2023 Form 990 Instructions

In this article we will cover the following points:

Form 990 Filing Instructions for Nonprofits and Tax-Exempt Organizations

- Updated April 21, 2023 - 12.00 PM Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations must report to the IRS their revenue, expenses, assets, liabilities, program service accomplishments, Organization's officer details. The reporting is done using Form 990.

Organizations must report Form 990 before the 15th day of 5th month after the accounting period ends.

IRS requires all Nonprofits and Tax-Exempt Organizations to make their Form 990 annual return and all related supporting documents available to the public.

Table of Content

1. What is the purpose of IRS Form 990?

IRS Form 990 is used by tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations to provide the IRS with the information required by section 6033.

Organizations with gross receipts more than or equal to $200,000 or total assets higher than or equal to $500,000 must file Form 990.

2. When is the deadline to file Form 990?

Nonprofits and Tax-Exempt organizations must file Form 990 before the 15th day of the 5th Month after the tax period ends.

Check out the 990 deadlines for organizations whose tax period ends other than December 31.

| Tax year End Date | Due Date |

|---|---|

| December 31 | May 15 |

| November 30 | April 15 |

| October 31 | March 15 |

| September 30 | February 15 |

| August 31 | January 15 |

| July 31 | December 15 |

| June 30 | November 15 |

| May 31 | October 15 |

| April 30 | September 15 |

| March 31 | August 15 |

| February 28/29 | July 15 |

| January 31 | June 15 |

To find out the Form 990 deadlines, visit here.

3. Instructions on how to Fill Out Form 990?

The instructions below will help you complete the filing process of Form 990.

Instructions to complete Basic Organization Information in Form 990

- Name of your Organization, EIN, address, and telephone number.

- Check the appropriate field on Box B for any Address change, Name change, Initial return (if the organization is filing a Form 990 for the first time), final return/terminated, Amended return, or Application pending.

- Check your appropriate section (501(c)(3), 501(c), 4947(a)(1) or 527) for tax-exempt status.

- Check the type of organization (Corporation, Trust, Association, Other), and the year of formation.

- Enter the group exemption number

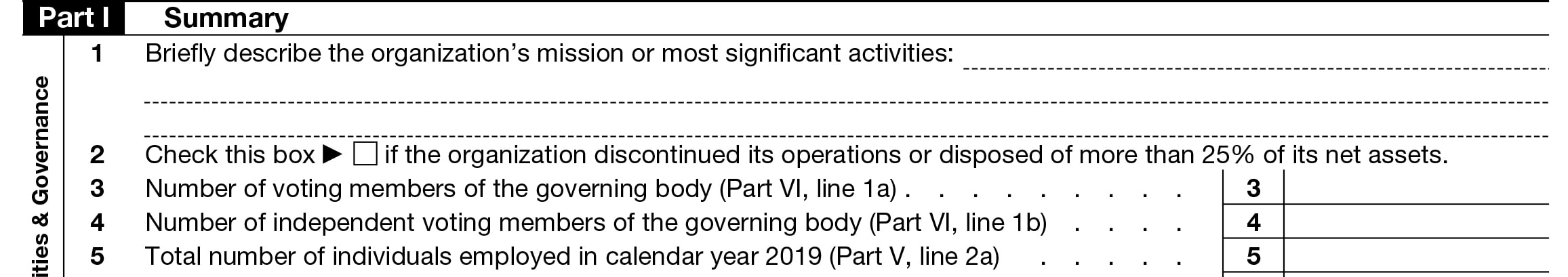

Instructions to complete Form 990 Part I - Summary

Line 1-7 is all about the Activities & Governance of your Organization for the tax year.

Enter the following details in line 1 - 7 of 990 Form

- Organization’s mission or most significant activities

- Number of voting members & independent voting members of the governing body

- Total number of individuals employed in calendar year 2019

- Total number of volunteers

- Total unrelated business revenue & unrelated business taxable income from Form 990-T

Line 8 - 12 is all about the Organization revenue details.

Enter the following details for the prior year & current year in line 8 - 12 of Form 990

- Contributions and grants

- Program service revenue

- Investment income

- Other revenue

Line 13 - 19 is all about the Organization expenses details.

