Left to file Form 990-T for May 15, 2025.

E-file Form 990-PF Online for Your Private Foundations

Our easy-to-use software offers you a comprehensive solution to file 990-PF and report your annual information.

Why E-File Form 990-PF with ExpressTaxExempt?

- Form-based or Interview style filing

- Includes 990-PF Schedule B for free

- Free First Amendment for original return filed with us.

- Retransmit rejected returns for FREE

- Supports Form 990-T to report UBTI

- Phone, email, & live chat support

View Pricing

The Tax990 Commitment: Accepted, Every Time—Nonprofit Tax Filing

Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Need more time to file? Submit Form 8868 for an automatic extension for free.

Retransmit Rejected Returns

If your return is rejected by the IRS due to errors, you can correct and resubmit it at no additional cost.

No Cost Corrections

Found an error after submitting your return? You can submit corrections free of charge–up to three times.

Money-Back Guarantee

If your form isn't accepted or is flagged as a duplicate, we’ll issue a full refund—no questions asked.

Form 990-PF: Key Insights

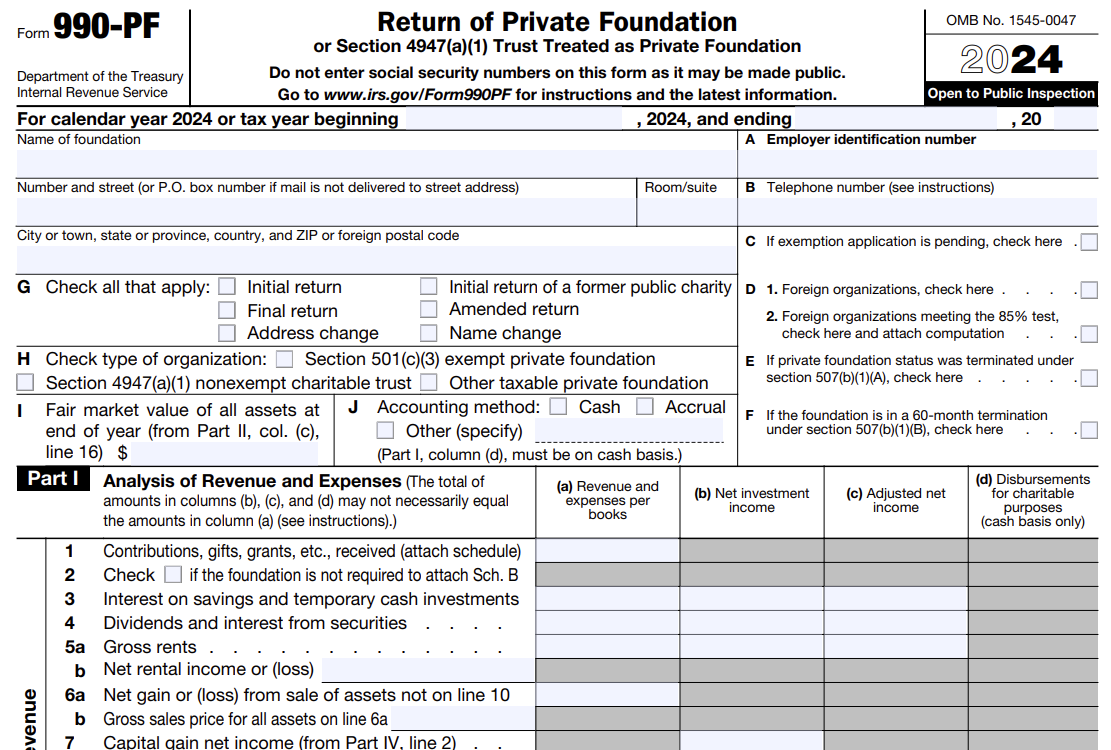

Form 990-PF is an IRS form that private foundations must file annually to report their income, expenses, activities, and certain other information.

It must be filed on or before the 15th day of the 5th month following the end of the organization’s tax year.

