E-File IRS Form 8868 Online

Securely Prepare and E-File Form 8868 with ExpressTaxExempt

Why E-File 8868 with ExpressTaxExempt?

- Take advantage of our package pricing and file Form 8868 for free when you pay in advance for a 990 return

- Get Extension Approved in minutes

- We will notify you when your extended 990 deadline approaches

- U.S based Chat, Email, & Phone Support

View Detailed Pricing

See why our clients choose ExpressTaxExempt!

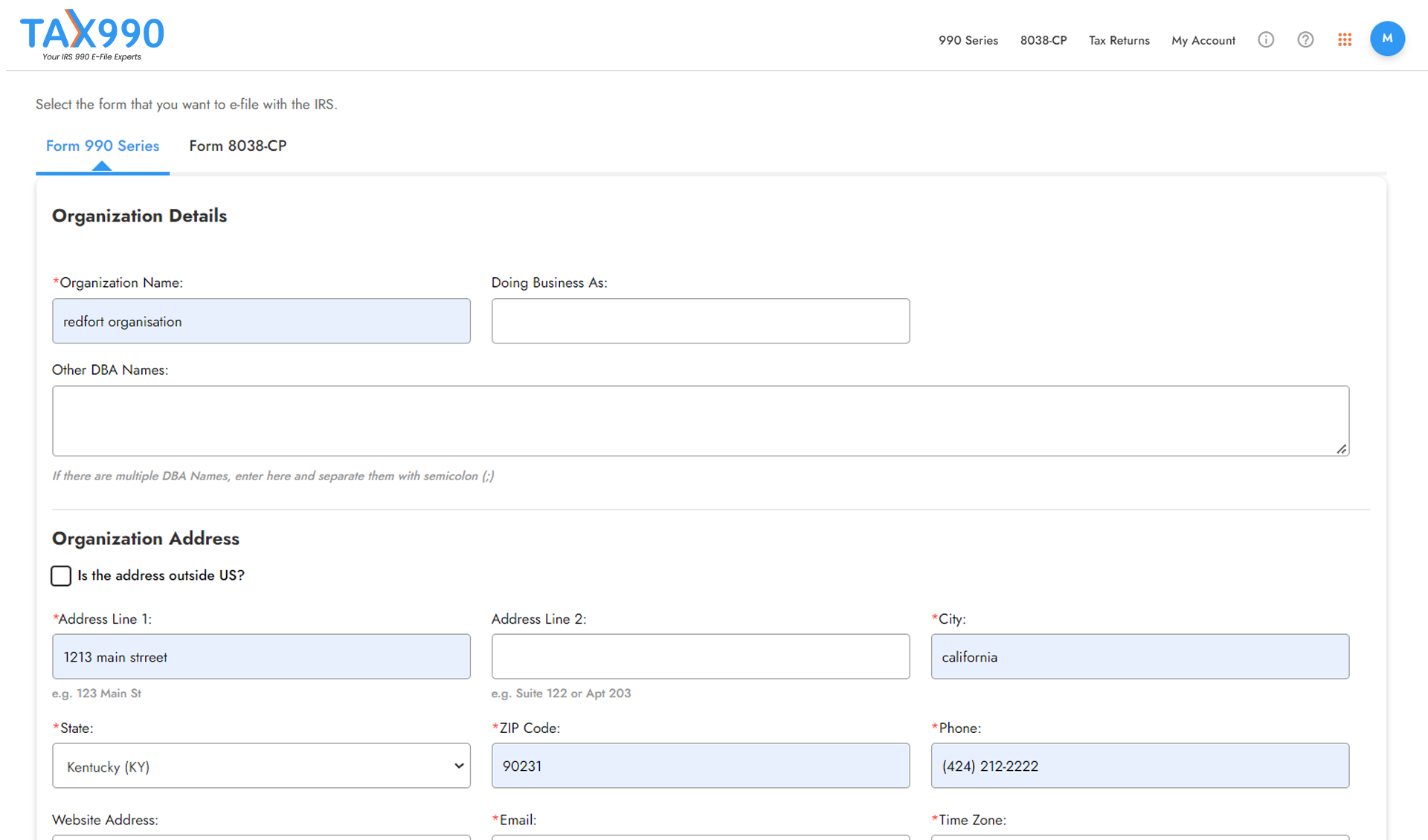

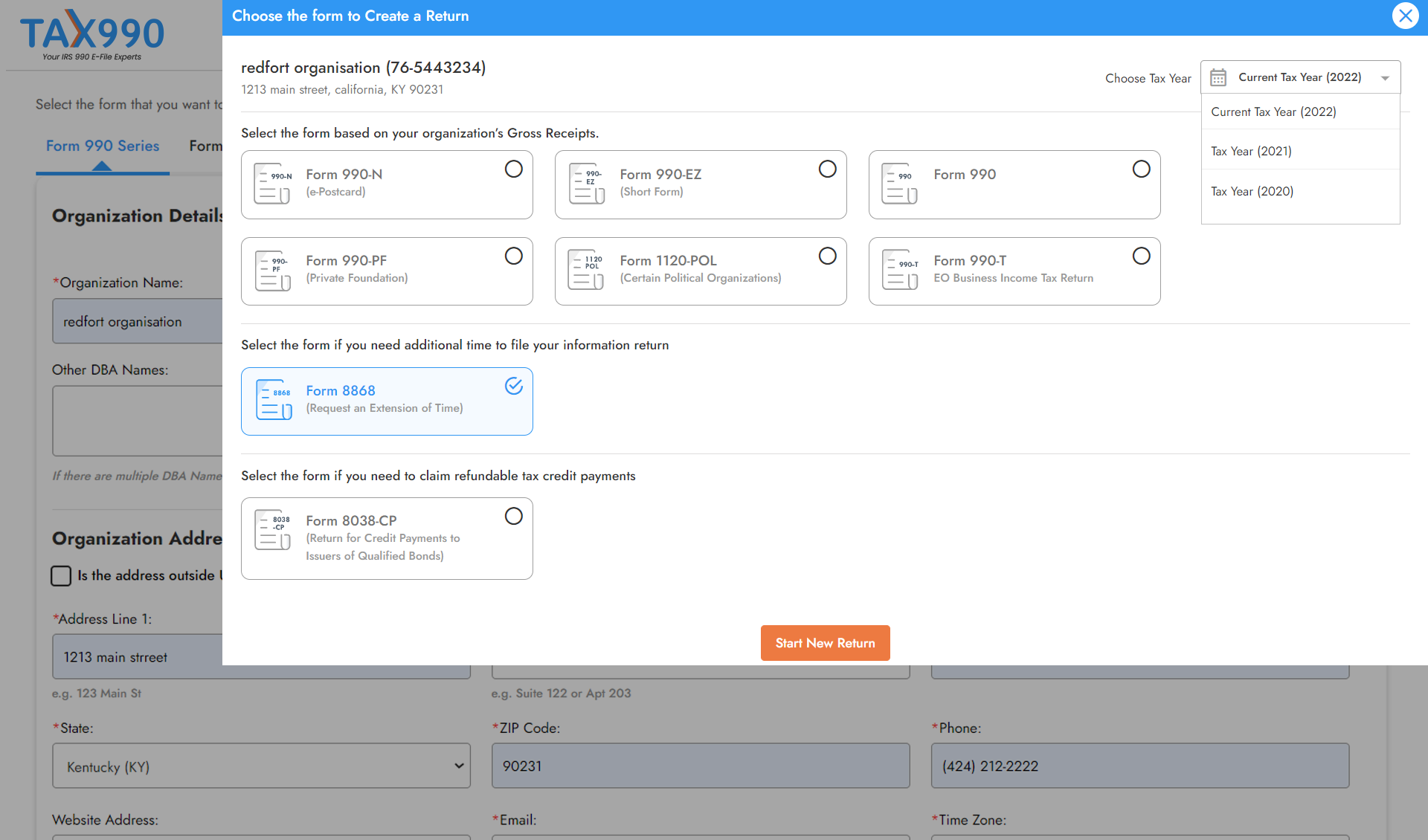

How to E-file Form 8868 Online for the 2023 Tax Year

with ExpressTaxExempt?