Enter the following details for the prior year & current year in line 13 - 19

- Grants and similar amounts paid

- Benefits paid to or for members

- Fundraising fees

- Other expenses

Line 20 - 22 is all about asset details.

Enter the following details for beginning of the year & end of the year in

line 20 - 22

- Total assets

- Total liabilities

Finally, the “Net assets or fund balances” of your Organization is shown at the end of Part I of Form 990.

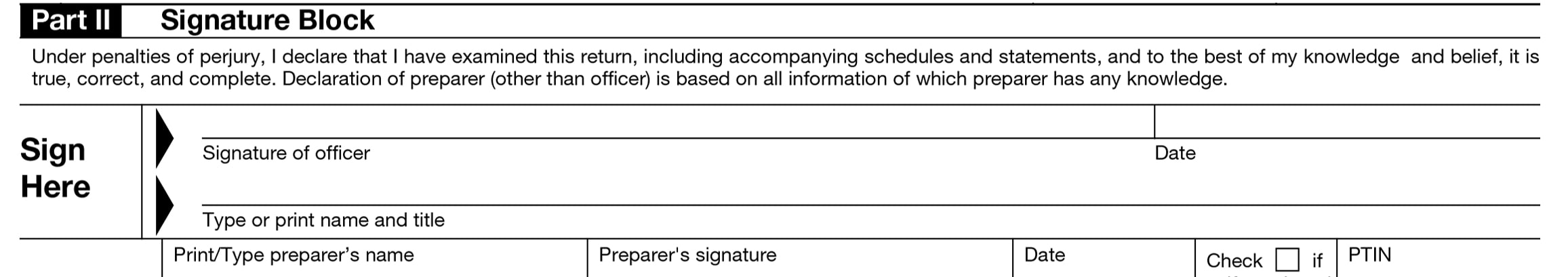

Instructions to complete Form 990 Part II - Signature Block

The current president, vice president, treasurer, assistant treasurer, chief accounting officer, or other corporate officers (such as a tax officer) is responsible for signing IRS Form 990 as of the filing date.

A receiver, trustee, or assignee must sign any return he or she files for a corporation or association.

Paid Preparer

The person who prepares the 990 return must sign the return, list the preparer's taxpayer identification number (PTIN), and fill in the other details like Firm's Name, address, EIN.

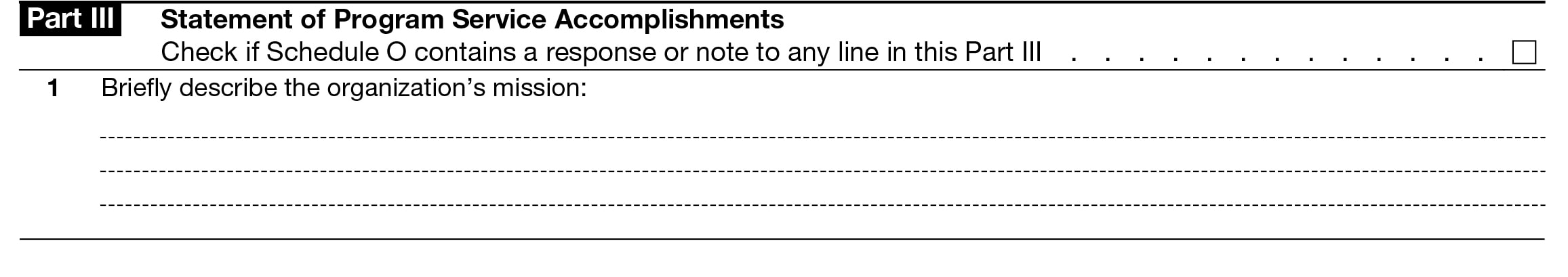

Instructions to complete Form 990 Part III - Statement of Program Service Accomplishments

Organization requires to report with the IRS regarding the organization's program service accomplishments.

A program service are activities like charitable activities, a college's provision of higher education to students under a degree program, a disaster relief organization's provision of grants or assistance to victims of a natural disaster, carried out by the organization.

