Left to file Form 990-T for May 15, 2025.

File Form 990-PF with the IRS Trusted E-file Provider

- Prepare your 990-PF yourself

- E-file them with the IRS on time

- Get real-time assistance

*Pay only when you transmit the return

Why E-File 990-N with ExpressTaxExempt

- E-File in 3 Simple Steps

- Instant Notification from the IRS

- Additional Users to Manage Accounts

- U.S based Chat, Email, & Phone Support

- Retransmit Rejected Returns for FREE

The Tax990 Commitment: Accepted, Every Time—Nonprofit Tax Filing

Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Need more time to file? Submit Form 8868 for an automatic extension for free.

Retransmit Rejected Returns

If your return is rejected by the IRS due to errors, you can correct and resubmit it at no additional cost.

No Cost Corrections

Found an error after submitting your return? You can submit corrections free of charge–up to three times.

Money-Back Guarantee

If your form isn't accepted or is flagged as a duplicate, we’ll issue a full refund—no questions asked.

IRS Authorized Provider

SOC 2 Certified

FTB Authorized Provider

10 Years of Excellence

24/7 Customer Support

Why Choose ExpressTaxExempt for 990-PF Filing?

Easy and Secure

Our cloud-based software comprises an intuitive interface, enabling easy navigation and a seamless filing experience.

Interview-Style Filing

If you’re a first-time filer, choose our interview-style filing to answer a series of questions and let us generate your 990-PF accordingly.