Ready to File Your Form 8868 Electronically?

Why E-file Form 8868 with ExpressTaxExempt?

Quick and Easy Filing

Automatic Extension, IRS requires no explanation

Instant IRS Approval

Conveniently file from

any Device

Volume Based Pricing for

Tax Professionals

US Based phone, email, and chat support

Frequently Asked Question on Form 8868

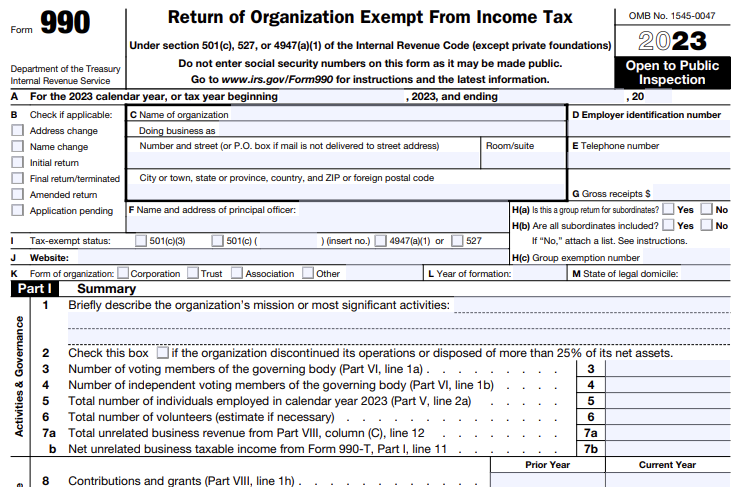

What is IRS Form 8868?

Form 8868 is used by exempt organizations to apply for an automatic 6-month extension of time to file their

Nonprofit tax returns. IRS requires no explanation of the extension on Form 8868.

What forms can extend using Form 8868?

| Form 990 or Form 990-EZ | Form 990-BL | Form 4720 (individual) | Form 990-PF |

| Form 990-T (sec. 401(a) or 408(a) trust) | Form 990-T (trust other than above) | Form 990-T (corporation) | Form 1041-A |

| Form 4720 (other than individual) | Form 5227 | Form 6069 | Form 8870 |

Note: Extensions are not applicable for Form 990-N.

When To File Form 8868?

File Form 8868 by the due date of the original nonprofit tax forms for which you are requesting an extension. For instance, an extension on the filing date for Forms 990, 990-EZ, 990-PF must be filed by the 15th day of the 5th month after the organization's fiscal tax year ends.

Use the Due Date Calculator to find your 990 deadline.