Enter the descriptive of the Organization's mission. If the Organization undertakes any significant program, choose yes on this part and explain in detail on Schedule O.

Enter the Organization's program service accomplishments for each of its three most expensive program services.

Section 501(c)(3) and 501(c)(4) organizations are required to report the amount of grants and their allocations to others, the total expenses, and revenue, if any, for each program service being reported.

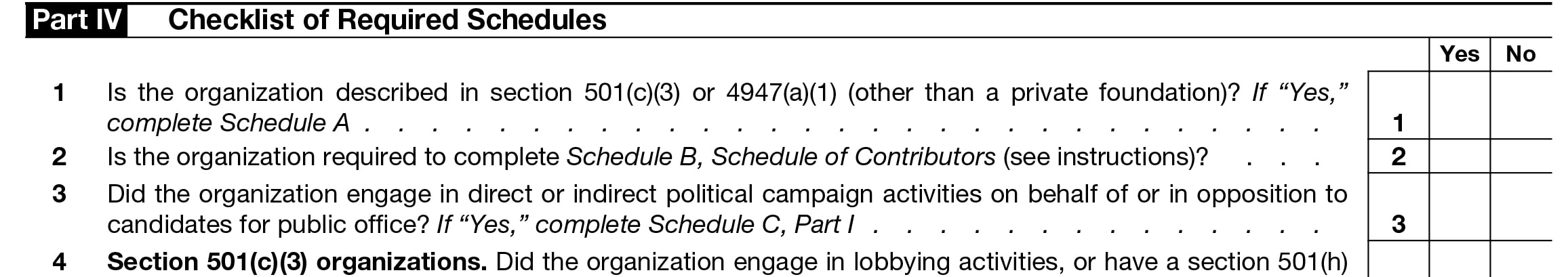

Instructions to complete Form 990 Part IV - Checklist of Required Schedules

The Organization must complete the applicable schedule for each "Yes" as the answer to a question on Form 990, Part IV.

For instance:

If the Organization selected "Yes" for being described under section 501(c)(3) or 4947(a)(1) (other than a private foundation), the Organization must complete Schedule A.

When section 501(c)(3) organization has met the 33 1/3% support test of the regulations under sections 509(a)(1) and 170(b)(1)(A)(vi), checks the box on Schedule A (IRS Form 990 or 990-EZ), Part II, line 13, 16a, or 16b, and received more than $5000 as a contribution from a single contributor, the organization must attach Schedule B.

There are 38 lines in the part which are required to complete by Nonprofits. Check Form 990 Instructions in detail against each line to complete this part.

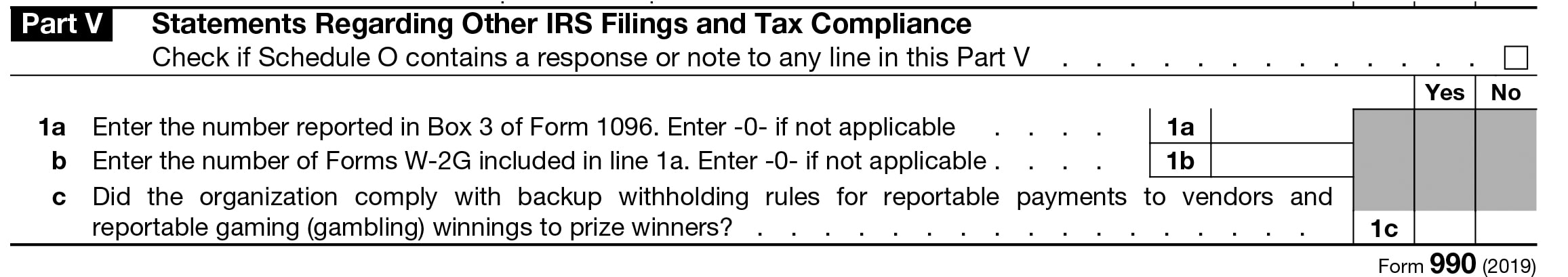

Instructions to complete Form 990 Part V - Statements Regarding Other IRS Filings and Tax Compliance

Line 1 to 16 is all about the information of IRS Filings.