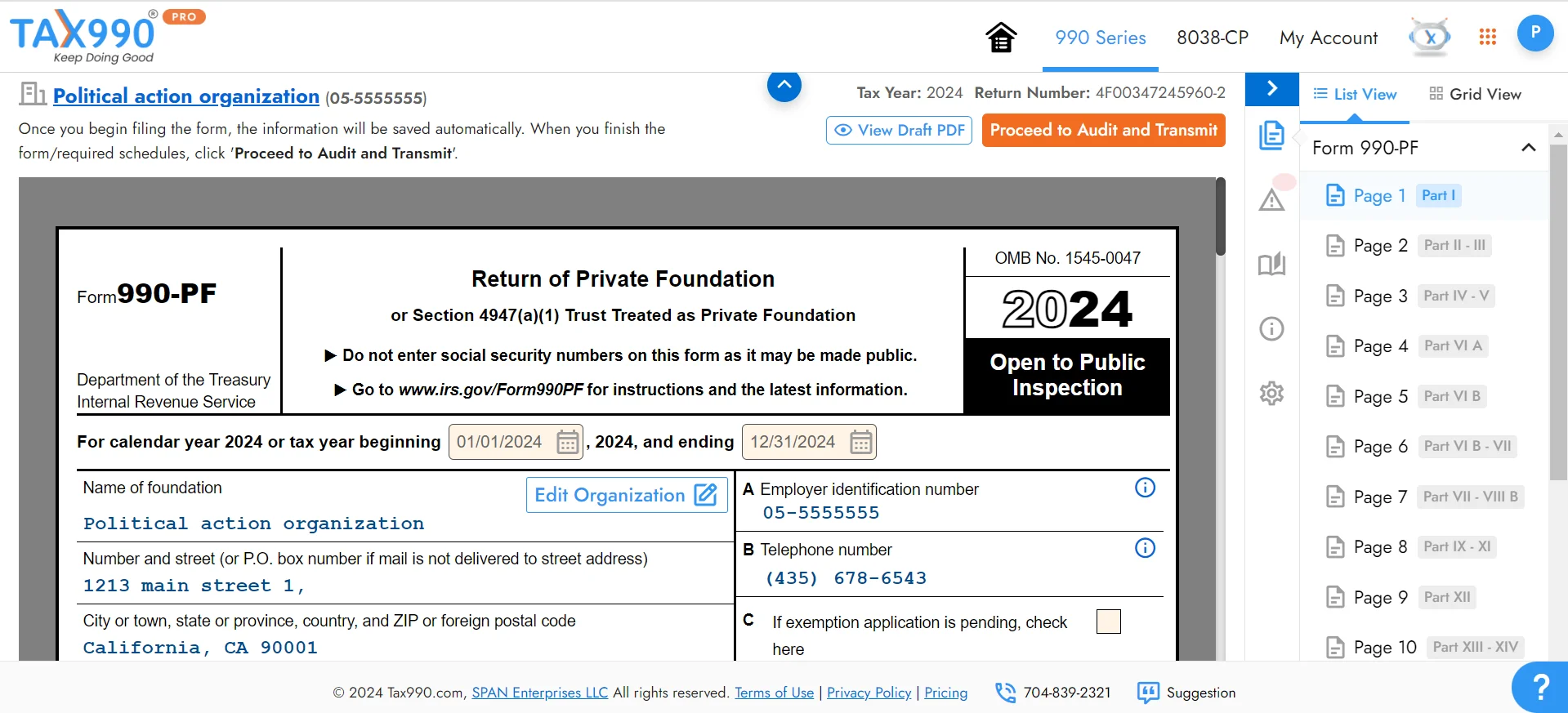

Direct-Form Entry

If you’re familiar with 990-PF filing, choose our form-based option to enter the data directly into the digitalized form on your own and submit it to the IRS.

Includes Schedule B

Based on the data you enter on your 990-PF, our software will automatically include Schedule B at no extra cost.

Copy Data Option

Skip manual entry by copying certain filing information from the prior year’s 990-PF filed with us onto the current year’s return.

Internal Audit System

Once you’re done preparing your 990-PF, let our system audit your return for any common errors based on the IRS business rules.

Free Retransmission

If the IRS rejects your 990-PF return for any errors, you can fix them and retransmit it for free

AI-Powered Knowledge Base

Upload your organization’s contributions and grant details quickly using our Excel templates.

Real-Time Support

Our dedicated support team has always gotten back to you via live chat, phone, and email to assist with your queries, if any.

Exclusive PRO Features for Tax Professionals!

Staff Management

Invite your team members and let them prepare and transmit the 990-PF filings for your clients. You can assign them specific roles and keep track of their activities.

Client Management

Prepare and manage 990-PF filings for unlimited clients (multiple EINs) and have your clients review the returns through a secure portal before transmission.

E-Signing Options

We support Form 8453-TE for Paid Preparers and Form 8879-TE for Electronic Return Originators (ERO) to ensure compliance with the IRS guidelines for e-signing 990-PF.

Ready to start e-file Form 990-PF?

How to File Form 990-PF with ExpressTaxExempt?

