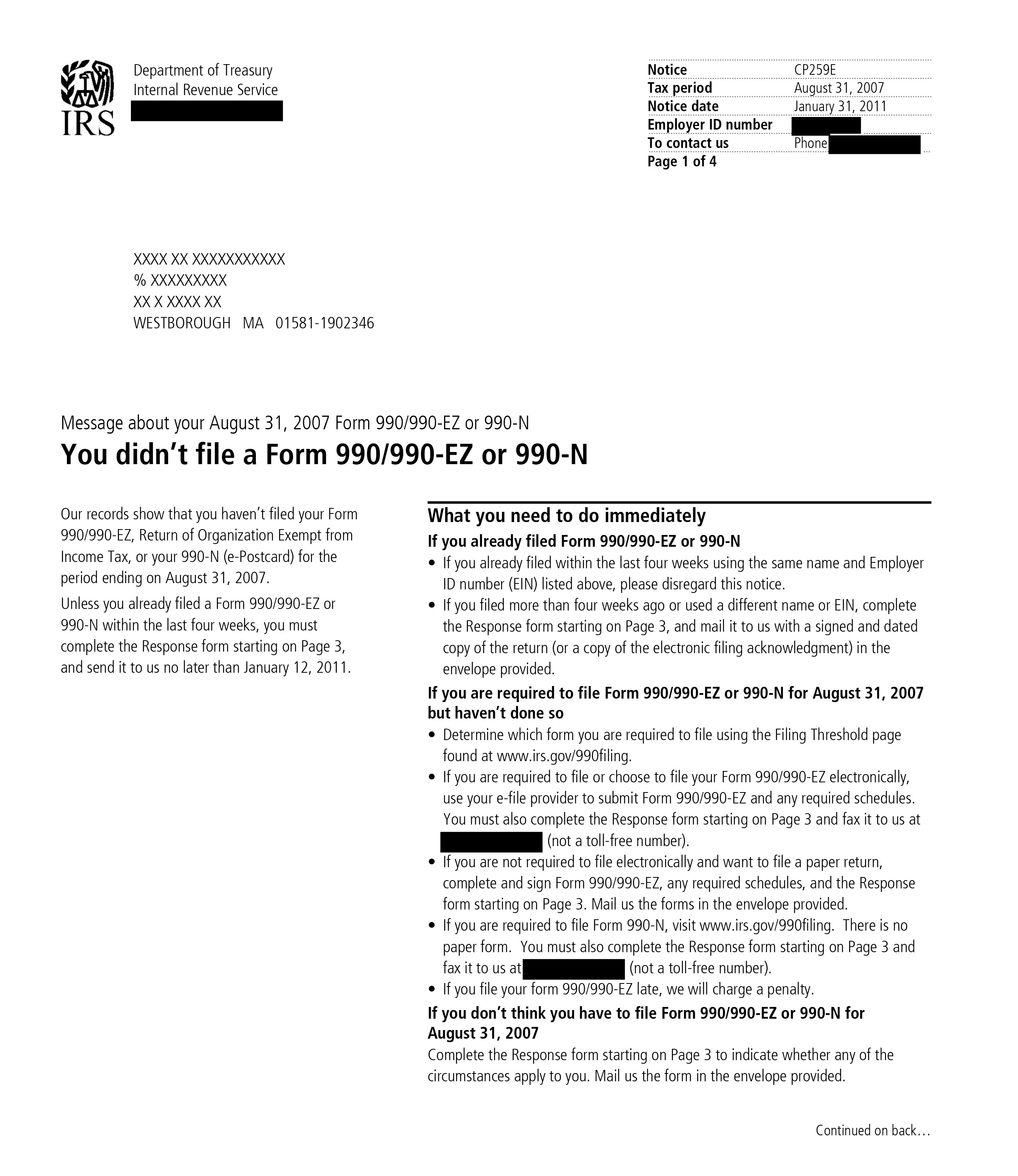

IRS CP259E Notice

A CP259E Notice is a formal notice from the IRS that you may receive because their records indicate that an organization that was required to file a 990-N did not file. If the organization has filed its return, with the same name and EIN as on the notice, within four weeks prior to receiving the notice, it may disregard the notice.

How do I respond to the notice?

- Disregard this notice if you have filed the return within the last four weeks using the same name and EIN listed on the notice.

- Otherwise, file your required Form 990-N, 990, or 990-EZ immediately according to the instructions on the notice.

- If you don't think you need to file, complete the response form enclosed with your notice and mail it to us using the envelope provided.

- If you filed more than four weeks ago or used a different name or EIN, complete the response form enclosed with your notice and mail it to us in the envelope provided along with a signed and dated copy of the return.

To avoid getting CP259E notice from IRS, e-file form 990-N (e-Postcard) now