Enter the amounts you entered for the various activities on the IRS Forms 1096, W-2G, W-3, 990-T, 8886-T, 8282, 4720.

Enter the values, If the Organization receives any funds, directly or indirectly, to pay premiums on a personal benefit contract, pay premiums, directly or indirectly, on a personal benefit contract, qualified intellectual property.

Enter the values of gross income from members, shareholders, or other sources.

Check with the IRS Form 990 Instructions in detail to complete Part V.

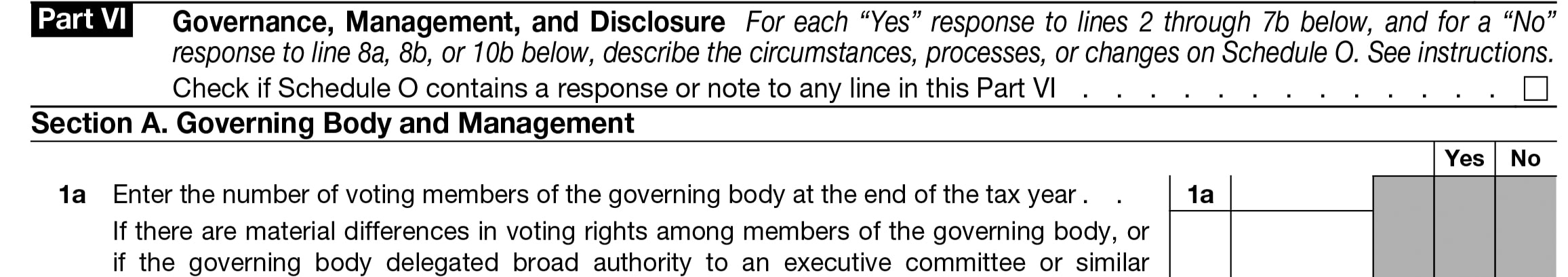

Instructions to complete Form 990 Part VI Governance, Management, and Disclosure

Line 1 to 12 is all about the Organization's governing body and management, governance policies, and disclosure practices.

All organizations that file Form 990 must complete Part VI.

Use Schedule O (Form 990-EZ or 990) to provide required supplemental information as described in this part, and to provide any additional information that the organization considers relevant to this part.

There are 3 sections in Part VI:

Section A. Governing Body and Management

An organization must provide the details of voting members, members or stockholders, and about governing body members.

The governing body is the group of one or more persons recognized under state law to make governance decisions on behalf of the organization and its shareholders or members, if required.

The governing body is, generally, the board of directors (sometimes referred to as board of trustees) of a corporation or association, or the trustee or trustees of a trust (sometimes referred to as the board of trustees).

Section B. Policies

Section B collects information about policies not required by the Internal Revenue Code

Enter the details of Organization such as

- Whether the organization have local chapters, branches, or affiliates

- If the organization provided a complete copy of IRS Form 990 to all members of its governing body before filing the form

Section C. Disclosure

List the states which require a copy of this Form 990 to be filed, even if the organization is yet to file Form 990 with that state.

Enter the organization’s books and records.

Check with the IRS Form 990 Instructions in detail to complete Part VI.

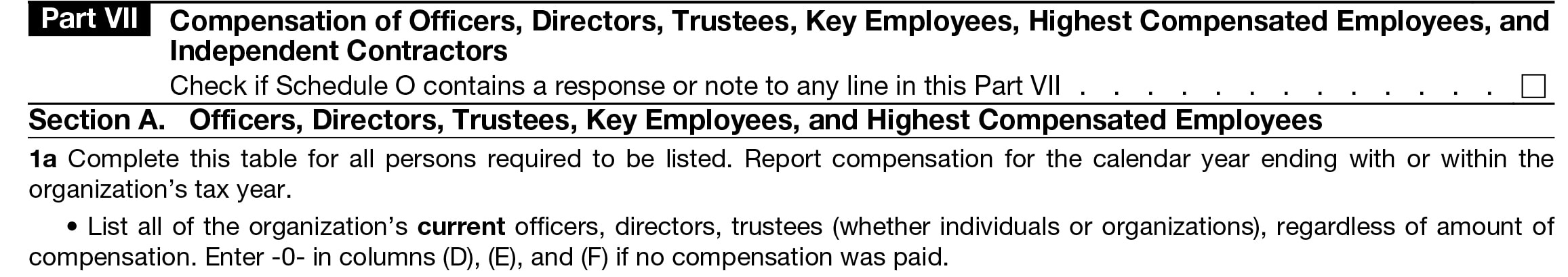

Instructions to complete Form 990 Part VII - Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors

There are 2 sections to be completed in part VII.