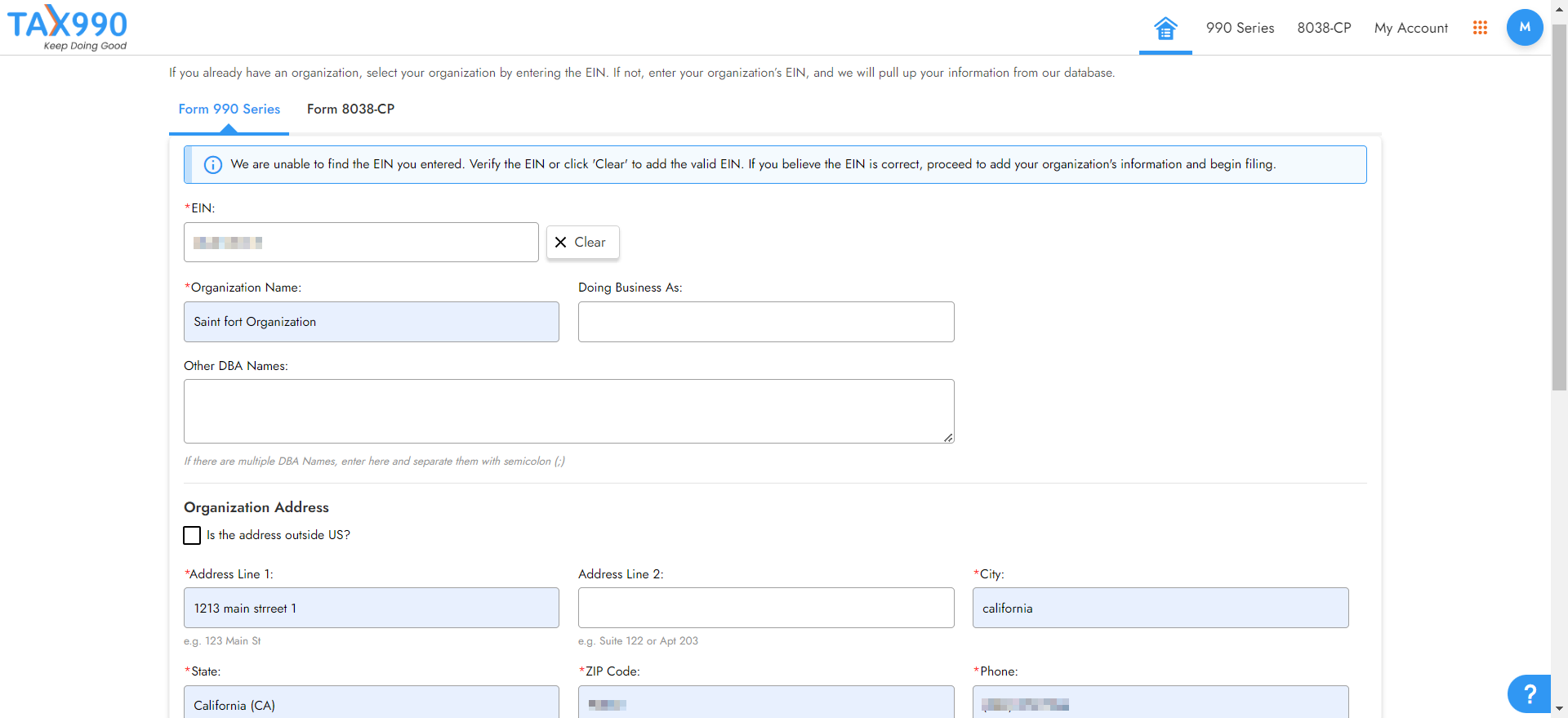

By searching for your EIN, you can import your foundation’s details from the IRS directly. You can also choose to enter your foundation’s details manually.