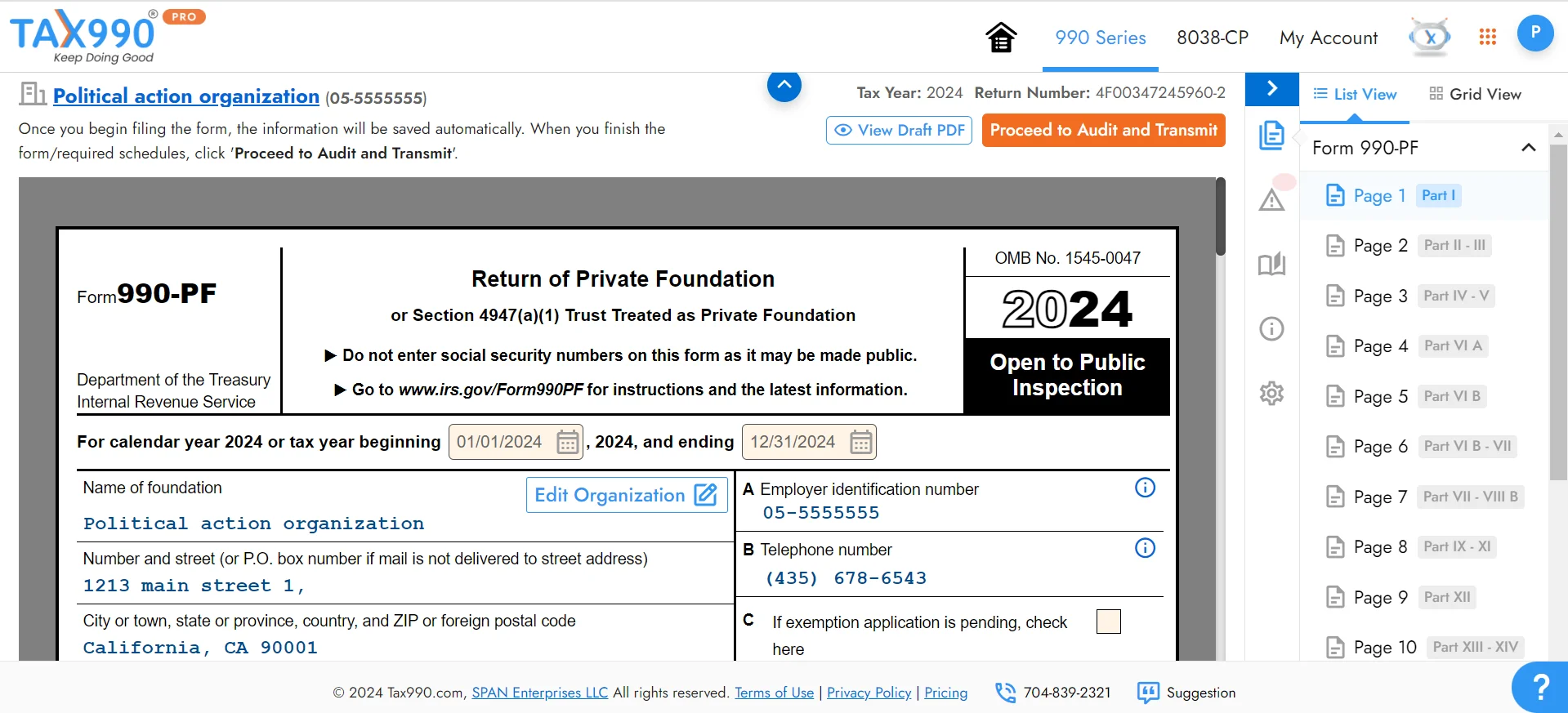

How to E-file Form 990-PF Online for the 2024 Tax Year

with ExpressTaxExempt?

