IRS Form 990 Schedule C Instructions

This article further explores the following points:

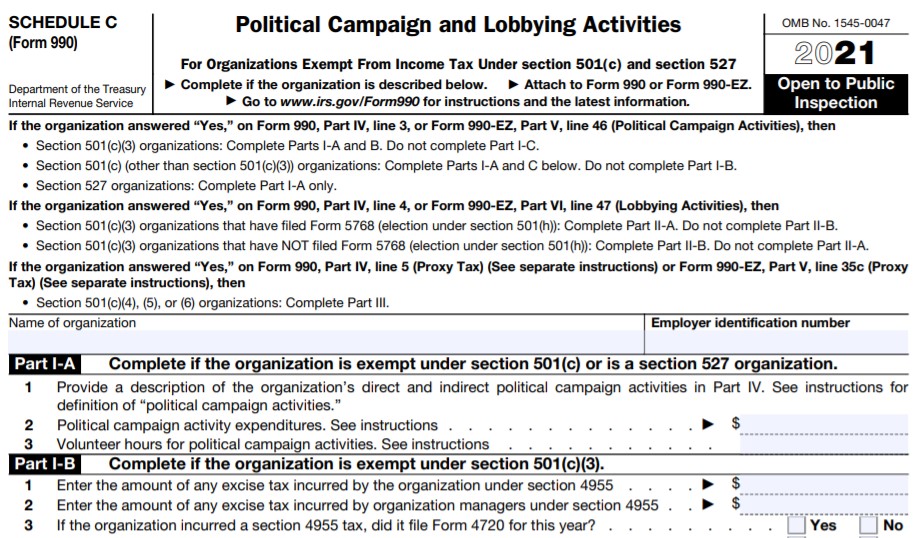

Form 990/990-EZ Schedule C - Political Campaign and Lobbying Activities

- Updated April 21, 2023 - 8.00 AM - Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations that file Form 990 or Form 990-EZ use the schedule C to provide required information about Political Campaign and Lobbying Activities.

Table of Contents

1. What is the Purpose of Form 990 Schedule C?

2. Who Must File Form 990 Schedule C?

3. Form 990/990-EZ Part I - Political campaign activities

4. Form 990/990-EZ Part II - Lobbying activities

5. Form 990/990-EZ Part III - Section 6033(e) Notice and Reporting Requirements

and Proxy Tax

6. Form 990/990-EZ Part IV - Supplemental Information

7. Other Resources in Form 990/990-EZ Schedule C

8. Choose ExpressTaxExempt to file your Form 990/990-EZ with Schedule C

1. What is the Purpose of Form 990 Schedule C?

Schedule C is generally used by Section 501(c) & Section 527 organizations to provide required information about the Political Campaign and Lobbying Activities.

Information provided on Form 990/990-EZ Schedule C will become available for the public to access and it helps volunteers, funders, contributors to find and evaluate the best

charity to support.

2. Who Must File Form 990 Schedule C?

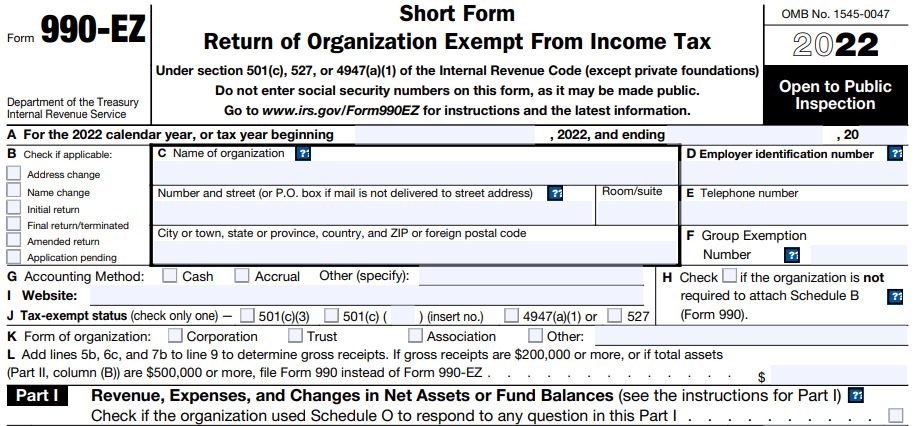

Nonprofits and tax-exempt organizations filing Form 990 and marking "Yes" to line 3, 4, or 5 on Part IV on the Checklist of Required Schedules, must file Schedule C.

