Form W9 for Nonprofit Organizations

Guide to Form W-9 Compliance in Non-Profit Organizations

As a non-profit organization, you may only be required to deal with one tax form, i.e., 990. But, in certain instances, you may have to deal with W-9. Form W-9 isn’t a tax form, but it holds high importance in ensuring tax compliance.

If you hire consultants, they have to report the income they receive from your non-profit organization in exchange for services done. On the other hand, if your non-profit organization offers services to another business, you might be requested to fill out a W-9 Form (Request for Taxpayer Identification Number and Certification).

Read this blog to understand Form W-9 for non-profit organizations; it is a breeze.

Table of Content

1. Form W-9 - An Overview

Form W-9 is an IRS document that is used in the U.S. to gather TIN from individuals, independent contractors, and businesses that receive certain types of income. This information is essential to properly report payments made by employers and businesses to the Internal Revenue Service (IRS).

2. What is Form W-9 for nonprofits?

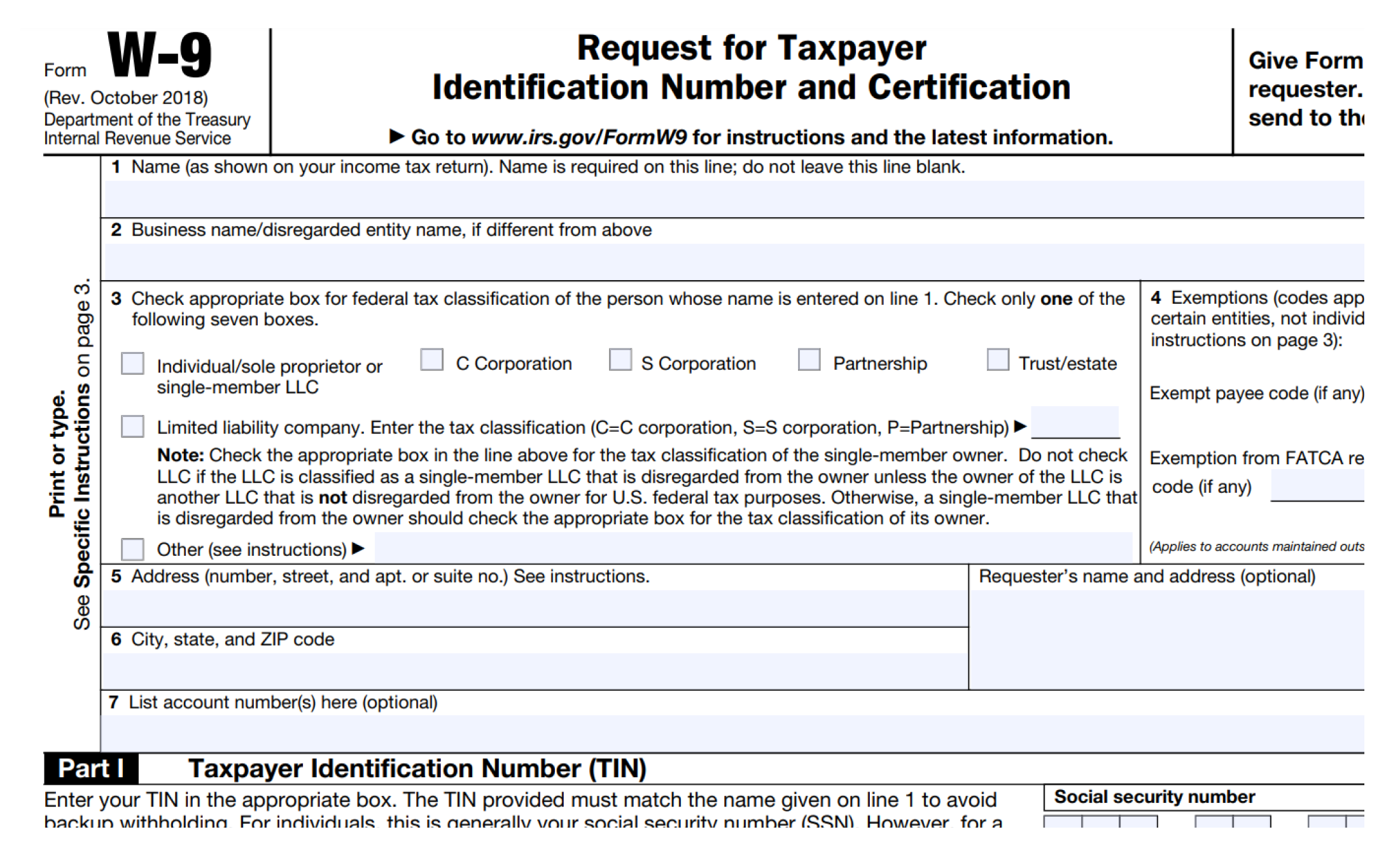

A "Request for Taxpayer Identification Number and Certification" is what the IRS Form W-9 is called. When independent contractors work for your non-profit or your non-profit works for another business, this form requests the necessary tax information from the contractor. The form asks for the contractor's name, address, Tax Identification Number, and other details.