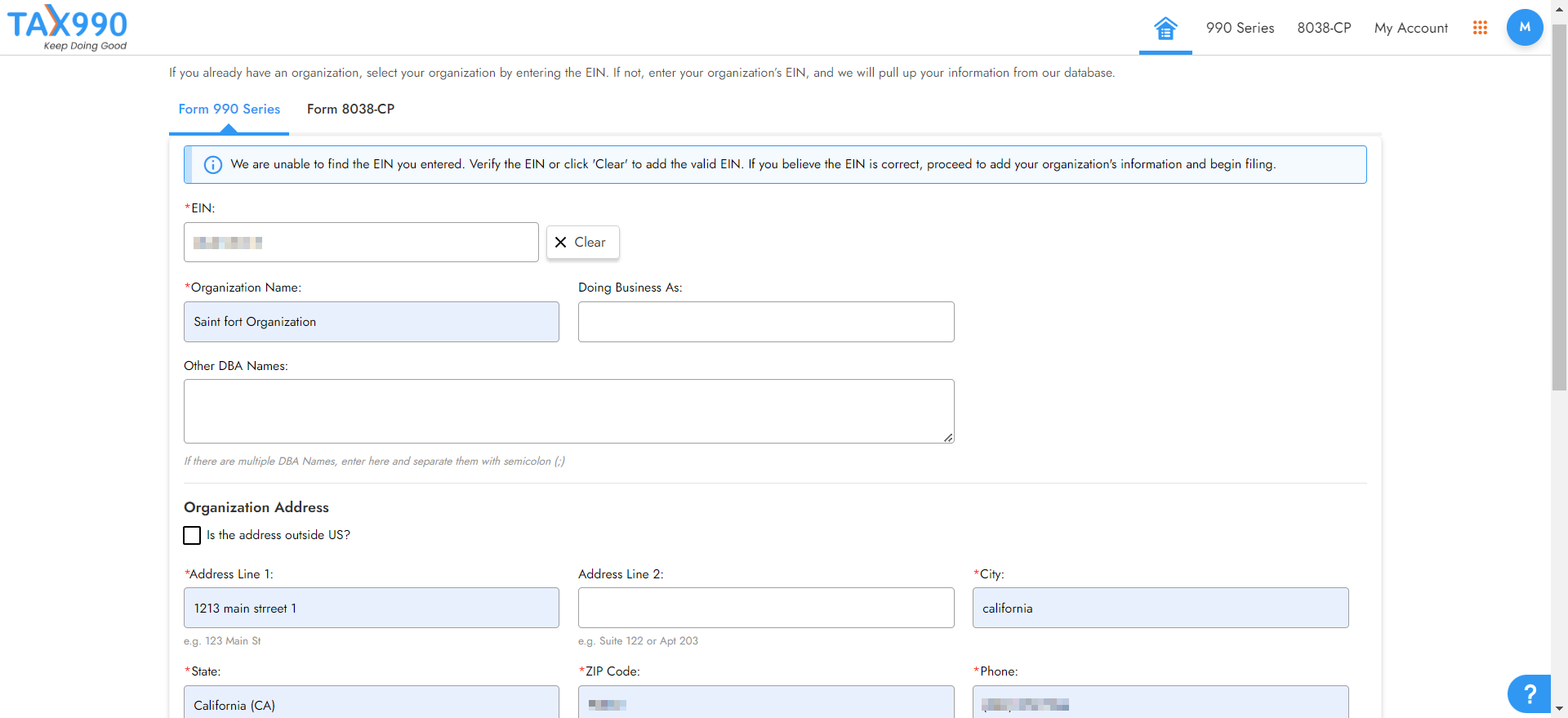

Search for your EIN, and our system will import your organization’s data from the IRS database. You can also enter your organization’s details manually.

