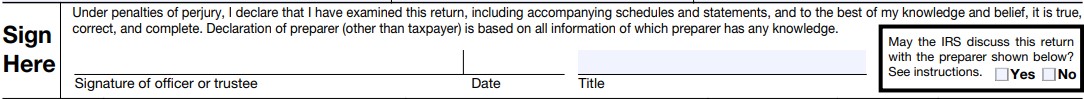

Signature

- The president, vice president, treasurer, assistant treasurer, chief accounting officer, or other corporate officers (such as a tax officer) can sign and approve the return in this section.

- A receiver, trustee, or assignee must sign any return that they are required to file for a corporation.

-

If the return is filed for a trust, the authorized trustee or trustees

must sign.

Sign and date the form and fill in the signer's title.

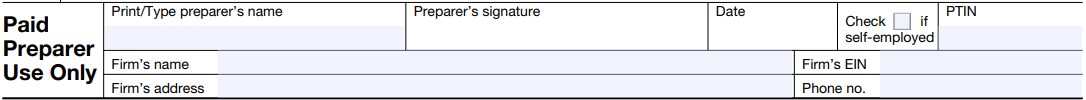

Paid Preparer

If a paid preparer is preparing the return, they can provide their details in

this section.

2. Instructions about Form 990-PF Schedule B

The private foundations must attach Schedule B with their Form 990-PF if they have any one contributor who contributed $5000 or more in terms of money, securities, or other property during the tax year.

There are three parts to complete on Schedule B 990-PF.

- Part I - Contributors

- Part II - Noncash Property

- Part III - Exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from a single contributor

Schedule B is open to public inspection for an organization that files Form 990-PF.

Learn More about 990-PF Schedule B

Note: If your foundation isn't required to complete Schedule B (no person contributed $5,000 or more), check the box on line 2.

3. How is 990-PF filed electronically?

The IRS has mandated the electronic filing of Form 990-PF under the “TaxPayer Act of 2019” for a tax year beginning on or after July 1, 2019.

To file 990-PF electronically without hassle, private foundations must choose an IRS-authorized e-file provider.

ExpressTaxExempt is here to Streamline your Form 990-PF filing!

Being authorized by the IRS, ExpressTaxExempt provides private foundations with the ideal choice for completing their nonprofit tax filing securely and accurately.

Here are the steps to file your Form 990-PF electronically with ExpressTaxExempt:

- Add your Organization Details

- Choose the corresponding Tax Year

- Enter the required Form Data

- Review your Form 990-PF

- Transmit to the IRS

Article Sources

- Instructions for Form 990-PF

- Schedule of Contributors