Organizations filing Form 990-EZ and marking "Yes" to line 46, 35c in Part V, line 47 in Part VI on the Checklist of Required Schedules, must file Schedule C.

3. Instructions to complete schedule C Form 990/990-EZ

Part I Form 990/990-EZ Part I - Political campaign activities

This part must be completed by section 501(c) organizations and section 527 organizations that file Form 990-EZ (and IRS Form 990).

Nonprofit organizations that chooses the option “Yes” to Line 3, Part IV of IRS Form 990, or line 6, Part V of IRS Form 990-EZ must complete the following parts:

- A section 501(c)(3) organization must complete Parts I-A and I-B. Don’t complete Part I-C.

- A section 501(c) organization other than section 501(c)(3) must complete Parts I-A and I-C. Don’t complete Part I-B.

- A section 527 organization that files the Form 990 or Form 990-EZ must complete Part I-A. Don’t complete Parts I-B and I-C.

Part I-A Complete if the organization is exempt under section 501(c) or is a section 527 organization

Enter the Political campaign activity expenditures, Volunteer hours for political campaign activities.

Part I-B Complete if the organization is exempt under section 501(c)(3)

Section 501(c)(3) organizations must enter any excise tax incurred during the tax year under section 4955 (political expenditures).

Part I-C Complete if the organization is exempt under section 501(c), except

section 501(c)(3).

Enter the amount spent by the organization for section 527 exempt function activities.

Enter the names, addresses and EIN of all section 527 political organizations to which the nonprofit organization made payments.

4. Form 990/990-EZ Part II - Lobbying activities

Organizations must provide the lobbying activities in part II. It must be completed only by the section 501(c)(3) organizations.

If the organization had chosen the option "Yes" for line 4, Part IV of IRS Form 990 or line 47, Part VI of

IRS Form 990-EZ then it complete the following parts:

- Organizations described under section 501(c)(3) and organizations that have filed Form 5768 (election under section 501(h)) complete this Part II-A.

- Organizations described under section 501(c)(3) that haven’t filed Form 5768 (election under section 501(h)) or have revoked a previous election must complete Part II-B.

5. Form 990/990-EZ Part III - Section 6033(e) Notice and Reporting Requirements and Proxy Tax

This part must be completed by section 501(c)(4), (5), and (6) organizations that have received membership dues, assessments, or similar amounts as defined in Rev. Proc. 98-19, 1998-1 C.B. 547 (or latest annual update), and that had answered "Yes" for line 5, Part IV of Form 990, or on line 35c of Form 990-EZ regarding the proxy tax.

6. Form 990/990-EZ Part IV - Supplemental Information

Use this Part to provide the narrative information required in Part I-A, line 1, Part I-B, line 4, Part I-C, line 5, Part II-A, line 1 (affiliated group list), Part II-A, lines 1 and 2, and Part II-B, line 1.

Also, report any additional details of the organization here.

7. Other Resources in Form 990/990-EZ Schedule C

What is a Lobbying Activity?

The IRS defines "lobbying activity" as an attempt made by any individual or an organization to influence the decisions made by a government. The attempt made to influence legislation by propaganda or otherwise, presentation of testimony at public hearings held by legislative committees, correspondence and conferences with legislators and their staffs, communications by electronic means, and publication of documents advocating specific legislative action are considered as lobbying activities.

What is Grassroots Lobbying?

Grassroots lobbying also known as indirect lobbying is an attempt made to influence legislation and make a difference in the decisions made by the government. Many companies, associations as well as individuals perform grassroots lobbying as an attempt to influence a change in the legislation.