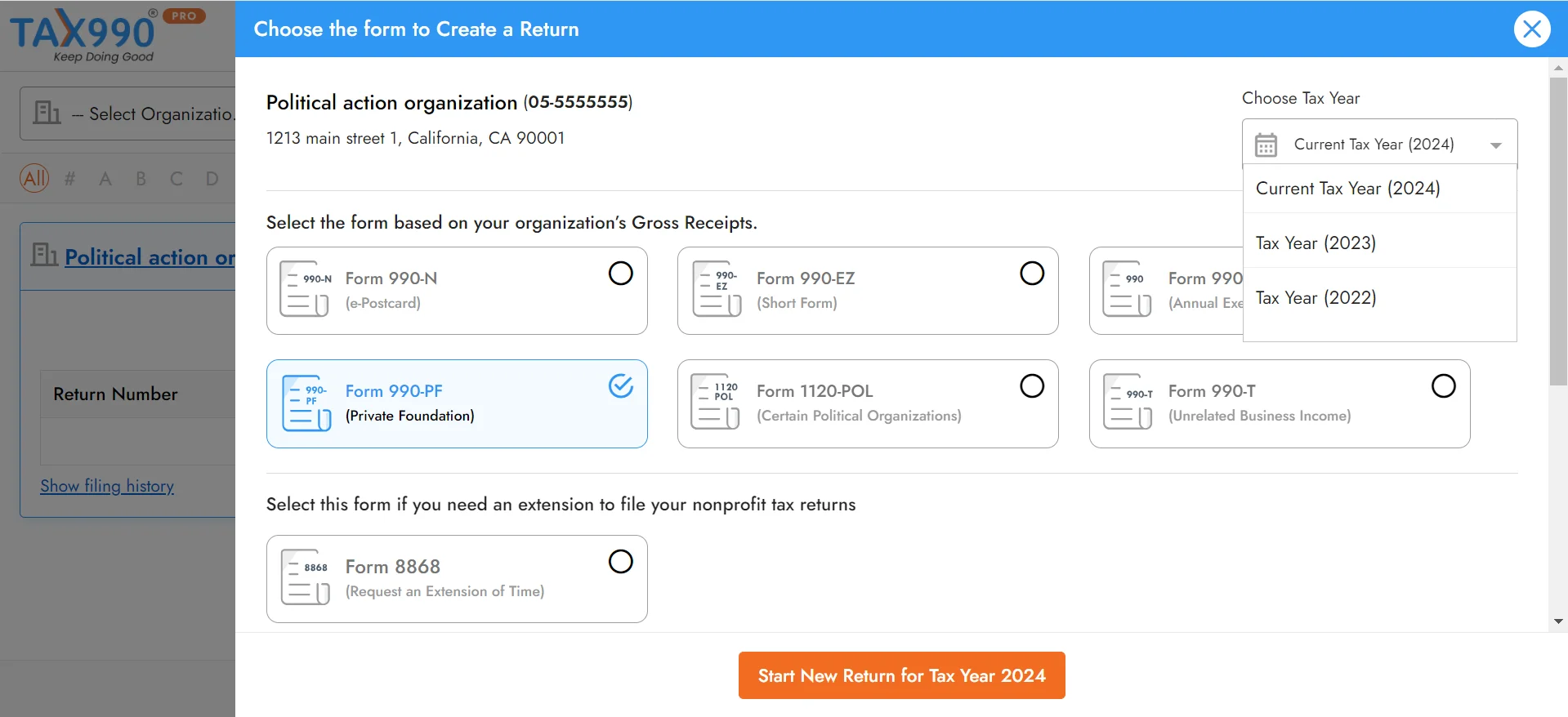

Choose the tax year for which you want to file a return and proceed. ExpressTaxExempt supports the current and the previous year's filing.

We provide a Form-based and Interview-Style filing option for 990-PF. Choose your preferred method and provide the required form information.