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

Organizations must complete Part VII, Section A for the following officers, directors, trustees, and employees of the organization whose reportable compensation from the organization and related organizations

- Enter the tax based on investment income, any penalty for underpayment of estimated tax, and tax due and overpayment.

- Current key employees (over $150,000 of reportable compensation).

- Current five highest compensated employees other than officers, directors, trustees, or listed key employees (over $100,000 of reportable compensation).

- Former officers, key employees, and highest compensated employees (over $100,000 of reportable compensation, with special rules for former highest compensated employees).

- Former directors and trustees (over $10,000 of reportable compensation in the capacity as a former director or trustee).

Enter the Name, average hours per week, position, Reportable compensation from the organization and related organization reported on W-2/1099-MISC, Estimated amount of other compensation from the organization and related organizations

Section B. Independent Contractors

Complete this Section B for your five highest compensated independent contractors that received more than $100,000.

Enter the total number of independent contractors who received more than $100,000 of compensation from the organization.

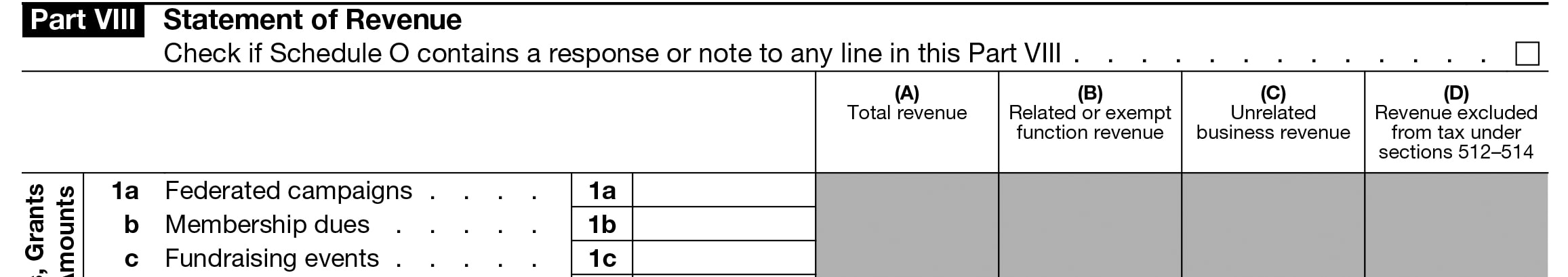

Instructions to complete Form 990 Part VIII - Statement of Revenue

This part is all about the revenues & contributions.

Enter the total revenue, Unrelated business revenue from Federated campaigns, Membership dues, Fundraising events, Related organizations, Government grants (contributions), all other contributions.

Enter the program service revenues, and other revenues such as Investment income, Income from investment of tax-exempt bond proceeds, Gross rents, Rental income, and also provide the information about Miscellaneous revenue.