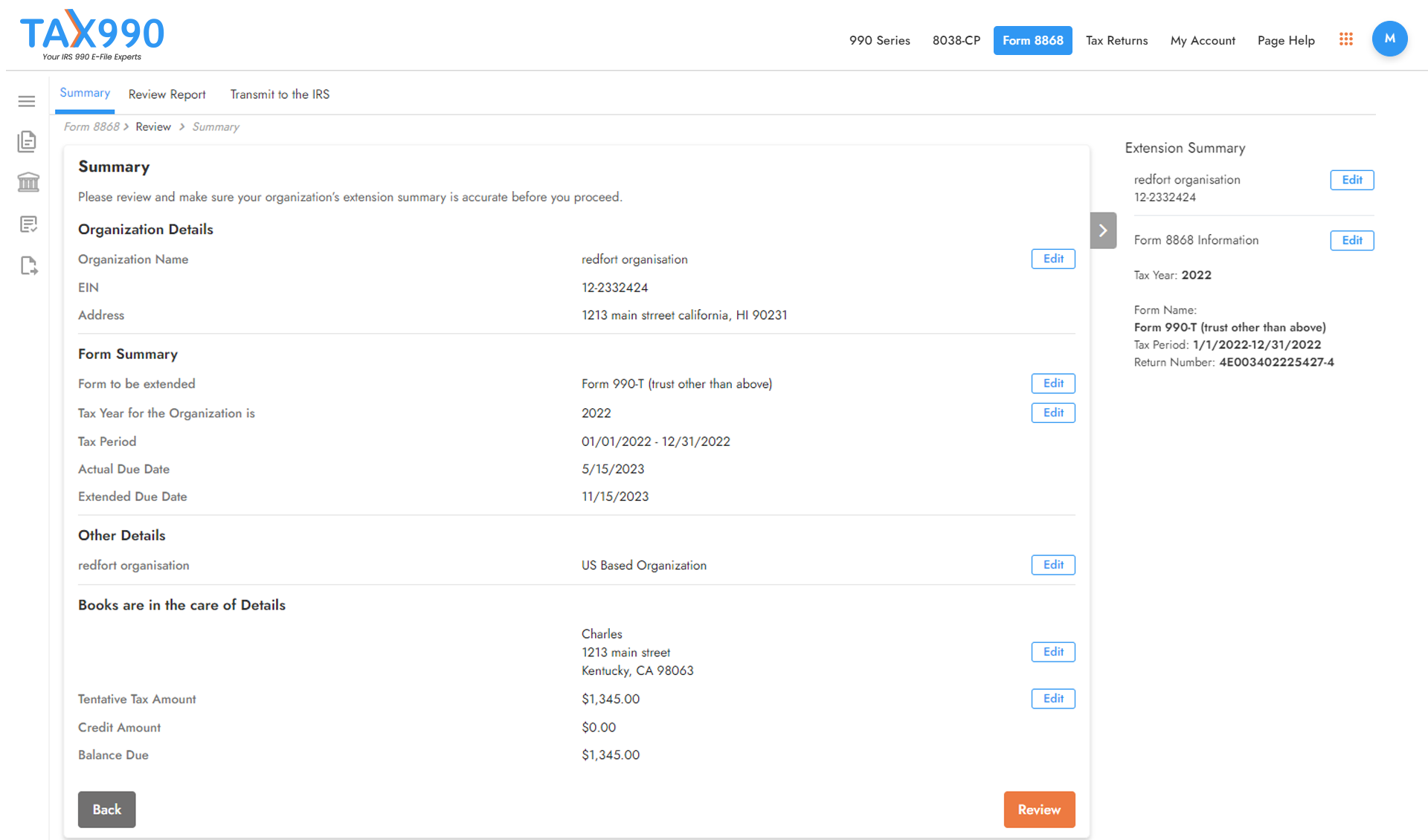

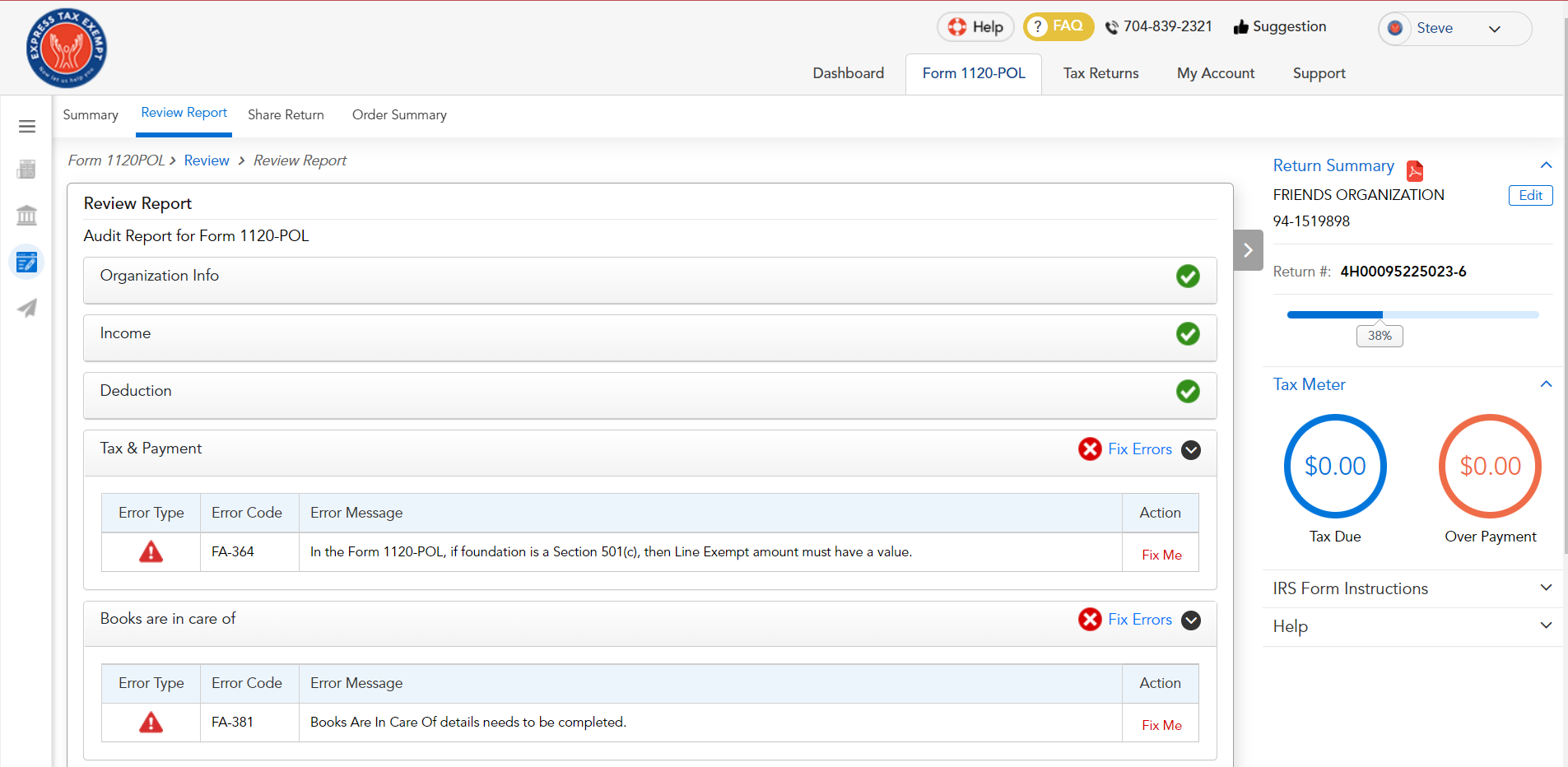

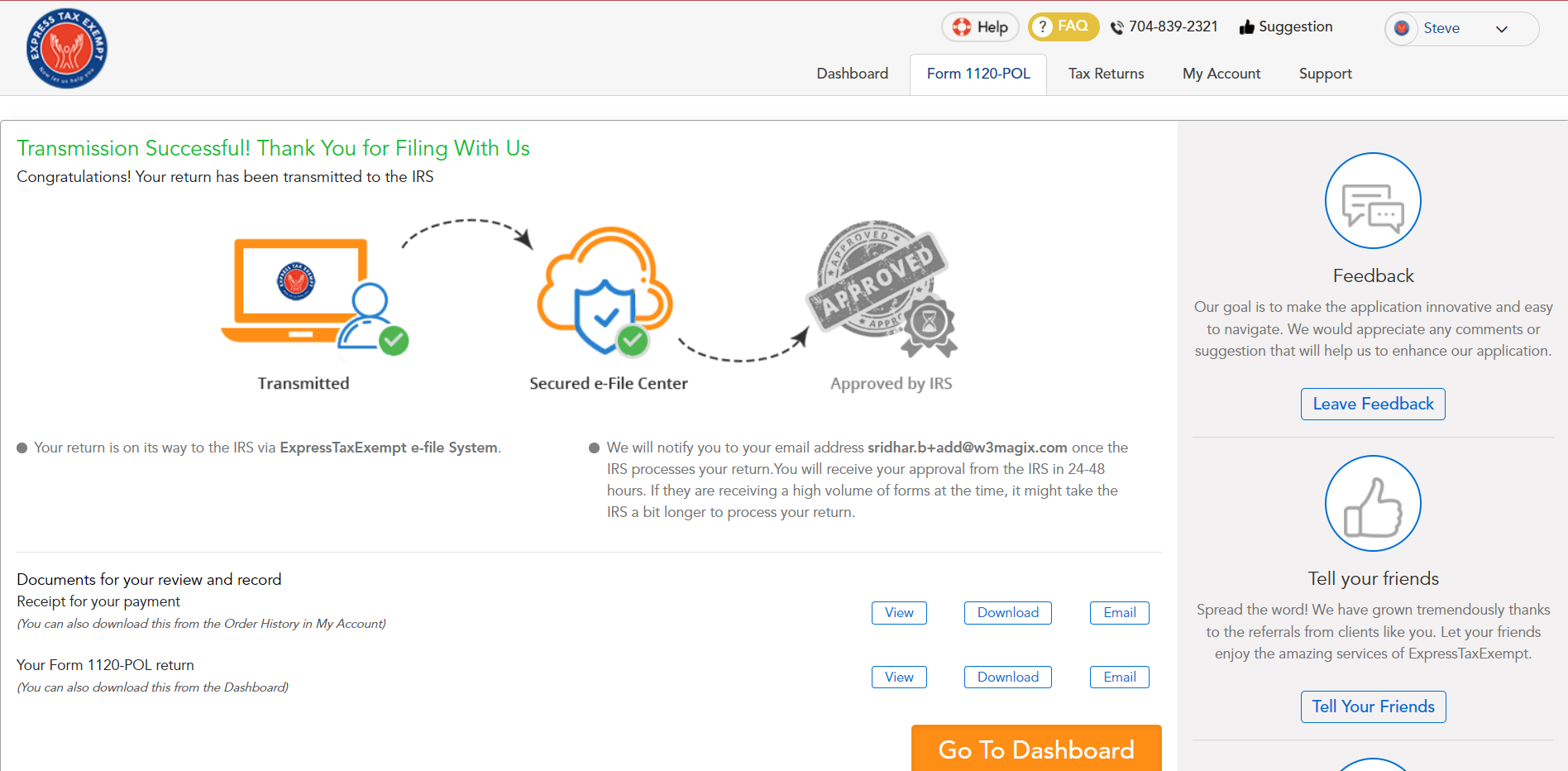

What Happens When You E-file tax extension Form 8868 with ExpressTaxExempt?

When you file an extension using Form 8868 with Tax 990, your form gets reviewed for basic errors, before transmission to the IRS, ensuring an error-free return.

You will get the status of the filing instantly.

Where do I mail in Form 8868?

IRS recommends the electronic filing of extension Form 8868 for faster processing of the 501c3 tax return and to get status instantly.

In case you decide not to file Form 8868 electronically but paper-file instead, complete the form and mail it to:

Internal Revenue Service Center,

Ogden, UT 84201-0045.

For the extension on the filing date of Form 8870, the IRS accepts only the paper-filing of Form 8868. Fill in the form and mail it to the above address.