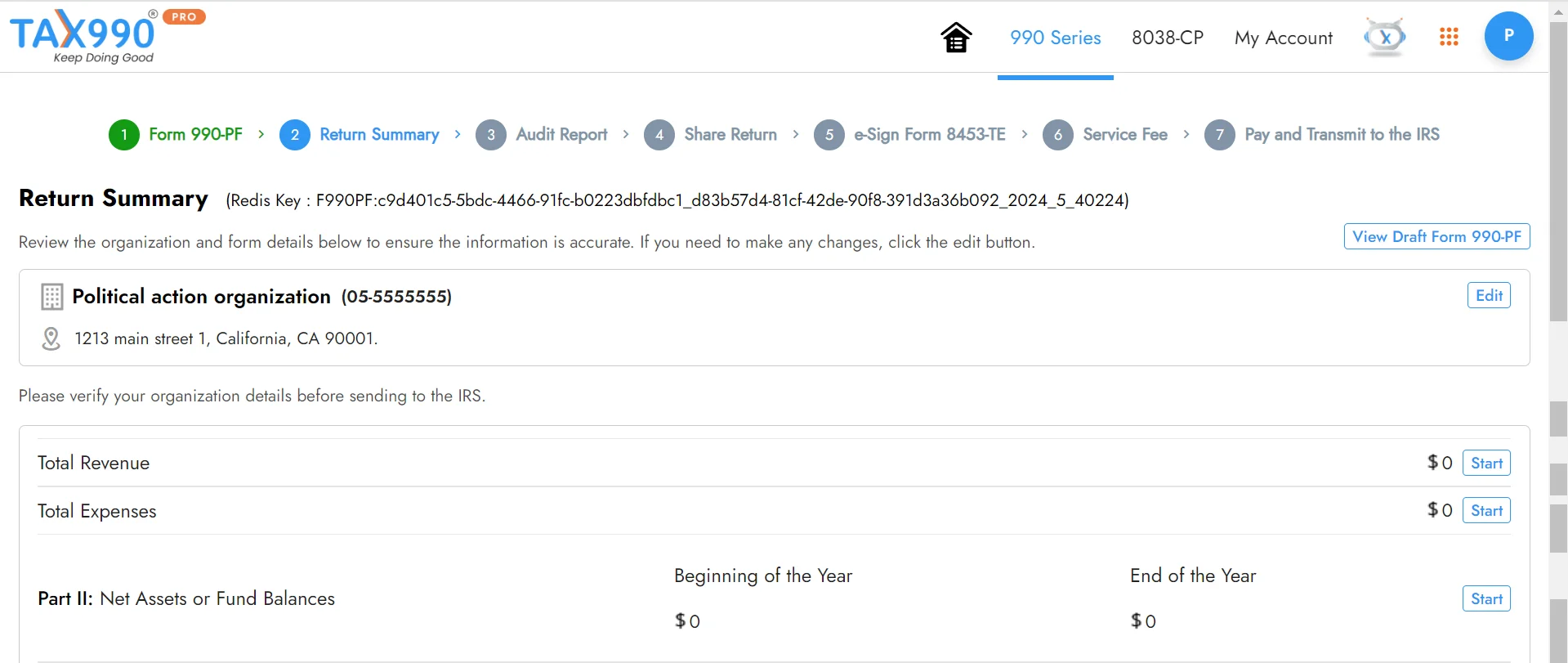

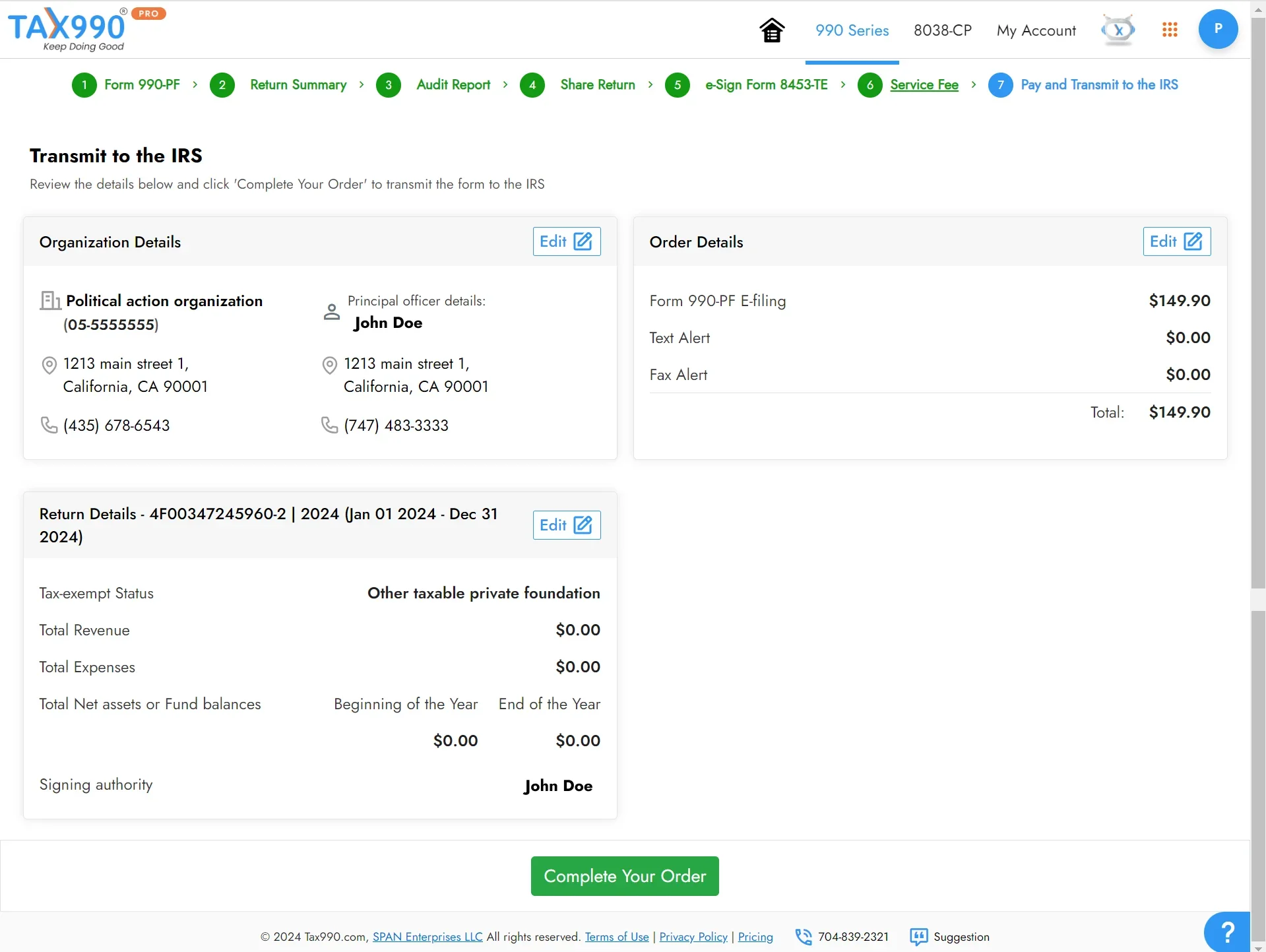

You can review the summary of your form. Also, you can share your form with other organization members to review and approve the return.

Once you have reviewed the form, you can transmit it to the IRS. Our system keeps you updated with the status of your form via email and text.

Ready to File Your Form 990-PF Electronically?

Why E-file Form 990-PF with ExpressTaxExempt?

Prepare forms using form based or interview-style

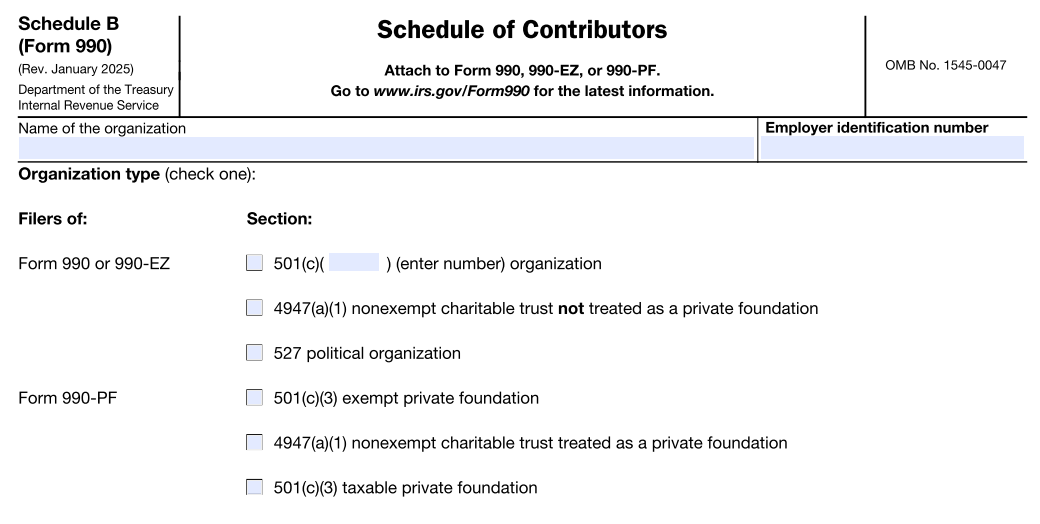

Includes Schedule B, Schedule of Contributors

Internal audit check for error-free 990-PF filing

Add and manage staff to assist in form preparation

Invite users to review and approve your 990-PF return

Copy Data from your Prior year's Return filed with us

Supports Form 990-PF Amended Return

Supports e-filing of Extension Form 8868

Access to knowledge base, chat, Email, & Phone Support

Exclusive PRO Features

Our software simplifies the 990-PF electronic filing process for Paid Preparers and Electronic Return Originators (EROs) with various exclusive features.

Team Management

Add your team members, assign them predefined roles, and delegate your 990-PF filing responsibilities.

Reviewers and Approvers

Have your 990-PF returns reviewed by the respective organization’s higher authorities before transmission.

Bulk Upload

Use our Excel templates to upload some of the form data in bulk without manually entering them.

File Form 990-PF Easily with our Amazing Features

See why our clients choose ExpressTaxExempt to

File Form 990-PF Online!

Form 990-PF Schedule-B

When you file Form 990-PF, the IRS requires you to attach Schedule B if you have received total contributions of $5000 or more (or) religious contributions of $1000 or more from any one contributor

If you choose ExpressTaxExempt to file Form 990-PF, you can have Schedule B included automatically based on the data you enter at no extra cost.