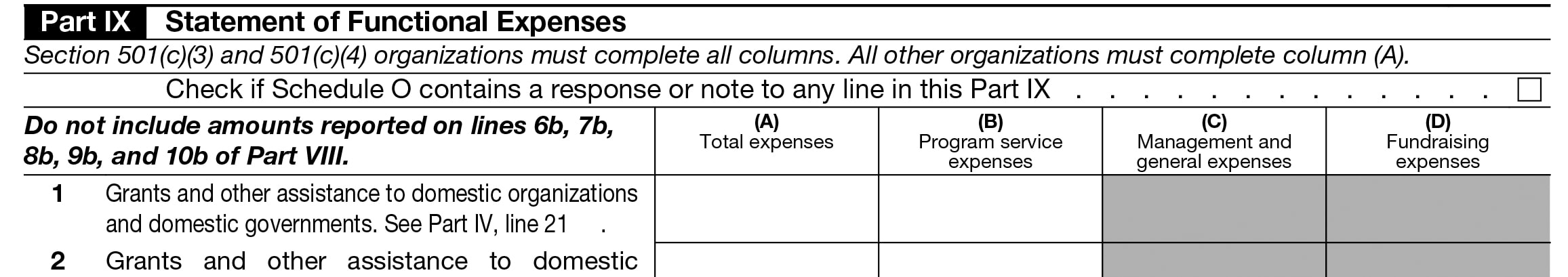

Instructions to complete Form 990 Part IX - Statement of Functional Expenses

Enter the values of total expenses, Program service expenses, Management and general expenses, Fundraising expenses for the grants & other assistance, Benefits paid to or for members, Other employee benefits, Payroll taxes, Fees for services, travel, occupancy, interest, royalties, occupancy, advertising & promotion, and more.

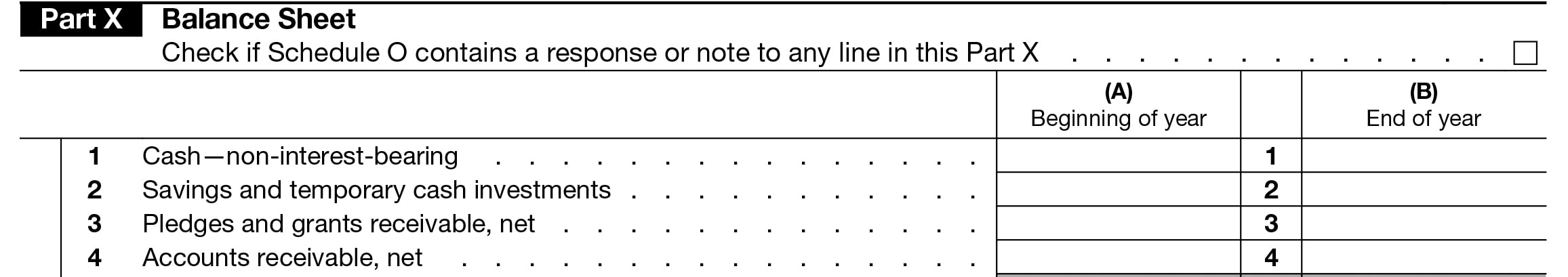

Instructions to complete Form 990 Part X Balance Sheet

The balance sheet depicts the financial position of Nonprofits at a specific point in time, eventually at the close of an accounting period.

The balance sheet shows an organization's financial health or net worth at a given time. The balance sheet of a nonprofit organization includes three main sections:

1. Assets

2. Liabilities

3. Fund balance

Organizations must provide the details related to the above sections for the beginning to the end of the year.

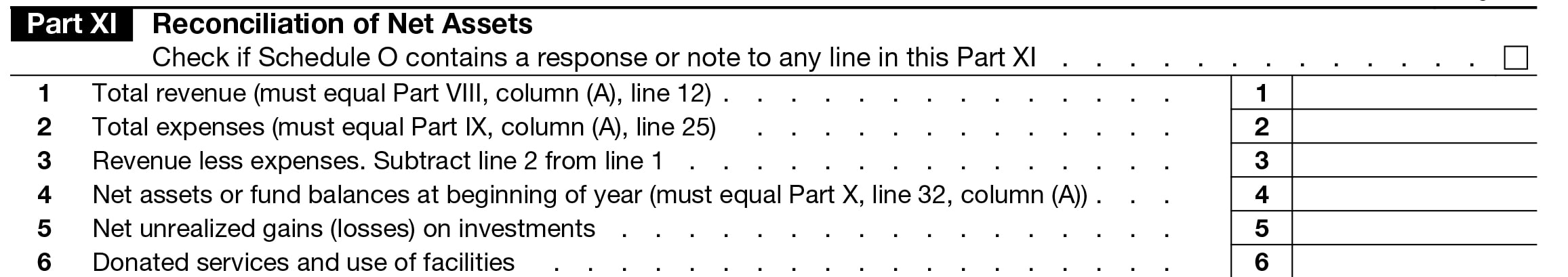

Instructions to complete Form 990 Part XI - Reconciliation of Net Assets

Reconciling items are used to review whether the net asset balance per the financial statements matches the net asset balance per the IRS Form 990.

