Form 990-PF for 2023: Return for Private Foundation

Quick Links

The IRS Mandates

E-Filing of Form 990-PF

Get Started with ExpressTaxExempt to E-File Your Form 990-PF!

- Secure & Accurate Filing

- Auto-generates 990-PF schedule B

- Supports 990-PF Amendment

- Retransmit Rejected Return for Free

- Supports Extension Form 8868

IRS Form 990-PF for Private Foundations

- Updated April 26, 2024 - 3.00 PM Admin, ExpressTaxExemptThe IRS has designed various types of 990 forms for nonprofits to fulfill their annual filing requirements. Among them is Form 990-PF, filed by nonprofits that are classified as private foundations for federal tax purposes.

This article elaborates on every aspect related to Form 990-PF that a private foundation must be aware of to ensure tax compliance with the IRS.

Table of Contents

1. What is Form 990-PF?

Form 990-PF is an annual information return filed by certain private foundations to figure the tax based on investment income and to report charitable distributions and activities.

The IRS will use this information to ensure that the respective private foundation stays compliant with the guidelines established.

Form 990-PF Filing Made Easy and Secure!

Get started with ExpressTaxExempt, an IRS-authorized e-file provider of 990 forms that simplifies the form preparation and e-filing process for private foundations. With numerous exclusive features, our software serves as the best choice for filing Form 990-PF with the IRS.

2. Who must file Form 990-PF?

Form 990-PF must be filed by the following private foundations every year:

- Exempt private foundations (section 6033(a), (b), and (c))

- Taxable private foundations (section 6033(d))

- Section 4947(a)(1) nonexempt charitable trusts treated as private foundations

- Organizations that made an election under section 41(e)(6)(D)(iv)

- Private foundations that are making a section 507(b) termination

- Organizations that agree to private foundation status and whose applications for exempt status are pending on the deadline for filing

Form 990-PF - Organizations that claim private foundation status haven't yet applied for exempt status and whose application isn't yet untimely under section 508(a) for retroactive recognition of exemption

3. When is Form 990-PF due?

Private foundations must file Form 990-PF by the 15th day of the 5th month after the tax year ends.

If a private foundation operates on a calendar tax year (which means the tax year ends on December 31), then the due date to file Form 990-PF is May 15th.

Operating in the fiscal tax year?

If you have any difficulty figuring out the 990-PF deadline for your foundation, try our free 990 due date calculator.

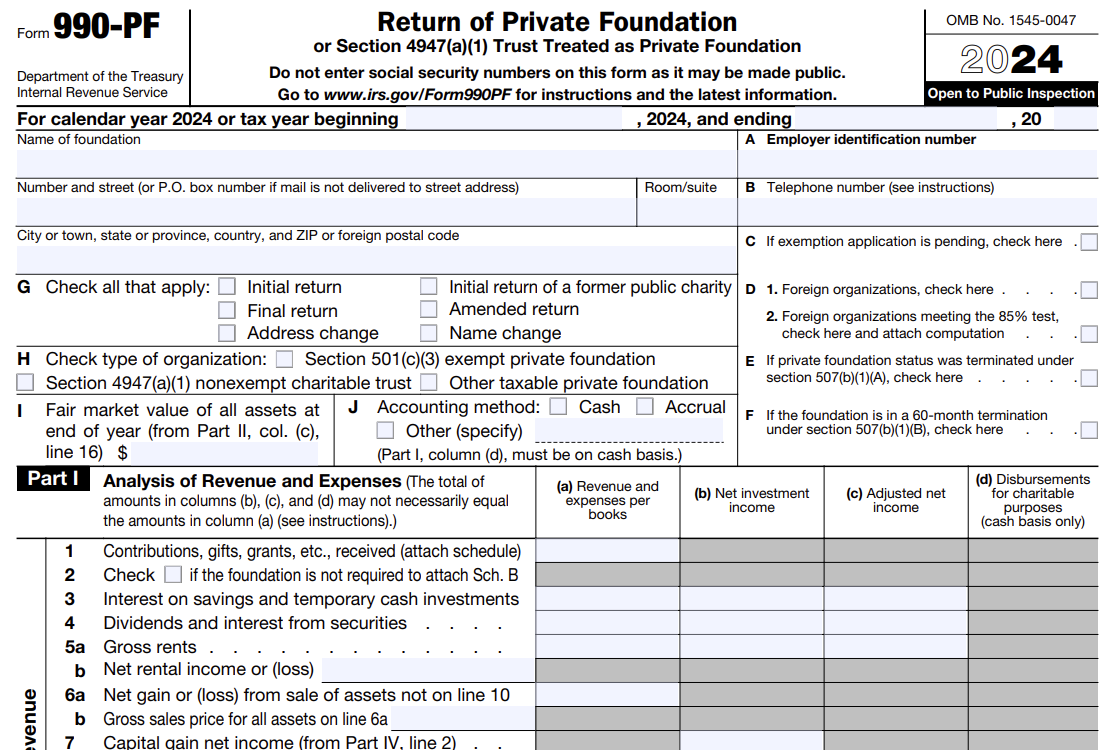

4. Breakdown of Form 990-PF

Form 990-PF contains 16 parts in total, wherein some parts are optional. Here is a list of parts in Form 990-PF:

- Part I - Analysis of Revenue and Expenses

- Part II - Balance Sheets

- Part III - Analysis of Changes in Net Assets or Fund Balances

- Part IV - Capital Gains and Losses for Tax on Investment Income

- Part V - Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948)

- Part VI - Statements Regarding Activities

- Part VII - Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors

- Part VIII - Summary of Direct Charitable Activities and Program-Related Investments

- Part IX - Minimum Investment Return

- Part X - Distributable Amount

- Part XI - Qualifying Distributions

- Part XII - Undistributed Income

- Part XIII - Private Operating Foundations

- Part XIV - Supplementary Information

- Part XV - Analysis of Income-Producing Activities and Relationship of Activities to the Accomplishment of Exempt Purposes

- Part XVI - Information Regarding Transfers To and Transactions and Relationships With Noncharitable Exempt Organizations

Need Help Filling Out Form 990-PF?

Click here for step-by-step instructions on completing each part of Form 990-PF.

5. Additional Requirements For Form 990-PF

In addition to Form 990-PF, the private foundations may also need to attach Schedule B, Schedule of Contributors, to provide additional information on contributions that they reported on Form 990-PF, Return of Private Foundation.

Generally, Schedule B must be attached if the private foundation has received contributions of $5000 or more from any one contributor during the respective tax year. Learn more about Form 990-PF Schedule B.

Notes:

The private foundations that aren’t required to attach Schedule B should answer “No” on Part I, line 2 on their Form 990-PF.

6. What are the penalties for late filing Form 990-PF?

The penalty amount for not filing or late filing Form 990-PF depends on the private foundation’s size.

- For private foundations with gross receipts < $1,208,500, the penalty amount is $20 / day with a maximum of $12,000 or 5% of the foundation’s gross receipts (whichever is less).

- For larger private foundations with gross receipts > $1,208,500, the penalty is $120 / day up to a maximum of $60,000 or 5 percent of the foundation’s gross receipts (whichever is less).

Click here to learn more about 990-PF penalties.

It’s Never Too Late to file your Form 990-PF!

With ExpressTaxExempt, you can prepare and e-file your 990-PF return easily, securely, and accurately on time.

7. Is there an extension for Form 990-PF?

Yes! Private foundations can extend the 990-PF filing deadline by

filing extension Form 8868.

By filing Form 8868, private foundations can get an automatic 6-month extension to file Form 990-PF. The IRS requires no explanation to file tax extension Form 8868, as it is completely automatic.

Get Your Extension in Minutes with ExpressTaxExempt!

Not only the 990 forms, ExpressTaxExempt also supports the

e-filing of Form 8868. You can get started with ExpressTaxExempt and apply for an extension of time in less than 10 minutes.

8. How to file Form 990-PF?

Under the “TaxPayer Act of 2019”, the IRS has mandated the electronic filing of Form 990-PF for quick, secure, and more accurate filing. Learn More.

To file 990-PF electronically without any hassles, you can get started with a reliable and trustworthy e-file provider.

Choose ExpressTaxExempt to file your Form 990-PF electronically

and effortlessly!

ExpressTaxExempt, the IRS-authorized e-file provider, can be the perfect choice for private foundations to complete their nonprofit tax filing precisely, promptly,

and securely.

- Our cloud-based Software simplifies the preparation of your Form 990-PF with interview-style (or) form-based filing methods.

- Based on the information you provide while filling out 990-PF, our system automatically generates Schedule B (if applicable) for Free

- If you have already filed Form 990-PF with the IRS, you can correct the information and file the Amended Return with our software.

-

You can Add More Users to review, approve, and manage your nonprofit

tax filings - Even if the IRS rejects your Form 990-PF for any reason, you can fix the errors and Retransmit the Return for Free.

- By filing electronically with our software, you get to know the Instant Status of your submitted forms.

Article Sources

- Tax-Exempt Status for Your Organization

- Instructions for Form 990-PF (2021)