However, the communication made will not be considered as a grassroots lobbying unless it encourages the recipients to take action about the specific legislation.

What is Direct Lobbying?

Direct lobbying generally refers to an attempt to influence any legislation through

communication with:

1. A member or employee of a legislative or similar body

2. A governmental official or employee (other than a member or employee of a legislative body) who may participate in the formulating legislation, but only if the principal purpose of the communication is to influence legislation

However, the communications made through direct lobbying must refer to specific legislation and reflect a view on that legislation.

What are Lobbying Expenditures?

Money spent to influence a legislative body at the local, state, or federal level is considered as lobbying expenditures. This includes all the allocable overhead and administrative costs paid or incurred to influence legislation and also the attempt to influence the public or other segments of the public on elections or other legislative matters.

What is considered Political Campaign Activity of an Exempt Organization?

Political campaign activities have occurred if the organization participated or intervened in (including the publishing of statements) any political campaign on behalf of (or in opposition to) any candidate for public office, directly or indirectly.

Additional Information

Section 501(h)

Section 501(h), the lobbying expenditure test is an alternative method used by organizations that define and limit the amount a public charity may spend on direct and grassroots lobbying activities. Organizations that elect to use this test method must file Form 5768 at any time during the tax year for which the expenditure test is to be effective.

Section 527

Political organizations described under Section 527 are subjected to a political organization taxable income even if the organization has tax-exempt status. This includes all political committees, parties, associations, funds or other entities which are organized and operated primarily for directly or indirectly accepting contributions or making politically related expenditures.

Section 501(c)(4)

Organizations described under Section 501(c)(4) work for the promotion of common good and welfare of the people of the community. The tax-exempt status acquired by these organizations is achieved by focusing on the promotion of social welfare to the community rather than its profits.

Section 501(c)(5)

Section 501(c)(5) provides exemption status for labour, agricultural, or horticultural organizations. According to the IRS, a section 501(c)(5) organization must provide the first line of service to its members.

However, an organization to be exempt under Section 501(c)(5) must meet the following requirements:

- The net earnings of the organization may not inure to the benefit of any member (private benefits to any individual).

- The objects of the organization must be in the best condition upon usage by those who engaged in the pursuits of labour, agriculture, or horticulture, the improvement of the grade of their products, and the development of a higher degree of efficiency in their respective occupations.

Section 501(c)(6)

Section 501(c)(6) of the Internal Revenue Code provides exemption status for business leagues, chambers of commerce, real estate boards, boards of trade and professional football leagues. These organizations generally don't focus on the profits and the net earnings aren't inured to the benefit of any private shareholder or individual. They can also take part in some political activities without losing their exemption status.

Form 5768

Form 5768 known as the Election/Revocation of Election by an Eligible Section 501(c)(3) Organization To Make Expenditures To Influence Legislation, is used by section 501(c)(3) eligible organization who either elect to use or revoke their election to use the provisions related to lobbying expenditures without losing its tax-exempt status.

Form 1120-POL

Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations is an annual income tax return filed by certain political organizations whose taxable income exceeds $100 for the tax year and other exempt organizations described under Section 527.

Form 4720

Form 4720, Return of Certain Excise Taxes on Charities and Other Persons Under Chapters 41 and 42 of the Internal Revenue Code is used by Private foundations filing Form 990-PF to figure and report the initial tax amount imposed on private foundations, foundation managers, and disqualified persons under sections 4941, 4942, 4943, 4944 and 4945.

8. Choose ExpressTaxExempt to file your Form 990/990-EZ with Schedule C

When you start filing the Form 990/990-EZ, the Schedule C will generate automatically based on the information you provided on the Form.

Our Software will review your Form for any errors, and ensure the transmission of error-free returns. Then you can transmit your Form to the IRS securely.

ExpressTaxExempt is an IRS authorized e-file service provider with providing safe and secure e-filing experience to users.