Enter the total revenue, expenses, net assets, or fund balances at the beginning of the year, gains, investment expenses, net assets, or fund balances to reconcile the Net Assets.

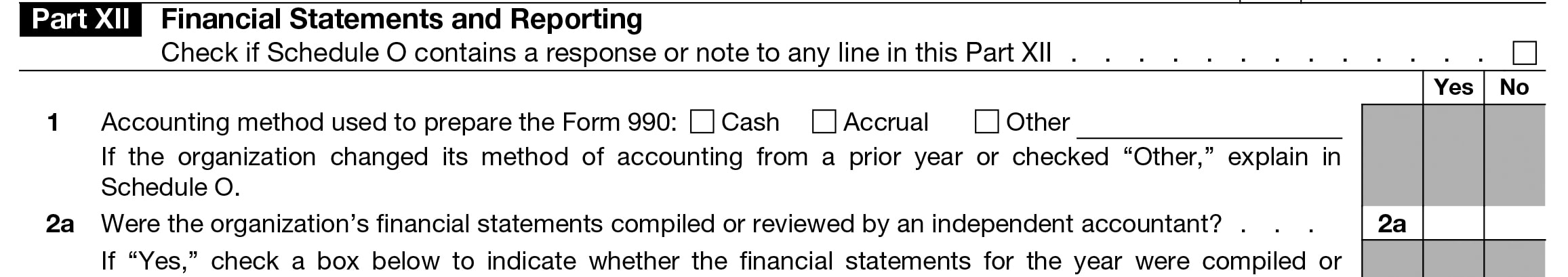

Instructions to complete Form 990 Part XII - Financial Statements and Reporting

Part XII is about financial statements and reporting used in Form 990.

Enter the accounting method used to prepare the Form 990, on whether the organization’s financial statements compiled, reviewed, or audited by an independent accountant.

4. Instructions about Form 990 Schedules

Nonprofits and Tax-Exempt Organizations must provide additional information when filing Form 990 through the various 990 Schedules.

There are 16 Schedules are available for Form 990 to provide more information about the Organization.

Missing to attach the required schedules may result in an incorrect filing. It may lead to IRS penalties.

- Schedule A - Public Charity Status and Public Support

- Schedule B - Schedule of Contributors

- Schedule C - Political Campaign and Lobbying Activities

- Schedule D - Supplemental Financial Statements

- Schedule E - Schools

- Schedule F - Statement of Activities Outside the United States

- Schedule G - Supplemental Information Regarding Fundraising or Gaming Activities

- Schedule H - Hospitals

- Schedule I - Grants and Other Assistance to Organizations, Governments, and Individuals in the U.S

- Schedule J - Compensation Information

- Schedule K - Supplemental Information on Tax-Exempt Bonds

- Schedule L - Transactions with Interested Persons

- Schedule M - Noncash Contributions

- Schedule N - Liquidation, Termination, Dissolution, or Significant

Disposition of Assets - Schedule 0 - Supplemental Information to Form 990

- Schedule R - Related Organizations and Unrelated Partnerships

Click here to learn more about the Form 990 Schedules.

5. Instructions to File Form 990 electronically

The Taxpayer First Act, enacted July 1, 2019, requires tax-exempt organizations to file all 990 and related forms electronically. i.e., organizations tax year beginning on or after July 2, 2019, must file their 990 returns electronically.

To File Form 990 electronically, get started with an IRS authorized provider like ExpressTaxExempt.

Then follow our step by step instructions to complete Form 990.

Step 1: Add Organization Details

Add your organization's name, EIN, address, and primary officer details. And then choose the Form 990 to e-file.

Step 2: Complete Form 990 Details

Start entering the questions about your organization's revenue, expenses, and other required information in Form 990

Step 3: Review your Form information

After completing all the required information, review all your Organization information to proceed further.

Step 4: Pay and transmit directly to the IRS

Once you review all the information, you can transmit the Form 990 to the IRS.