IRS Form 990 Schedule A Instructions

This article further explores the following points:

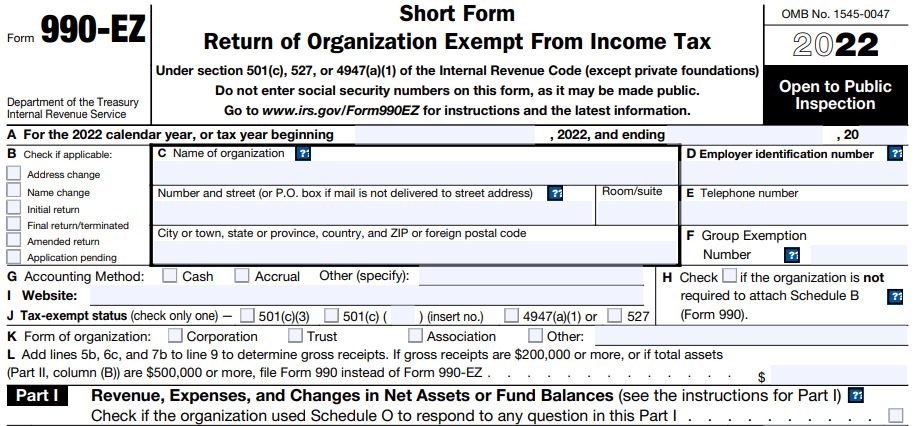

Form 990/990-EZ Schedule A - Public Charity Status and Public Support

- Updated April 21, 2023 - 2.00 PM - Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations that file Form 990 or Form 990-EZ use this schedule to provide required information about public charity status and public support.

Table of Contents

1. What is the Purpose of Form 990 Schedule A?

Schedule A is generally used by Nonprofits and tax-exempt organizations to provide required information about the public charity status and public support.

Organizations must make Form 990 Schedule A available for public inspection. This allows members of the public, such as donors and contributors, to view the organization's activities and ensure they are fulfilling their mission.

2. Who Must File Form 990 Schedule A?

3. What Accounting Method to use for calculating Schedule A?

Organizations should follow the same accounting method that it is selected on IRS Form 990, Part XII, line 1, or IRS Form 990-EZ, line G.

If the accounting method changed from the prior year, the organization must provide an explanation in Schedule O.

4. Instructions to complete Schedule A with Form 990/990-EZ

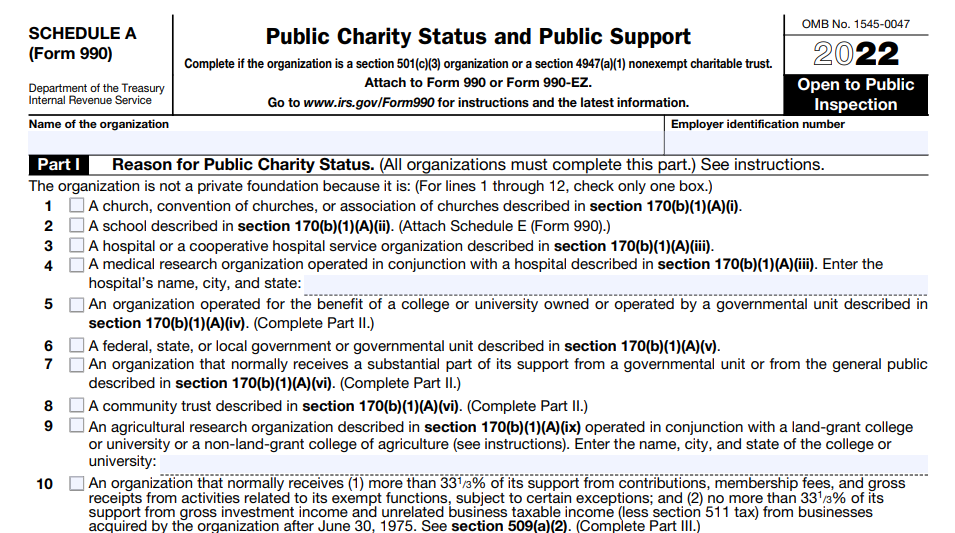

Part I: Reason for Public Charity Status

To complete Schedule A, all organizations should check any one of the boxes on lines 1 through 12 to represent the reason that the organization is a public charity for the tax year.

The reason can be the same as stated in the organization's tax-exempt registration letter from the IRS or following IRS determination letter, or it can be different.

Part II - Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and

170(b)(1)(A)(vi)

An organization that doesn't check any of the boxes on part I, shouldn't file Form 990, Form 990-EZ, or Schedule A (Form 990 or 990-EZ) for the tax year. Instead the Organization

should file Form 990-PF.

Line 5 - An organization operated for the benefit of a college or university, owned or operated by a governmental unit described in section 170(b)(1)(A)(iv)

Line 6 - A federal, state, or local government or governmental unit described in

section 170(b)(1)(A)(v).

Line 7 - An organization that normally receives a substantial part of its support from a governmental unit or the general public described in section 170(b)(1)(A)(vi).

Part II is only to provide the values of gifts, grants, and contributions accounted towards public support. Program service revenue is excluded.

It is necessary to track large donations for purposes of Schedule A, Part II, as excess contributions must be calculated and excluded from public support.