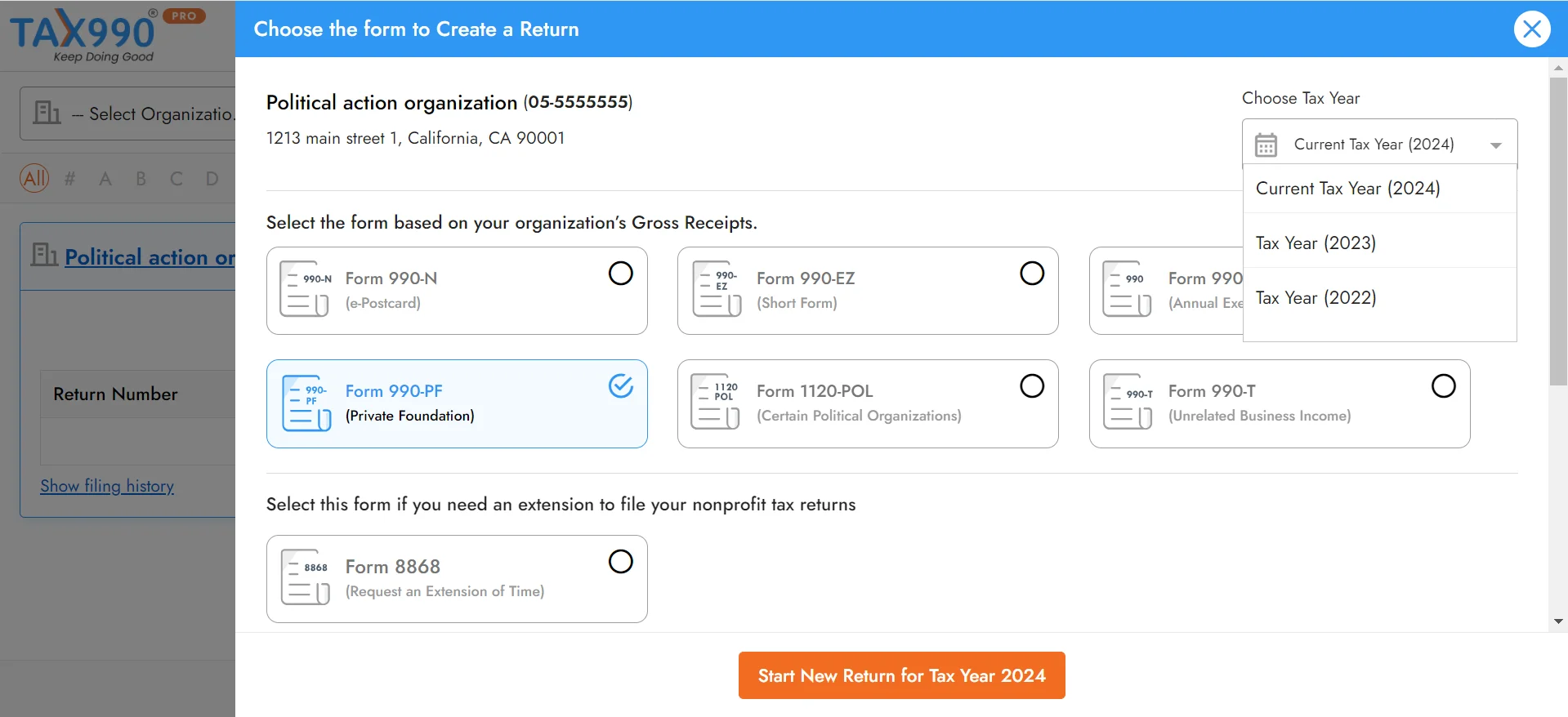

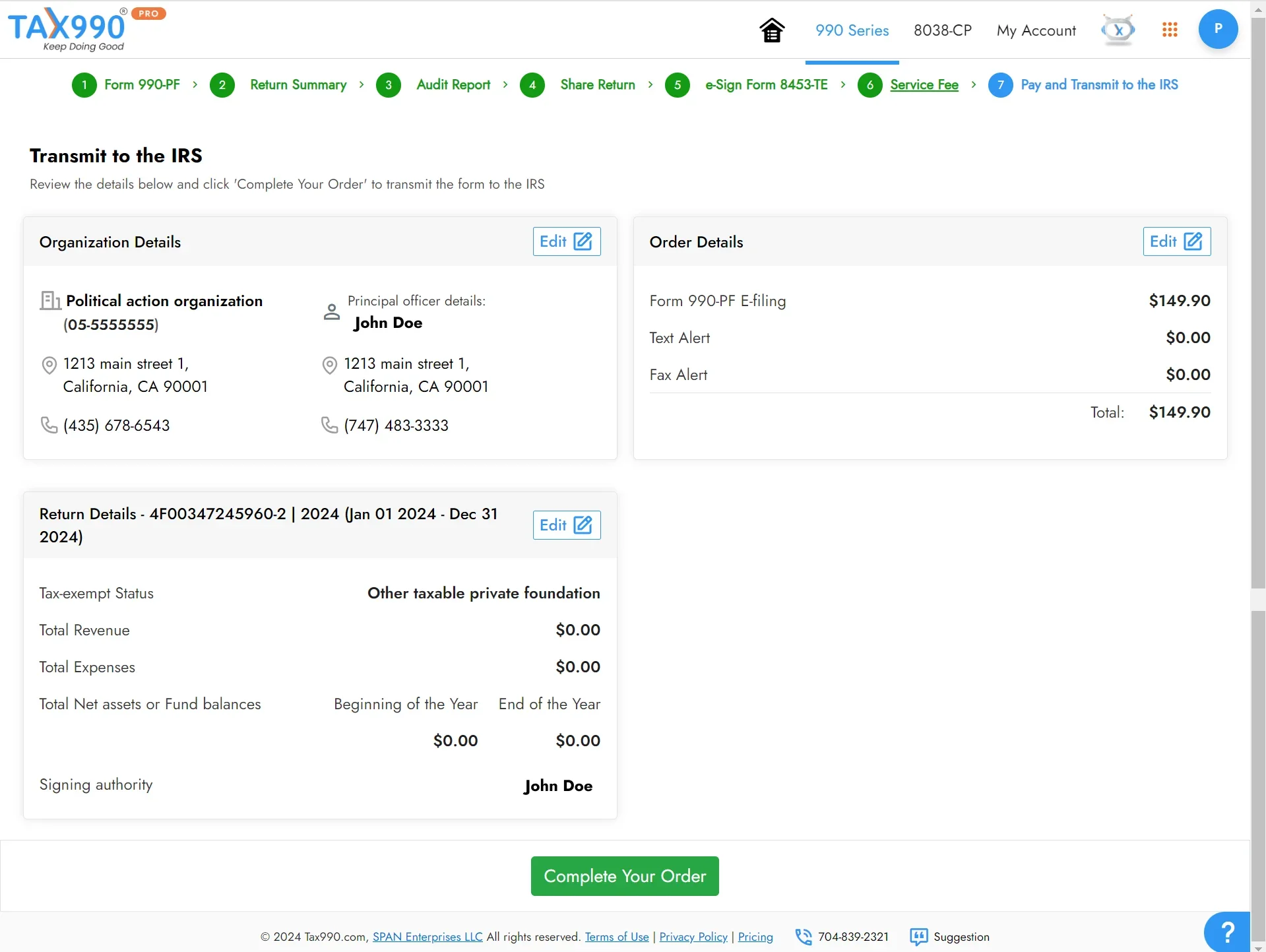

You can file Form 990-PF for the current and previous tax years with Tax 990. So, select the applicable tax year, select Form 990-PF and proceed.

We provide Form-based and Interview-Style filing options. Choose whichever is convenient for you and provide the required form data.