As you know, even if you are exempt from paying taxes, you still need to file an IRS report. Form 990 is the tax form for which you must file the most yearly reports. Apart from that, you'll need to consider filling out or requesting the W-9 Form in

certain instances.

3. When will you deal with the W-9 Form as a non-profit organization?

As a good rule of thumb, the Form W-9 must be completed when a contractor is not an official employee of your nonprofit organization. The IRS views the W-9 Form as determining if the contractor is an Individual (Sole proprietor), S-Corp, LLC, or non-profit 501(c)(3) for tax implications.

There are two cases in which your nonprofit organization may need to deal with the W-9 Form: You will either need to fill out Form W-9 because your nonprofit organization has rendered services for another business, or your nonprofit organization requests Form W-9 from the contractor you hired.

-

Request W-9 Form

All you have to do to get a W-9 Form from a contractor your non-profit organization hired is request one. A filled-out form will be returned to you.

Please request the W-9 Form as soon as possible once you start working with the contractor. This saves you from having to seek down your contractors and obtain documents at the end of the year, which is already a stressful time.

Based on the information obtained from W-9, you will need to file the applicable 1099 Form for the contractor.

Example: Your nonprofit hired a local artist to paint an artwork around the city. In this scenario, just request the artist to fill out a W-9 once you've paid them above $600.

-

Fill W-9 Form

A business will ask for a W-9 Form from your non-profit if it hires you to provide any paid services. In this scenario, you must fill out Form W-9 and submit it to the business that hired your nonprofit.

Example: Let’s say you’re an employment association and provide a paid awareness program to a corporation. In this scenario, the corporation will ask you to fill out Form W-9 and file Form 1099 for you at the end of the year.

4. How do you fill out Form W-9 for non-profits?

In the following section, we'll review the information you'll need and how to fill out the W-9 for non-profits. The Form is brief and easy to complete. All you need to know is your non-profit's history and technical details.

Here’s how you can fill out the Form W-9 for Non-profits:

| Line 1 (Organization’s official name) | Enter the name of your nonprofit corporation on Line 1 as it appears in your Articles of Incorporation. |

| Line 2 (Organization’s unofficial name) | You can leave this space blank on Line 2 if you operate under your official name. |

| Line 3 (Federal tax classification) | If your nonprofit organization is exempt from taxes[501(c)(3)], select the "Other" box and enter "Nonprofit corporation exempt under IRS Code Section____." |

| Line 4 (Exemptions) |

If your nonprofit organization is exempt from backup withholding and FATCA reporting, enter the appropriate codes in the required space. Here are the codes applicable for organizations exempt from federal income tax under section 501(a):

|

| Line 5 & 6 (Address) | Enter your non-profit organization's mailing address. |

| Line 7 (Account Number) | You can provide account numbers in Line 7 that your employer might require. However, listing these is optional. |

| Part I (Provide your TIN) | In Part 1, enter your TIN as issued by the IRS. Since an EIN is required to operate as a nonprofit organization, you should always provide your EIN in this form and leave the Social Security number box empty. |

| Part II (Certification) |

The following conditions must be certified under "Part II":

In this section, all that is required is your signature and the date. |

5. What happens if your nonprofit organization fails to complete Form W-9?

If you, as a nonprofit, decline to provide your TIN on Form W-9, the requester may deduct 24 % of your income in taxes. If your nonprofit's failure to provide a Form W-9 leads to reporting errors or non-compliance with tax regulations, the requester can be subject to penalties and interest. The IRS imposes penalties for inaccuracies in information reporting, and these penalties can accumulate over time.

6. It's Simple to Complete a W-9 for Your Nonprofit!

Completing Form W-9 for your nonprofit organization with our Sister Concern Taxbandits is easy.

- With TaxBandits Fillable W-9 Solution, your non-profit organization can quickly fill out the Form W-9.

- Use TaxBandits Form W-9 Manager to request W-9 online from the contractors you hired and manage them securely in

one place.