Excess contributions are those that exceed 2% of the total contribution revenue for a five-year rolling period. Governmental agencies and other 501(c)(3) non-profit organization's contributions are excluded from the calculation of excess contribution.

The calculated Public support should be reported on line 14. To meet the public support test, the calculated percentage of public support must be greater than 33 1/3%.

Part III - Support Schedule for Organizations Described in Section 509(a)(2)

If the Organization selected under Part I, Box 10 was selected, Part III should be completed.

Gifts, grants, contributions and program service revenue counts towards the public support calculation should be reported on Part III.

Report the calculated public support on line 14. To meet the public support test, the percentage of public support calculated must be greater than 33 1/3%

Part IV – Supporting Organizations

If you complete line 11 in Part 1, you must complete Part IV.

The sections to complete will depend on the type of supporting organization (I, II, or III), but all supporting organizations must complete Section A.

Part V - Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations

Complete Part V, if your organization is a Type III Non-Functionally integrated supporting organization.

This part helps organizations inform the IRS if the supporting organization met the distribution requirement. The requirement that the organization must make a minimum amount of distributions to or for the use of one or more supported organizations.

Part VI – Supplemental Information

Provide narrative information for any of the lines in the earlier parts requiring further explanation here. Also, Report any additional details of the organization here.

5. Other Resources in Form 990 Schedule A

What is a qualified public charity?

The IRS lays out certain requirements that make an organization eligible for public charity status. As they are exempt from paying taxes, public charities must be supported financially by the general public.

Types of Organizations that Qualify as Public Charities

-

Organizations That Engage in Inherently Public Activity Section [ IRC 509(a)(1) and 170(b)(1)(A)(i)-(v)]

- Churches

- Educational Institutions

- Hospitals and Medical Research Organizations

- Certain Organizations Related to Colleges and Universities

- Governmental Units

-

Publicly Supported Organizations - [IRC 509(a)(1) and 170(b)(1)(A)(vi) ; IRC 509(a)(2)]

- Organizations Receiving Substantial Support from a Governmental Unit or from the General Public.

- Organizations Supported by Exempt Function Income.

-

Supporting Organizations [IRC 509(a)(3)]

- Organizations that carry out their own exempt purposes by supporting other exempt organizations, or public charities.

-

Organizations That Test for Public Safety [IRC 509(a)(4)]

- Organizations that are organized and operated exclusively for testing public safety.

While some of these organizations automatically qualify as a public charity by the nature of their activities, others must qualify using the Public Support test for public charity status.

What is the Public Support Test?

The Public support test is a methodology used by the IRS to determine the authenticity of any non-profit organization that claims to be a publicly supported organization.

There are two different public support tests:

- 509(a)(1) Test - Conducted on organizations described in sections 509(a)(1) and 170(b)(1)(A)(vi) of the Internal Revenue Code (IRC).

- 509(a)(2) Test - Conducted on organizations described in section 509(a)(2).

Both the tests measure the public support of an organization over a Five-year period.

What are the requirements for these public support tests?

A non-profit organization may receive many forms of contributions, such as gifts, grants, donations, membership fees, and certain gross receipts.

As per the IRS, to qualify as a public charity, an organization should receive all these contributions primarily from the public rather than from a single private source.

Here are the requirements to obtain public charity status:

-

The One-Third Test for 509(a)(1) and 170(b)(1)(A)(vi)

- The organization should receive at least one-third (33.33%) of its contributions from the general public.

-

If the organization receives contributions between 10% - 33.33%, it can still qualify as a public charity using the Facts and Circumstances test. In that,

- The organization should establish that it receives a major part of its contributions from governmental units or the general public under all the facts and circumstances. It should show the IRS that it attracts the public consistently.

- The organization should describe the facts and circumstances which establish that the organization is publicly supported in Part VI of Schedule A.

-

The One-Third Test for 509(a)(2)

- The organization should receive more than one-third, (33.33%) of its contributions from the general public, and/or from gross receipts from activities related to its tax-exempt purposes.

- Also, the organization should not receive more than one-third (33.33%) of its contributions from gross investment income and unrelated business taxable income.

If the organization doesn’t qualify as a public charity using either of these tests, it will be reverted back to being a private foundation.

What are the calculations involved in the Public Support Test?

Basically, there are two components:

-

Total support

- All the gifts, grants, and contributions received by the organization.

- Membership fees

- Exempt function income and other income.

- Interest and dividends

- Net income from Unrelated Business Activities (UBI)

- Tax revenues levied for organization benefit

- The value of services or facilities furnished by a governmental unit

-

Public support

- Grants from government agencies and public charities

- Contributions from private sources such as donations from an individual, private foundation, or a corporation. (It should not exceed 2% of the organization’s total support.)

The percentage of public support received by an organization

The organization’s Public Support

The organization’s Total Support

6. Choose ExpressTaxExempt to file your Form 990/990-EZ with Schedule A

When you start filing the Form 990/990-EZ, the Schedule A will generate automatically based on the information you provided on the Form.

Our Software will review your Form for any errors, and ensure the transmission of error-free returns. Then you can transmit your Form to the IRS securely.

As we are an IRS Authorized software, we provide a safe, secure, and accurate filing experience.