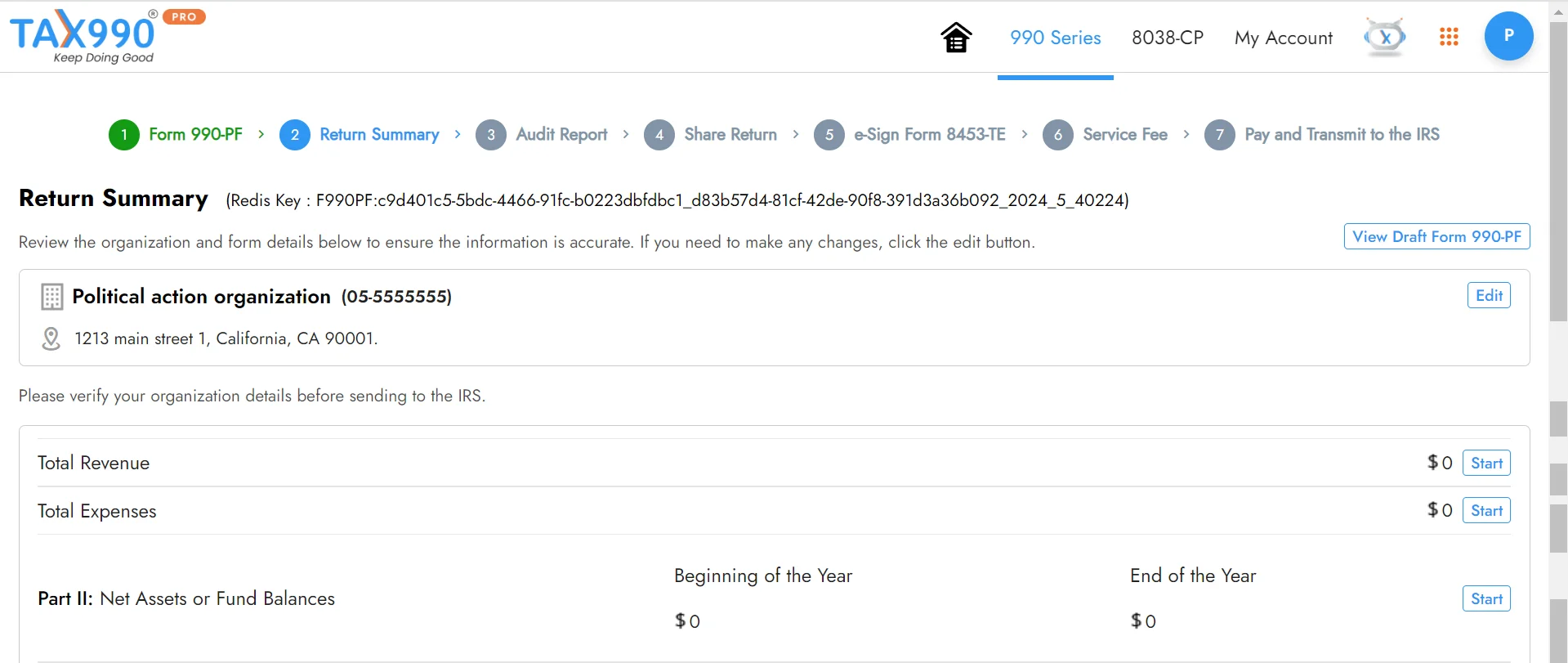

Review the summary of your form and make changes if required. You can also share your form with foundation members for their review and approval.

You can transmit the form to the IRS after reviewing it. Our system provides you with instant updates about the IRS status of your form via email and text.

Ready to File 990-PF Electronically?

See what our clients love about ExpressTaxExempt!

Cost to E-file Form 990-PF with ExpressTaxExempt!

Cost to E-file Form 990-PF ExpressTaxExempt!

Nonprofits

Form 990-PF Pricing

- No Subscription Fee

- No Software Downloads

- Pay only for what you file

- Live Chat, Email, & Phone Support

E-file for $169.90/Form

Package Pricing

- Free Extension Form 8868

- File Extension in 3 Simple Steps

- Get Extension Approved in Minutes

- Get Timely 990 Deadline Reminders

E-file for $169.90/Form

Actual Cost $184.80

Tax-pros

Having More Nonprofit to report?

ExpressTaxExempt is a perfect choice for you!

- Manage Multiple EIN’s in one place

- User-Friendly Dashboard

- Dedicated Customer Support

| Form 990-PF | Pricing |

|---|---|

| 1 - 10 Returns | $149.90 |

| 11+ Returns | $119.90 |