Form 990-PF Amended Returns

If you need to make any information on a previously filed 990-PF return, you can easily file an amendment with ExpressTaxExempt.

Note: ExpressTaxExempt allows you to e-file 990-PF amendment, even if your original return was filed elsewhere.

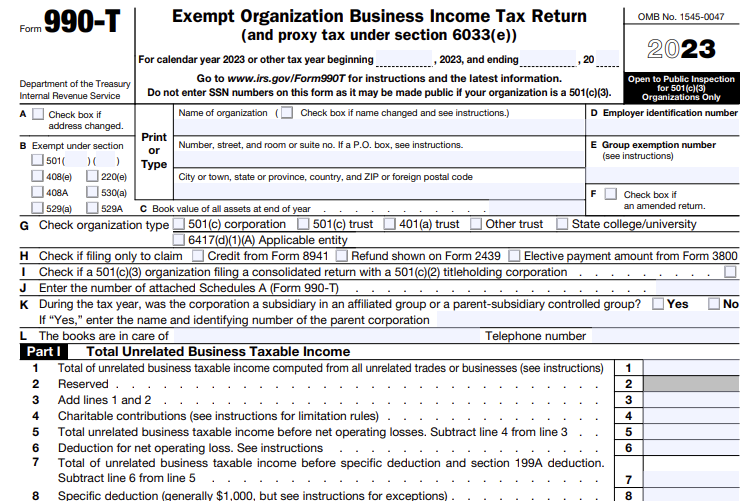

Reporting Unrelated Business Income Information on Form 990-T

When an exempt organization generates a gross income of $1000 or more through various business activities unrelated to their primary exempt purpose in the corresponding tax year, they must file Form 990-T.

ExpressTaxExempt also supports the filing of Form 990-T. Learn More

Frequently Asked Questions on Form 990-PF

What is IRS Form 990-PF?

Form 990-PF is a return of Private Foundation or section 4947 (a) (1) Nonexempt Charitable Trust Treated as a Private Foundation used to calculate the taxes based on investment income and to report charitable distributions and activities.

Learn more about Form 990-PF

When is the due date to file Form 990-PF?

The due date for organizations operating other than the calendar year will be the 15th day of the 5th month from when the tax period ends. Find 990-PF Due Date

If your organization follows a calendar tax year, then the deadline to file Form 990-PF for 2024 tax year is May 15, 2025. E-File Now

Who must file Form 990 PF?

Private Foundations described in Section 501(c)(3) and exempt under Section 501(a) and Section 4947 (a) (1) Nonexempt Charitable Trusts must file Form 990-PF to report the private foundation total assets, financial activities, trustees, and officers and a complete list of grants awarded for the specified fiscal year.

Tax 990 supports the filing of Form 990-PF.

What are the information required to file Form 990-PF?

Form 990-PF comprises 16 parts. Primarily, you’ll need the following information to complete your 990-PF e-filing.

- Financial Information: Revenue, expenses, assets, and liabilities

- Programs and Activities: Program services, political and lobbying activities, etc.

- Compensation Details: The compensation paid to the key employees of the foundation such as director, trustees, etc.

- Other Information: Details regarding the other compliance requirements and changes that occurred in the foundation.

Check out our Form 990-PF instructions guide for more information.

Is there an extension available for Form 990-PF?

Yes! If you need additional time to file your 990-PF return, you can file Form 8868 and get an automatic extension of up to 6 months.

If you follow the calendar tax year and filed an 8868 extension, your 990-PF deadline is November 17, 2025.

Should Form 990-PF be filed electronically?

The IRS Form 990-PF must be filed electronically. The Taxpayer First Act, enacted July 1, 2019, requires private foundations to file Form 990-PF electronically. Learn More

To E-file Form 990-PF efficiently, get started with Tax990 and follow the step-by-step instructions to complete your filing.

Helpful Resources for IRS Form 990-PF

Recent Queries for Form 990-PF

- What information do I need to file Form 990-PF?

- What is Net Short-Term Capital Gain in Form 990-PF?

- What is unrelated business gross income in Form 990-PF?

- How to Complete the Balance Sheet on Form 990-PF? (Use Case)

- My organization was terminated. What do I need to know before filing the final Form 990-PF?

E-File Form 990-PF for your Private Foundation!

Why Should I E-file Form 990-PF With ExpressTaxExempt?

Style Process

990-PF Forms for free